Client Relationships: How CMOs Can Avoid The Pitfalls

By Eric Langer, president and managing partner, BioPlan Associates, Inc.

Outsourcing in the biomanufacturing industry is increasing, and biotherapeutic developers are starting to contract out activities previously considered too core or strategic. Competition has intensified among CMOs who are keen to respond to increased demand for their services. But how can CMOs best differentiate themselves?

Outsourcing in the biomanufacturing industry is increasing, and biotherapeutic developers are starting to contract out activities previously considered too core or strategic. Competition has intensified among CMOs who are keen to respond to increased demand for their services. But how can CMOs best differentiate themselves?

Our latest study of the biopharmaceutical manufacturing industry (10th Annual Report and Survey of Biopharmaceutical Manufacturers) looks at the issues clients consider when outsourcing manufacturing to a CMO. Results from the study suggest that while technical expertise is obviously a factor, “soft” issues that surround communication skills and contract management are actually the crucial differentiating elements that clients focus on when evaluating potential partners.

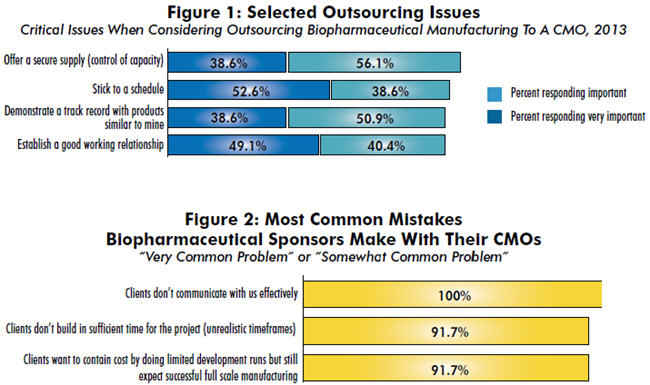

We asked 238 biomanufacturing decision makers from around the world to assess the importance of numerous factors when making a decision to outsource to a CMO. The most common consideration, indicated by 94.7 percent of respondents to be either “very important” or “important,” was for CMOs to offer a secure supply (control of capacity). Other common considerations included sticking to a schedule (91.2 percent), demonstrating a track record with similar products (89.5 percent), establishing a good working relationship (89.5 percent), and complying with the company’s quality standards (85.9 percent).

On the other end of the spectrum, fewer respondents indicated that providing superior process development services, assistance in determining the value of capital avoidance, or “being local” were important considerations.

Top Differentiators for CMOs

When it came to the most crucial differentiators, though, the rankings changed considerably. The top two factors viewed as “very important” by the most respondents were:

- Stick to a schedule (52.6 percent)

- Establish a good working relationship (49.1 percent).

It’s interesting to see that while capacity control was most commonly cited by respondents as a general issue, it did not figure among the most important. This factor also seems to have become less important over the past few years after hitting something of a peak in 2009.

It’s also worth noting that two of the top five most important factors relate to issues of communication. While those may appear to be “soft” factors, they strike at the core of these relationships, which are ultimately built on trust and a shared commitment. Each party has a stake in the outcome and must share in the responsibilities entailed. The prevailing sentiment in these relationships really needs to be that the contract and its associated negotiations are not the determiners of the relationship — it’s the commitment and bond between the two parties that’s most important.

Establishing a strong relationship allows both flexibility and a shared focus on a common cause. Benefits include improved time management, the most crucial consideration for most biomanufacturers. Clearly, formal agreements and processes do have to be in place – but when a good relationship has been established, the inevitable issues that arise can be better handled or avoided.

For CMOs seeking to differentiate themselves from their peers, fostering a reputation as an effective and cooperative partner can be just the nudge needed to sway a potential client’s decision. The “technical” issues that are most important to clients should be part of a worthy CMO’s expertise in any case. Obviously, everyone strives to avoid obvious patent infringement, and if a CMO did not practice “good intellectual business practice,” it would not stay in business very long. The same could be said about complying with quality issues, these will clearly always be important to clients, but CMOs that cannot demonstrate a strong track record with quality issues are unlikely to last very long in the business. This is the ante required just to be in the game.

Another very important component of any customer-CMO relationship is that both sides must be flexible and cooperative, and make efforts to understand the perspective of the other party. This component will make itself evident during early conversations about the individual steps of the collaboration, when potential red flags can be identified and resolved.

This understanding of client needs appears to be lacking in the biopharmaceutical CMO space. Our study shows that many decision makers complain about a range of problems, including service suppliers’ inflexibility and lack of responsiveness. Most CMOs claim to listen and communicate, but our data shows that these problems continue to top the list of relationship hurdles. Granted, this isn’t universal, and many CMOs certainly listen to their clients’ needs.

For example, CMC Biologics recently purchased the XOMA Corp. facility in Berkeley, CA so that it could meet specific, emerging technical and equipment needs. According to Andy Walker, Ph.D., CMC’s VP of process development, “We listened to our customers and determined that our acquisition of the former XOMA manufacturing facility will enable CMC to support some types of manufacturing processes which were not as easily supported at our facilities in Seattle and Copenhagen. In addition, being closer to some of our clients ensures we are providing the flexibility required for the relationship.”

CMOs Have Their Complaints, Too

Of course, it’s not just the client that has issues when establishing or maintaining a relationship. We separately surveyed a sample of CMOs to see what they deemed to be the most common mistakes made by their biopharmaceutical clients.

The most commonly cited problem? Clients not communicating with them effectively. This was identified as a “very common problem” or “somewhat common problem” by every single CMO. Following that, a long list of the issues frequently mentioned by respondents included:

- “Clients don’t build in sufficient time for the project (unrealistic timeframes)”

- “Clients want to contain cost by doing limited development runs but still expect successful full scale manufacturing”

- “Clients expect us to resolve the most difficult scientific or technical problems.”

Communication is Key

It’s telling that two of the five most common issues cited by CMOs also relate to communication and scheduling. These appear to be real pain points on both sides of the coin — with the ability to screw up an otherwise solid relationship. Indeed, as the biomanufacturing contract manufacturing industry continues to mature, issues revolving around customer service and solid client-vendor relationships could become even more important, especially if CMOs find it difficult to differentiate themselves on the basis of non-negotiable issues such as quality compliance and IP protection. Ultimately, entering into a partnership requires trust and making a leap-in-faith that both parties will do things right and on schedule.

Survey Methodology: The 2013 Tenth Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production yields a composite view and trend analysis from over 300 responsible individuals at biopharmaceutical manufacturers and CMOs in 29 countries. The survey included over 150 direct suppliers of materials, services, and equipment to this industry. This year’s study covers such issues as: new product needs, facility budget changes, current capacity, future capacity constraints, expansions, use of disposables, budgets in disposables, trends in downstream purification, quality management and control, hiring issues, and employment. The quantitative trend analysis provides details and comparisons of production by biotherapeutic developers and CMOs. It also evaluates trends over time and assesses differences in the world’s major markets in the U.S. and Europe.

If you want to learn more about the report, please go to bioplanassociates.com.