Logistics Providers Strive To Fulfill Biopharma Needs – Specialty Companies Offer Advantages, But Get A Bad Rap On Price

By Kate Hammeke, VP of Market Research, Industry Standard Research (ISR) @ISRreports

According to clinicaltrials.gov, there are over 92,000 drug or biologic registered studies under way right now. Nearly one-fifth (17 percent) of the drugs currently in development are biologic-based therapeutics.

Because biological assets are temperature sensitive, the challenges in transport and distribution are quite different from logistical obstacles faced by traditional, small molecule-based drugs. Both global logistics giants (such as FedEx and UPS) and a host of specialty logistics companies (such as Marken, World Courier) focused on the life sciences industry have fine-tuned their offerings in order to meet the cold chain needs for biomaterials, such as clinical trial samples, active pharmaceutical ingredients, cell banks, tissue samples, and more.

Because biological assets are temperature sensitive, the challenges in transport and distribution are quite different from logistical obstacles faced by traditional, small molecule-based drugs. Both global logistics giants (such as FedEx and UPS) and a host of specialty logistics companies (such as Marken, World Courier) focused on the life sciences industry have fine-tuned their offerings in order to meet the cold chain needs for biomaterials, such as clinical trial samples, active pharmaceutical ingredients, cell banks, tissue samples, and more.

With high stakes ranging from legal to financial risk, it’s important to ensure that the logistics company engaged for the job is not the weakest link in the cold chain. Nice Insight asked 100 respondents in charge of the handling and distribution of biological specimens or clinical trials materials their opinions and preferences on shipping partners. When it comes to overall preference, global logistics companies such as FedEx, UPS, and DHL are favored over specialty companies by a relatively slim margin (39 vs. 31 percent). Thirty percent of respondents stated they prefer to use a mix of both specialty and global logistic companies. Among the group of respondents who use both types of providers, specialized providers received a little more of their business (55 vs. 45 percent).

Respondents attribute on-time delivery and flexibility in pickup and dropoff times to both types of providers. However, logistics giants are best known for their convenience and affordability, while specialty providers are associated with temperature-control options and white-glove handling. Because participants indicated they are more likely to select a logistics company based on best fit for a project rather than price, the added-value services available through specialty providers are likely to win the companies’ new business. And — based on 97 percent of respondents who said their logistics expenditure increased or stayed the same last year — there is more business to be had. Only 3 percent thought it would decrease.

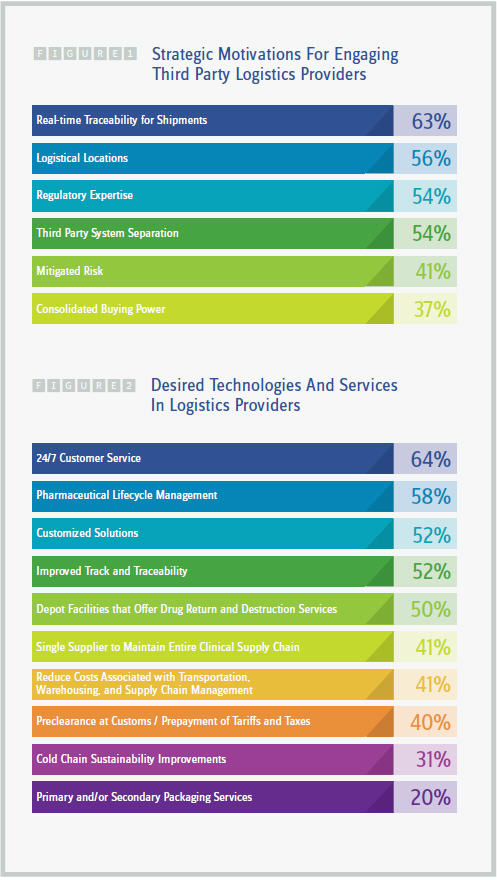

Real-time traceability for shipments (63 percent) along with logistical locations (56 percent) and regulatory expertise (54 percent) are the leading reasons for engaging a third party logistics provider for handling biomaterials. Twentyfour/ seven customer service topped the list of the most sought after technologies and/or services from logistics providers.

Customer service is followed by more specialized services such as pharmaceutical lifecycle management, where storage, distribution, and reverse logistics are all handled by the provider — an area where a specialty company has a clear advantage. Depot facilities that offer drug return and destruction services, as well as retest labeling for clinical trials materials, are additional areas where biopharma companies desire solutions that specialty companies are best positioned to fulfill.

It’s not surprising that logistics giants are perceived to be more affordable than specialty providers, or that price ranked fourth in importance, after quality, reliability, and regulatory knowledge. Both of these statements — along with 49 percent of respondents stating they “select a logistics provider based on project best fit” when asked about pricing tolerance — support use of a combination of global and specialty providers. Thus, it is interesting and somewhat conflicting to see that price came in as the top reason buyers would consider switching from their current supplier.

While global companies continue to fine-tune their offerings in order to remain top of mind among customers in the life sciences market, it will be interesting to see whether these companies are able to develop the same quality of service for life sciences’ specialized needs and keep their reputation for being more affordable.

Survey Methodology: Nice Insight conducted a supply chain survey targeting 100 supply chain decision makers. The survey was comprised of 30 questions geared toward understanding current supply chain needs and practices, present and future expectations from logistics providers, and which services and traits influence provider selection.

If you want to learn more about the report or how to participate, please contact Nigel Walker, managing director, or Kate Hammeke, director of marketing intelligence, at Nice Insight by sending an email to nigel@thatsnice.com or kate.h@thatsnice.com.

If you want to learn more about the report or how to participate, please contact Nigel Walker, managing director, or Kate Hammeke, director of marketing intelligence, at Nice Insight by sending an email to nigel@thatsnice.com or kate.h@thatsnice.com.