A Diversified Portfolio Of CROs Might Improve Results

By Kate Hammeke, director of marketing intelligence, Nice Insight

Since its inception, the primary goal of Nice Insight’s Pharmaceutical and Biotechnology Outsourcing Survey has been to optimize collaborations between CROs/CMOs and sponsor organizations. The benefits of improved collaborations play out in many forms and offer advantages every step of the way — from reduced costs, improved staff efficiencies, and increased shareholder value, all the way to much-needed therapies reaching the market more quickly and being more affordable for consumers. Outsourcing Insights has been a platform for Nice Insight to share simple strategies on how to get the best results from an outsourcing relationship, whether that relationship is tactical or with a preferred vendor or strategic partner. Each of these different types of outsourcing relationship has its merits.

Since its inception, the primary goal of Nice Insight’s Pharmaceutical and Biotechnology Outsourcing Survey has been to optimize collaborations between CROs/CMOs and sponsor organizations. The benefits of improved collaborations play out in many forms and offer advantages every step of the way — from reduced costs, improved staff efficiencies, and increased shareholder value, all the way to much-needed therapies reaching the market more quickly and being more affordable for consumers. Outsourcing Insights has been a platform for Nice Insight to share simple strategies on how to get the best results from an outsourcing relationship, whether that relationship is tactical or with a preferred vendor or strategic partner. Each of these different types of outsourcing relationship has its merits.

In the contract research market, most sponsor organizations engage CROs in relationships that fall into each category — only 5% of our survey respondents state that all of the CROs they work with are strategic partners. Results from a recent strategic partnering survey indicated that, in fact, approximately 1/3 of total outsourcing expenditure on early-stage development is spent with each type of alliance. This is both interesting and important for CROs to understand because for several years talk in the industry has focused strongly on a “strategic partnership model.” So much so, that the investment firm Morningstar has reported that “this type of partnership model has been key to CRO success and growth” (referring to an 11.1% increase in CRO revenue in 2011).

However, if a CRO focuses exclusively on engaging in strategic partnerships, the company may be inadvertently missing out on the bulk of sponsors’ financial outlay. Overall, sponsors indicated that they spend more than 2/3 of this expenditure with tactical providers (37%) and preferred vendors (34%). As a contract service provider, the key is to know when to position your business to attract each type of relationship and how to win business slated for each category.

Similar to building an investment portfolio that will maximize profits while limiting risks, diversity is essential. Diversity in outsourcing alliances — from both the sponsor side and the contract service side — protects each party from the old cliché of putting all one’s eggs in a single basket and elicits benefits from each of the different types of relationships. For the same reason that a financial advisor should steer an investor away from putting all of their money into one type of stock, it’s not a good idea to focus all business development efforts on one type of relationship structure. From the sponsor perspective, there will be times when the benefits of engaging a CRO on a tactical level outweigh the benefits of using a preferred provider or strategic partner for the same job. Each time Nice Insight has asked sponsor audiences about their interest in forming strategic partnerships (defined as a long-term, win-win commitment that maximizes the effectiveness of both participants’ resources), the collective response is that they’re strongly in favor — fewer than 10% of respondents are neutral or uninterested. However, when these same respondents move on to a series of questions that help discern their true outsourcing rationale, the results frequently indicate tactical motivations.

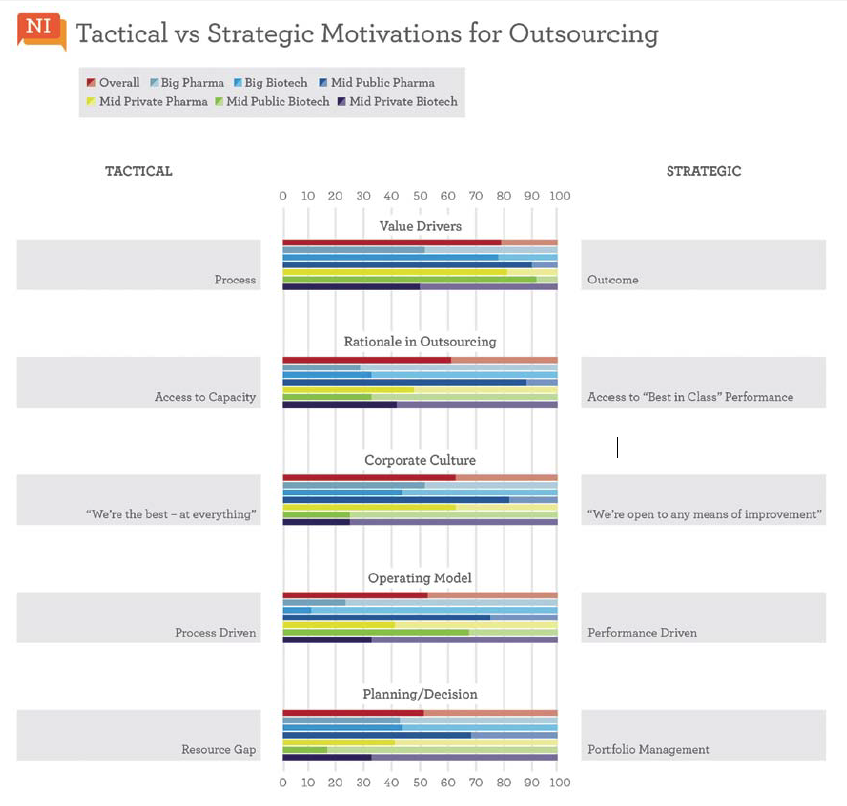

This is a fundamental challenge to the strategic partnership philosophy because the reasoning used by these decision makers doesn’t always correlate with the results they say they want. Affirming an interest in strategic partnerships, yet placing a heavy emphasis on “process” over “outcome” or “access to capacity” over “access to best in class performance” highlights a somewhat paradoxical situation.

The graph on the following page shows the characteristics selected by respondents that best coincide with their business’s operating model for working with outsourcing partners. Understanding and applying this information will help CROs to refine their approach by interpreting and focusing on the underlying factors that prompted the sponsor to outsource the services. It may also help sponsors to better clarify their own true outsourcing motivations and identify opportunities to reap the benefits of outsourcing to a wider spectrum of CROs.

Click this image to view it in more detail.

Survey Methodology: The Nice Insight Pharmaceutical and Biotechnology Survey is deployed to outsourcing-facing pharmaceutical and biotechnology executives on a quarterly basis/four times per year [Q2 2012 sample size 2,402]. The survey is composed of 750+ questions and randomly presents ~30 questions to each respondent in order to collect baseline information with respect to customer awareness and customer perceptions on 300 companies that service the drug development cycle. More than 1,200 marketing communications, including branding, websites, print advertisements, corporate literature, and trade show booths are reviewed by our panel of respondents. Five levels of awareness from “I’ve never heard of them” to “I’ve worked with them” factor into the overall customer awareness score. The customer perception score is based on six drivers in outsourcing: Quality, Innovation, Regulatory Track Record, Affordability, Productivity, and Reliability, which are ranked by our respondents to determine the weighting applied to the overall score.

If you want to learn more about the report or how to participate, please contact Nigel Walker, managing director, or Salvatore Fazzolari, director of client services, at Nice Insight by sending an email to niceinsight.survey@thatsnice.com.