Navigating The New World Of Value-Based Healthcare

By Mary Beth Lewis, GlaxoSmithKline, Brian Griner, Ph.D, Quintiles, and Mridul Malhotra, Quintiles

Demonstrating the value of therapies to the many healthcare stakeholders is an ongoing challenge for drugmakers. This involves complex analytics and requires developing appropriate evidence to meet stakeholder needs.

There are parallels between medicine and baseball in these efforts to use evidence in practice, as described in the 2012 New England Journal of Medicine paper, Moneyball and Medicine. In his 2003 bestseller, Moneyball, Michael Lewis points out that the architects of evidence-based baseball have developed metrics to evaluate player performance in terms of the value they add to the team. “Similarly, architects of new value-based approaches to healthcare delivery have attempted to develop metrics to evaluate the performance of therapeutic strategies, individual practitioners, and organizations,” states the NEJM paper.

There are parallels between medicine and baseball in these efforts to use evidence in practice, as described in the 2012 New England Journal of Medicine paper, Moneyball and Medicine. In his 2003 bestseller, Moneyball, Michael Lewis points out that the architects of evidence-based baseball have developed metrics to evaluate player performance in terms of the value they add to the team. “Similarly, architects of new value-based approaches to healthcare delivery have attempted to develop metrics to evaluate the performance of therapeutic strategies, individual practitioners, and organizations,” states the NEJM paper.

The New World Of Value-Based Healthcare

Against a backdrop where healthcare costs have increased five times faster than the GDP in the United States since 1960, and despite the fact that services account for most healthcare spending, pharmaceuticals remain an easy target for criticism and pricing pressures. This applies particularly to high-priced drugs for cancer and rare diseases. These trends are driving a need for value-based pricing. In the U.S., the Patient Protection and Affordable Care Act (PPACA) of 2010 has far-reaching implications for the cost structure of the healthcare market. Other key trends include the rise of accountable care organizations (ACOs) and the linking of reimbursements to quality metrics and reductions in the total cost of care. In the EU, the fact that fewer players are involved in healthcare than in the U.S. means that cost containment efforts are highly sophisticated. Here, new pricing frameworks are being based on perceived value rather than cost plus a profit margin, on evidence rather than historical experience, and on the perspectives of many stakeholders rather than just one. Levels of adoption of these frameworks vary by country and are supported by recent legislative changes.

For biopharma companies, the implications of value-based healthcare include the need to:

- change the focus of R&D so that companies focus investment on treatments that make significant advances in clinical performance

- redefine pricing evaluations for new medicines so that pricing reflects true societal value and takes account of wider economic benefits of treatments beyond direct health gains

- improve patients’ access to new therapies that their clinicians believe may provide benefits.

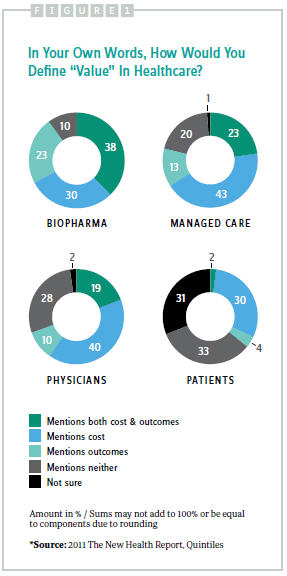

Defining value remains a challenge, with no consensus among stakeholders. Physicians typically focus on evidence of a new product’s effectiveness, while patients demand more assurance regarding a drug’s safety, and payers require proof of a therapy’s cost-effectiveness. Additionally, policy makers demand confirmation of a product’s real-world risk/ benefit profile in large populations. The 2011 New Health Report found that biopharma executives were the only group in which a majority included outcomes as part of their definition (Figure 1). For patients and physicians, the process (quality of care) appeared to matter as much as the outcome when it came to value, although nearly one-third of patients did not feel they could define value.

A Value-Based Framework

Pressures to develop a value-based framework include:

- declining R&D productivity despite increased investment, with the potential of proteomics so far not fulfilled, and significant funding gaps

- limited revenue and growth due to patent expiries, regulatory issues, promotional saturation, and restricted access to physicians

- external pressures such as high public expectations, patient dissatisfaction, pressure from investors, and safety concerns

- pricing issues including reimbursement challenges, pressures from buying groups, and high costs to patients.

A strategic approach to a value-driver’s assessment encompasses five key marketfacing considerations:

A strategic approach to a value-driver’s assessment encompasses five key marketfacing considerations:

- price sensitivity: What is the relationship between price and demand?

- performance: What is the product’s cost/benefit relationship?

- profile: How does the product compare to the competition — current and future?

- practice/organizational economics: How do pricing and volume impact the economics of the organization?

- positioning for value: What attributes, for which patients, provide the greatest value and fulfill unmet needs?

When modeling stakeholder decisions, biopharma companies typically optimize the profile and strategy for each group in isolation. This “divide-and-conquer” approach to research does not measure the real impact that each stakeholder’s decisions have on other stakeholders in the healthcare system. A more holistic approach takes account of the fact that each stakeholder reacts to a manufacturer’s offering directly and also to the reactions of other stakeholders.

An integrated approach to product potential and optimization research uses an interlocking research design and holistic modeling across all audiences simultaneously to provide a more comprehensive assessment. This provides a truer sense of actual expected share and optimal pricing information, as well as identifying the real leverage that may be available to influence demand.

A multistakeholder-linked value driver model simulates the real-world market dynamics due to changes in the product or marketplace to measure price sensitivity and changes in product demand. This type of model incorporates bidirectional influence dynamics that occur in the long and short term to provide a more robust and realistic view of the key drivers of overall market potential and revenue-optimizing pricing strategy.

Linked value-driver models are constructed in several steps. First, the decisions made by each stakeholder are identified (the dependent variables). Second, the likely degree of influence of each stakeholder on product adoption is determined. The experimental design then reflects these factors.

The model reflects payers’ likelihood of reimbursing a product, healthcare providers’ likelihood of prescribing, and patients’ chances of accepting or requesting the therapy. The model also considers that in the marketplace each stakeholder responds to the strengths and weaknesses of an individual product and its competitors and also responds to the reactions of other stakeholders.

Value-Based Pricing

Value-based pricing triangulates both stated and revealed value metrics to provide a robust measure of value at different price points that more closely reflects the true value of a product. This approach includes a health economic appraisal, a willingness to pay assessment, and reference price benchmarking to develop a pricing and access strategy that maximizes uptake and profit. A case study using a linked value-driver model is described below.

Linked Value-Driver Model Of Product X

Background & Objectives

Background & Objectives

Company Y is developing a new product, Product X, to follow its current formulations as part of its life cycle management strategy. In addition, there is the possibility of a generic entering the market in the future. The Company Y team needs to understand the impact of this market-changing factor on potential demand for a new formulation.

Research addressed the following objectives:

- Develop a linked value-driver model of physicians, patients, and payers to identify product features that optimize market demand for a new formulation.

- Determine optimal pricing given different market-access scenarios.

- Evaluate future market scenarios to measure the impact of likely payer decisions and the availability of generics on demand for Product X.

Payers are key to the success of Product X – determining reimbursement, inclusion on formulary, and imposing cost limits on doctors and practices. This study also aimed to determine how much benefit there might be in providing direct-to-patient information.

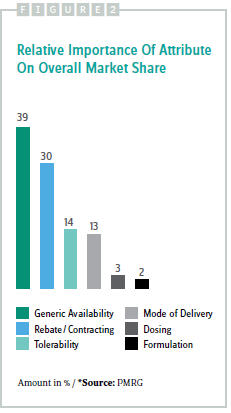

The relative importance of attributes to the overall market share of Product X is illustrated in Figure 2, which shows that generic availability and rebating have a substantial impact, while tolerability and mode of delivery have a smaller but still significant impact. Dosing and formulation drive a very small portion of overall preference share for Product X.

An analysis of attribute sensitivity using the linked value-driver model indicated that rebates and contracting are the largest positive drivers, and generic competition is the largest negative driver of base-case market share.

The linked value-driver model’s forecast for adoption and utilization confirms that adoption of Product X depends heavily on market access, which depends on price and the presence or absence of generic competitors.

Overall, the linked value-driver model provides comprehensive predictions on many elements of the likely future performance of Product X. A major feature is that small differences in marketaccess pricing can have significant impacts on the product’s revenue stream over long periods.