Single-Use Recycling Mismatch: BioPharmaceutical Manufacturers Missing An Opportunity

By Eric Langer, president and managing partner, BioPlan Associates, Inc.

The biopharm industry is expressing increased concern over disposal issues associated with single-use devices. Although cost and economic issues continue to be a priority today, there is a growing gap between how manufacturers believe their plastic single-use system (SUS) devices should be disposed of and what is actually being done, according to results from our 9th Annual Report and Survey of Biopharmaceutical Manufacturers.

The biopharm industry is expressing increased concern over disposal issues associated with single-use devices. Although cost and economic issues continue to be a priority today, there is a growing gap between how manufacturers believe their plastic single-use system (SUS) devices should be disposed of and what is actually being done, according to results from our 9th Annual Report and Survey of Biopharmaceutical Manufacturers.

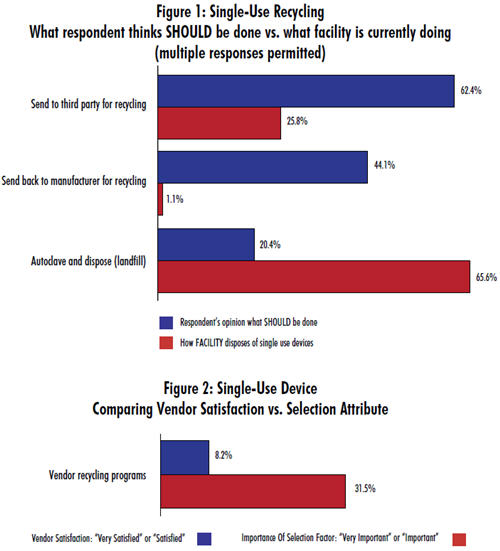

In our study, we asked 302 biotherapeutic developers and CMOs to tell us how their facilities dispose of SUS devices and compared the responses to opinions on what should be done (see www.bioplanassociates.com). The results were striking.

Almost 2/3 of respondents indicate that recycling is currently done by autoclave and landfill disposal. But, just one in five believes that this is what should be done. Burying bags in landfills has a major environmental impact because bag films are derived from polyethlylene, polypropylene, ethylene vinyl acetate, and nylon. These materials don’t easily decompose.

Instead, the industry shows a strong preference for recycling, whether that be by sending devices, post-use, to a third party for recycling (62.4%) or back to the manufacturer for recycling (44.1%). Here, again, we find a deep gap between desire and reality. Just one in four is actually sending their devices post-use to a third party for recycling, and virtually none (1.1%) are sending them back to the manufacturer for recycling.

While these three methods constitute the preferred and most widespread manners for disposing of single-use devices, there are other discrepancies in the methods we identified:

- “Reuse in non-GMP applications” is only being currently performed by 9.7%, but recommended by about twice as many.

- “Incinerate as medical waste” is currently done by about 10% of respondents, but is considered to be a best-practice by about half that many (5%).

- “Reuse in GMP applications, with documentation and control” is another process performed by far less than recommend it.

- “Send back to manufacturer” is done by fewer than 5%, but recognized as something that should be done by over 15%.

Some comments we have received in the past regarding the issue include: “This is going to be a serious issue,” “If single-use components could be manufactured from sustainable materials, that would greatly improve the image of the technology,” and “The use of disposables must have a positive impact on cost as well as their environmental impact to justify their widespread use.”

Industry expert Dr. Steven Chamow, president of Chamow Associates, says, “The move to single-use technologies will bring a very substantial waste stream from biologics production facilities. Because much of this waste stream is classified as biowaste, cost of disposal will be significant. Recycling can reduce the solid waste stream and potentially the cost of raw materials. This is an area that will grow in importance as use of disposables becomes more widespread, as it certainly will.”

The Vendor’s responsibility

We also evaluated the importance of 13 attributes associated with single-use devices and compared that with the level of satisfaction (or dissatisfaction) with vendors to this industry segment. We found that the gaps between the service and products offered, and the importance of each attribute, can be used to prioritize specific areas that are both most important and most in need of improvement.

A number of respondents voiced that SUS sellers should assist in proper waste disposal. Yet it appears that this is not yet an important selection factor when considering single-use device vendors. We found that 31.5% of respondents consider vendor recycling programs to be either “very important” or “important” when selecting a vendor. Yet only 8% of the industry is satisfied with their vendor’s current recycling programs.

This suggests that recycling programs are becoming a critical attribute for vendors and reflects overall attributes toward waste disposal — that is, concerns about waste disposal are becoming important, but are not actually inhibiting industry growth. (In our 2010 study, we found fewer than one in five respondents saying that waste disposal issues significantly reduce the respondents’ usage of disposables.) Even so, vendors looking to differentiate themselves from their competition would be wise to consider this factor. This year, satisfaction with single-use vendors on recycling programs had the lowest level of satisfaction of the 13 areas we measured.

Recycling Efforts Will Grow

Although today cost and economic issues are more important than concerns over environmental and disposal issues, recycling programs are becoming an increasingly burdensome problem, and vendors are increasingly being rated as unsatisfactory in dealing with recycling. As SUSs become more common — particularly in commercial manufacture — the focus will be on more recycling efforts that bring cost-effective, environmentally friendly alternatives to landfill solutions.

Survey Methodology: The 2012 Ninth Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production in the series of annual evaluations by BioPlan Associates, Inc., yields a composite view and trend analysis from 302 responsible individuals at biopharmaceutical manufacturers and CMOs in 29 countries. The methodology also included 185 direct suppliers of materials, services, and equipment to this industry. This year’s survey covers such issues as new product needs, facility budget changes, current capacity, future capacity constraints, expansions, use of disposables, trends and budgets in disposables, trends in downstream purification, quality management and control, hiring issues, and employment. The quantitative trend analysis provides details and comparisons of production by biotherapeutic developers and CMOs. It also evaluates trends over time and assesses differences in the world’s major markets in the U.S. and Europe.

If you want to learn more about the report, please go to bioplanassociates.com.