Innovation Moves Up In Rank And Technologies Move Into The Outsourcing Paradigm

By Kate Hammeke, VP of Market Research, Industry Standard Research (ISR) @ISRreports

Now into the fifth year of examining outsourcing behaviors and ways contract suppliers can improve the drug development process, the results from the 2015 Nice Insight Biopharmaceutical Outsourcing Survey show that the biopharmaceutical industry is making some subtle changes in how it prioritizes companies when it comes to selecting a CRO or CMO.

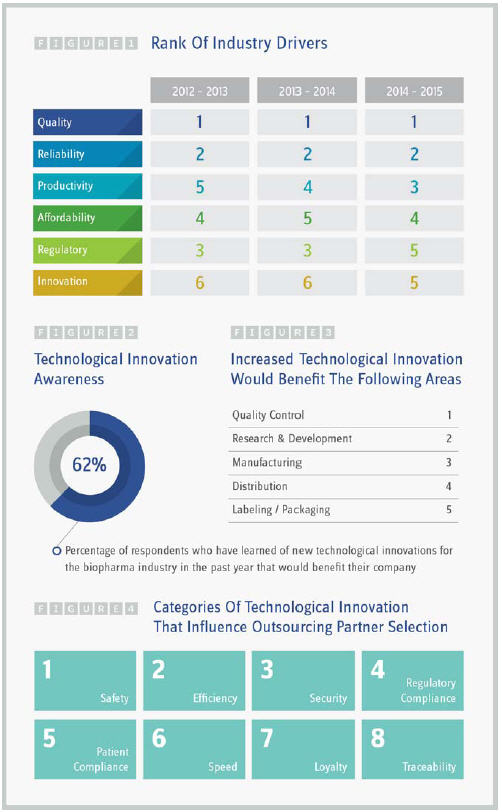

For the first time since introducing the measure in 2012 (when it replaced “accessibility”), innovation moved up in rank among the six key outsourcing drivers to tie for fifth place with a company’s regulatory track record. Introducing innovative new technologies to the lab, manufacturing plant, or supply chain can boost productivity and strategically position your business to attract projects that utilize these assets.

For the first time since introducing the measure in 2012 (when it replaced “accessibility”), innovation moved up in rank among the six key outsourcing drivers to tie for fifth place with a company’s regulatory track record. Introducing innovative new technologies to the lab, manufacturing plant, or supply chain can boost productivity and strategically position your business to attract projects that utilize these assets.

Almost two-thirds of research participants stated that they had learned of a technological innovation in the past year that would benefit their company (62 percent). Respondents indicated that safety topped the list of how technological innovations would influence outsourcing partner selection, followed by efficiency and security. Interestingly, patient-centric traits tended to place higher in the ranks than technological innovations that were more in tune with the business’ profits like creating customer loyalty, speeding time to market, or improving traceability. The areas to experience the greatest benefit from technological innovations were quality control, research and development, and manufacturing; this shows that both CROs and CMOs have an opportunity to capture new business and partnerships by promoting innovative technologies utilized by the company. As a matter of fact, interest levels in partnering with a CRO/CMO utilizing technological innovations for increased efficiency, quality, safety, and traceability were very strong — only 3 percent of respondents indicated no interest.

Not only has innovation moved up in ranks when it comes to factors that influence outsourcing partner selection, so has productivity, which ranked fifth in 2013, fourth in 2014 and now third in 2015. Improving time to market through increased productivity is a key way technological innovations can provide an advantage, especially when it comes to contract research. Sixty-two percent of respondents stated that cloudbased data management services were the greatest opportunity for cost and/ or timesaving when it comes to contract research. This was followed by half of respondents stating that the use of robotics labs to perform routine tests would improve productivity. Web-based life sciences labs were supported by 44 percent of respondents, and both mobile technologies for recruiting/communicating with participants as well as mobile technology for monitoring participants were backed by 38 percent of respondents. Shared online data banks for nonproprietary clinical information rounded out the list with 23 percent of respondents indicating it as an opportunity for cost and/or timesaving.

While a robotics lab may sound like it’s right out of a sci-fi film, the technology currently exists and has the potential to offer a variety of advantages to drug developers. According to survey respondents, the most appealing element of working with a robotics lab is that it can offer faster turnaround than a traditional CRO due to its 24/7 workflow (61 percent). More than half of the respondents found the reduced possibility of human error (56 percent) and the precise nature of repetitive tasks making the experiments more easily reproduced (50 percent) to be benefits of engaging a robotics lab. The mechanical advantage of using robots may give way to secondary benefits like freeing up staff from rote tasks so that scientists can focus on data interpretation and designing new experiments (41 percent).

It will be interesting to see how businesses like Transcriptic and Emerald Cloud Laboratory—two potential game changers based out of Menlo Park, CA — will fit into the outsourcing strategies of drug developers. Regardless of how these innovative companies are included in the mix, one thing is for sure: Biopharma companies are drawn to contract suppliers that use innovative technologies to improve productivity.

Survey Methodology: The Nice Insight Pharmaceutical and Biotechnology Survey is deployed to outsourcing-facing pharmaceutical and biotechnology executives on an annual basis. The 2014-2015 report includes responses from 2,303 participants. The survey is comprised of 240+ questions and randomly presents ~35 questions to each respondent in order to collect baseline information with respect to customer awareness and customer perceptions of the top ~125 CMOs and ~75 CROs servicing the drug development cycle. Five levels of awareness, from “I’ve never heard of them” to “I’ve worked with them” factor into the overall customer awareness score. The customer perception score is based on six drivers in outsourcing: Quality, Innovation, Regulatory Track Record, Affordability, Productivity, and Reliability. In addition to measuring customer awareness and perception information on specific companies, the survey collects data on general outsourcing practices and preferences as well as barriers to strategic partnerships among buyers of outsourced services.

If you want to learn more about the report or how to participate, please contact Nigel Walker, managing director, or Kate Hammeke, director of marketing intelligence, at Nice Insight by sending an email to nigel@thatsnice.com or kate.h@thatsnice.com.

If you want to learn more about the report or how to participate, please contact Nigel Walker, managing director, or Kate Hammeke, director of marketing intelligence, at Nice Insight by sending an email to nigel@thatsnice.com or kate.h@thatsnice.com.