Demand For Innovation In High-Value Bioprocessing

By Eric Langer, president and managing partner, BioPlan Associates, Inc.

Caution inhibits adoption of new technologies

Downstream processing is where drug products in biomanufacturing operations have their highest value. The biologic about to be purified has undergone many prior unit operations, and the costs in material, equipment, and labor can reach well over a million dollars per batch. So this uniquely sensitive area demands careful implementation of changes and improvements. This caution may be one reason that sorely needed innovation in downstream processing continues to be slow in coming.

Downstream processing is where drug products in biomanufacturing operations have their highest value. The biologic about to be purified has undergone many prior unit operations, and the costs in material, equipment, and labor can reach well over a million dollars per batch. So this uniquely sensitive area demands careful implementation of changes and improvements. This caution may be one reason that sorely needed innovation in downstream processing continues to be slow in coming.

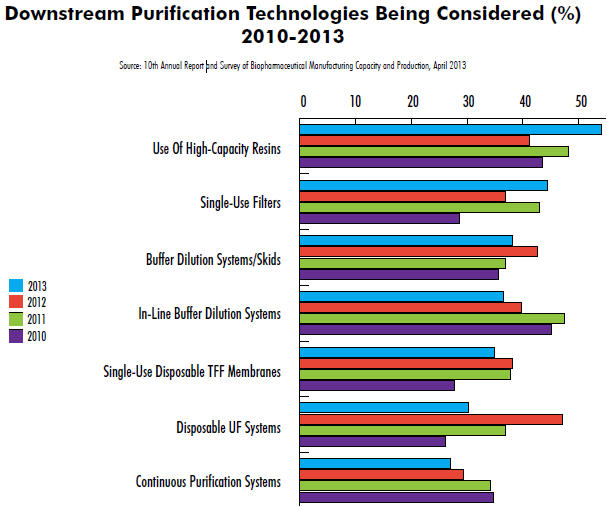

Results from our 10th Annual Report and Survey of Biopharmaceutical Manufacturers indicate that industry interest in innovation in downstream processing continues. This year, we evaluated dozens of areas of innovation. In downstream operations, for example, innovative, singleuse, disposable, tangential flow filtration (TFF) systems are one of the top five new downstream purification technologies under consideration for adoption, cited by 34.9% of respondents to our study. Also seeing strong interest are in-line buffer dilution systems (36.5%), buffer dilution systems/ skids (38.1%), and single-use filters (44.4%). But topping the list is interest in high-capacity resins (54%).

Interest in disposable TFF systems appears to have stabilized this year at ~35% of respondents, after rising from 27.8% in 2010. Interestingly, while levels of interest in TFF systems remain, that isn’t the case for other downstream technologies we evaluated. For example, in-line buffer dilution systems (36.5% vs. 45.2% in 2010), continuous purification systems (27% vs. 34.8% in 2010), and alternatives to chromatography (20.6% vs. 24.3%) have gradually declined in interest over the years. Conversely, those at the top are seeing steadily increasing consideration, with healthy growth in interest for high-capacity resins (54% vs. 43.5% in 2010) and single-use filters (44.4% vs. 28.7% in 2010).

Some of the decline in interest is the innate conservatism associated with the back end of the process. In addition, the capacity crunch associated with downstream bottlenecks has lifted somewhat as facilities fix bottlenecks in their current systems with incremental improvements.

CMOs Leading Change

When we sort responses by biotherapeutic developers vs. CMOs, an interesting picture arises, one that may point to future growth for single-use disposable TFF membranes. In our previous column, we noted that CMOs often act as leading indicators of industry adoption of innovative practices. When looking at innovation in downstream purification, we note that single-use disposable TFF membranes are the top new technologies under consideration by CMOs, cited by half of those respondents, along with use of highcapacity resins and single-use filters.

Notably, the gap in interest between CMOs and biodevelopers was larger for single-use TFF membranes than any other technology. While half of our CMOs demonstrated an interest in innovation in this area, just 32.1% of biodevelopers concurred, a 17.9% point gap. We found a similar discrepancy in last year’s study, with CMOs way ahead of the curve in tangential flow filtration demand (55.6% expressing interest, versus 35.6% of biodevelopers). The upshot is that as biodevelopers close the gap with CMOs, we are likely to see greater industry pressure for adoption of these devices.

Adoption of TFF Devices Has Grown

There are signs that acceptance of disposable TFF devices is already growing. This year, we found that among users of disposables, three-quarters of them report using tangential flow filtration devices at some stage of biopharmaceutical manufacturing. That’s the result of a slow, gradual increase from 71.8% in 2007, which in itself came after a big jump from 43.5% in 2006.

And while TFF devices have been one of the fastergrowing applications over the past 7 years (+8.1% compound annual growth rate between 2006 and 2013), others have grown faster, with membrane adsorbers, bioreactors, and mixing systems each seeing a ~20% point CAGR in adoption in that time frame. Surprisingly, adoption of TFF devices (at any stage of manufacturing) is slightly higher among biotherapeutic developers (75.6%) than CMOs (71.4%). This result, combined with the finding that CMOs may be more interested in TFF innovation, suggests that biodevelopers are content with existing TFF technologies, while CMOs are the ones pressing for more innovation.

Where To From Here?

Of course, tangential flow filtration devices are but one of many downstream purification innovations that the industry is seeking. Purification is an area of industry concern in 2013. In fact, the 450 global subject matter experts and industry manufacturers on our Biotechnology Industry Council pointed to aspects of downstream purification as one of their most critical trends of the year.

The range of solutions being sought and proposed to downstream purification problems is evident in the responses from our panel. For example, several micro-trends in downstream bioprocessing include:

- alternatives to Protein A

- purification related to impurity profiles in biosimilars

- bioburden control in chromatography columns

- improving overall harvest operations.

As our studies show, some innovations will become integrated over time to resolve chronic problems, while others will fade as the acute urgency for solutions is resolved.

Survey Methodology: The 2013 10th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production is an evaluation by BioPlan Associates, Inc. that yields a composite view of and trend analysis from 300 to 400 responsible individuals at biopharmaceutical manufacturers and CMOs in 29 countries. The respondents also include more than 185 direct suppliers of materials, services, and equipment to this industry. Each year the study covers issues including new product needs, facility budget changes, current capacity, future capacity constraints, expansions, use of disposables, trends and budgets in disposables, trends in downstream purification, quality management and control, hiring, and employment. The quantitative trend analysis provides details and comparisons of production by biotherapeutic developers and CMOs. It also evaluates trends over time and assesses differences in the world’s major markets in the U.S. and Europe.

If you want to learn more about the report, please go to bioplanassociates.com.