The Biopharma Pipeline Is Strong, But Are New Innovations Reaching Patients?

By Eduardo Schur, Justin Zamirowski, Atin Patel, and Maya Desai, Navigant

There has been much enthusiasm over the success of late-stage biopharmaceutical development and the rise in associated FDA approvals over recent years. A 2019 Navigant analysis of the health of the biopharma pipeline heading into 2019 found the number of new chemical entities gaining FDA approval more than doubled, while worldwide R&D spending increased 3.5%.

Despite the rise in successful approvals, previous research on launch performance indicated a central theme — that a majority of new products failed to meet their desired launch targets.

The evidence and insights shared with multiple stakeholders generated a central question: While the pipeline is strong, how many innovations are actually reaching patients — and what can companies do to position their products for a successful launch?

To address this important business question, we assessed forecast revenues vs. actuals as a proxy for performance of all new molecular entities (NMEs) approved by FDA from 2011 to 2015. We chose this timeframe so we could analyze products with a minimum of three years of data. After eliminating products that were discontinued, that were irrelevant due to factors such as transfer of ownership or out-licensing, or for which we could not obtain financial data, we selected 104 of the 183 NMEs approved during this period.

Key Performance Trends

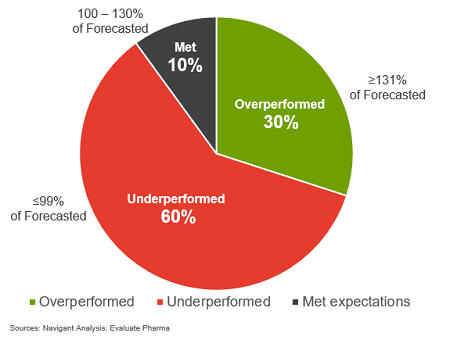

The analysis revealed that 30 percent of products overperformed (defined by 131 percent or more of forecasted performance), 10 percent met expectations (100 to 130 percent of forecasted performance), and 60 percent underperformed (less than 100 percent of forecasted performance). (See Figure 1.)

Figure 1: Product performance vs. analysis consensus forecast, based on first-year sales of 104 products (2011–2015)

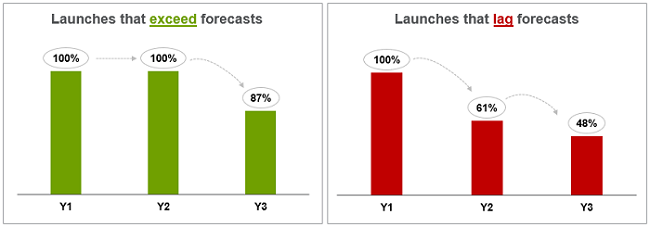

We confirmed the previously established theory that a product’s initial demand at launch sets a longer-term trajectory of performance, with the majority of Year 1 overperformers continuing to exceed expectations in Year 2 and Year 3, and Year 1 underperformers largely continuing to lag in subsequent years. (See Figure 2.) While many underperformers did improve against forecasts by Year 3, time to achieve peak sales is lengthening across several therapeutic areas and product categories. Further, we took a preliminary look at performance data for NMEs approved by FDA in 2016 and found that 60 percent of these products met or exceeded expectations, as compared to 40 percent of products approved from 2011 to 2015, indicating a potential shift in previously seen trends.

Figure 2: Product launch performance trajectory over three years

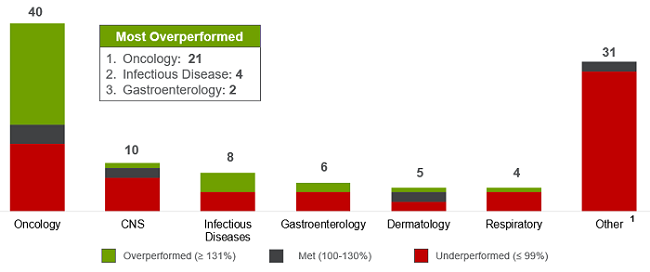

We also reaffirmed that most overperformers are in the oncology segment, where more than half of the products exceeded expectations, followed by infectious disease and gastroenterology. (See Figure 3.) Together, these three categories made up 90 percent of all overperformers. As expected, hepatitis C therapies accounted for most of the overperformance in infectious disease, where high expectations and warehoused patients primed successful launches. One surprising finding was the growing success of gastroenterology, where two of six products exceeded forecast.

Figure 3: Distribution by therapeutic area for approved products (2011–2015)

7 Critical Factors For Successful Launch Performance

After reviewing the data and adding multiple variables to explain the results, we identified common characteristics that explains successful launches.

1. Level Of Unmet Need

As expected, our analysis showed that products addressing a clear unmet need perform better. Among overperformers, unmet needs ranged from filling a clear gap in treatment to addressing safety, efficacy, or convenience challenges.

For example, in relapsing multiple sclerosis (MS) we observed the third introduction to become the most successful novel drug launch of the year. Tecfidera exceeded analyst projections by 270 percent in Year 1 due to physician and patient demand, driven by its comparatively benign safety profile and its addressing of known efficacy and convenience challenges.

2. Degree Of Differentiation

Degree of differentiation was also key to performance success. For example, Takeda brought Entyvio to market with a highly targeted launch in gastroenterology. As a result, the company was able to differentiate it as the first and only approved gut-selective prescription medication indicated for the treatment of moderately to severely active ulcerative colitis and Crohn’s disease. Entyvio exceeded analyst expectations by 500 percent in Year 1.

In oncology, overperformance was closely associated with being first in a tumor type or a new line of therapy, as well as showing clear outcomes, including overall survival (OS) and progression-free survival (PFS). For example, Amgen’s Kyprolis overperformed largely due to head-to-head comparison data showing its superiority over established protease inhibitor Velcade in OS and PFS in patients with relapsed or refractory multiple myeloma who had failed one to three prior therapies.

3. Intensity Of Competition

However, even a novel drug with clear differentiating benefits can face difficulties when entering an environment with a deeply entrenched standard of care. This challenge was particularly strong in the respiratory and cardiovascular (CV) markets, where 80 percent and 100 percent of therapies, respectively, underperformed at launch.

4. Care Setting

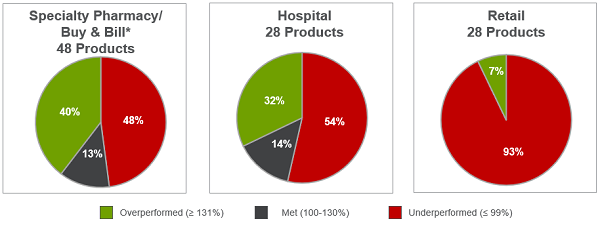

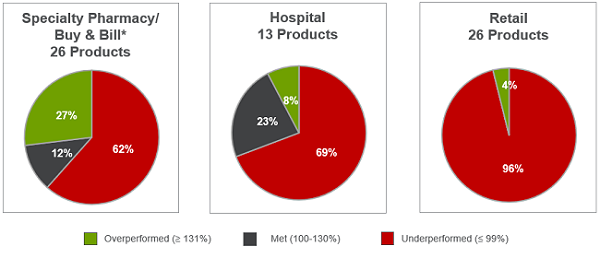

Setting of care significantly influences performance success. Our analysis showed that specialty pharmacy / buy and bill products performed best, with 40 percent of products exceeding expectations. In contrast, 93 percent of retail products performed worse than expected. (See Figure 4.)

Figure 4: Distribution by channel for approved products (2011–2015)

Launching a product into a simple care model with well-established integration and specialty champions, as in oncology, positions a company for success. In other product areas, such as thrombosis and heart failure, more complicated patient start settings and continuation of care models often lead to lower overall initial uptake and longer timeframes to peak penetration and commercial success. A product started in hospital and continued in an outpatient setting brings significant challenges in connectivity and integration. Products launched into a dense and interdependent care environment require multiple field force teams to reach more stakeholders with messaging that speaks to varying perspectives, needs, and goals to generate demand and pull through sales.

5. Reimbursement

Clear reimbursement pathways are also critical to performance success, and the unique challenges of reimbursement for different therapeutic areas, product types, and care settings have a significant impact. Products launched in oncology, where there are limited reimbursement hurdles, led the way in clear, carve-out payment mechanisms that fit into existing payment models. In fact, removing oncology products from our analysis of performance by care setting resulted in reducing overperformers by ~75 percent in hospital products and ~33 percent in specialty pharmacy/ buy and bill products. (See Figure 5.)

Figure 5: Distribution by channel after removal of oncology products

Beyond oncology, specialty products continued to overperform, while retail products were most likely to underperform, highlighting the clear advantages of being able to leverage existing buy-and-bill payment models. In key therapeutic areas such as CV, reimbursement barriers led to prolonged time to peak sales and slower overall adoption, resulting in underperformance. Many other underperformers, including in the respiratory segment, were able to boost sales through label expansion, improved market access and reimbursement, and increased salesforce. This demonstrates the critical importance of early outreach to payers, efforts to secure preferential coverage, and early and persistent market development.

6. Need For Market Development

Indeed, the degree of needed market development, or shaping, had a significant impact on product performance. Most underperforming products required a high degree of market development to either displace entrenched competitors or build awareness of an unmet need or change behavior. In contrast, most products that exceeded expectations entered the market with clear benefits and a clear place within preexisting treatment regimens.

Most CV drugs initially underperformed at launch, while a significant number progressed to blockbuster status through expanded target populations, physician education programs, and significant direct-to-consumer (DTC) advertising spending. After one such therapy doubled the DTC spending of its leading existing competitor to build awareness around its clinical superiority, the therapy went from underperforming at launch to overcoming the competitor and becoming the market leader within four years.

7. Therapeutic And Previous Portfolio Experience In The Disease

Manufacturers with a high degree of therapeutic area expertise and previous portfolio experience in the disease area of a new product achieved higher performance. This was particularly clear in MS, gastroenterology, and oncology. For several of the CV therapies that underperformed at launch but eventually achieved success, their respective companies’ deep experience helped drive the ability to adjust the commercial and medical execution and drive adoption through market development over time.

Conclusion

Our analysis makes it clear that companies must anticipate and address several critical factors in order to position new therapies for a successful launch. By focusing pipeline resources on therapies that address unmet needs in efficacy, safety, or convenience — and then shaping product launches around clearly targeted patient subgroups and real-world evidence — companies can help to ensure payer access, address provider concerns and resistance, and present a clear value proposition that speaks to all stakeholders. This can, in turn, increase the likelihood of exceeding forecasted performance and reaching patients with valuable new treatments. We will continue to monitor product performance to determine if the launch performance in 2016 represents a larger shift in overall launch success.

About The Authors:

Eduardo Schur serves as managing director and global leader of Navigant’s Life Sciences Practice, bringing more than 28 years of experience in the pharmaceutical market. His expertise includes strategic planning, market assessments, and product launches in multiple therapeutic areas. Prior to joining Navigant, Schur was VP of marketing at Bristol-Myers Squibb and held several commercial leadership positions with Johnson & Johnson in the U.S. and abroad. Schur is part of the faculty at Rutgers University Edward J. Bloustein School of Planning and Public Policy.

Eduardo Schur serves as managing director and global leader of Navigant’s Life Sciences Practice, bringing more than 28 years of experience in the pharmaceutical market. His expertise includes strategic planning, market assessments, and product launches in multiple therapeutic areas. Prior to joining Navigant, Schur was VP of marketing at Bristol-Myers Squibb and held several commercial leadership positions with Johnson & Johnson in the U.S. and abroad. Schur is part of the faculty at Rutgers University Edward J. Bloustein School of Planning and Public Policy.

Justin Zamirowski is a director and Launch Excellence Practice co-lead at Navigant. He has more than two decades of R&D and commercial experience across sales, marketing, market access, product development, and application of real-world evidence in biotech, pharma, and specialty pharma companies. In addition, Zamirowski has led multiple product launches across such therapeutic areas as central nervous system (CNS), cardiovascular, GI, and oncology.

Justin Zamirowski is a director and Launch Excellence Practice co-lead at Navigant. He has more than two decades of R&D and commercial experience across sales, marketing, market access, product development, and application of real-world evidence in biotech, pharma, and specialty pharma companies. In addition, Zamirowski has led multiple product launches across such therapeutic areas as central nervous system (CNS), cardiovascular, GI, and oncology.

Atin Patel is a Life Sciences Practice consultant at Navigant. He has experience in both the pharmaceutical and medical device industries related to opportunity assessment, market forecasting, product planning, and launch and lifecycle strategy. Patel has worked on engagements across a range of specializations, including CNS, digital health, in vitro diagnostics (IVDs), oncology, and respiratory.

Atin Patel is a Life Sciences Practice consultant at Navigant. He has experience in both the pharmaceutical and medical device industries related to opportunity assessment, market forecasting, product planning, and launch and lifecycle strategy. Patel has worked on engagements across a range of specializations, including CNS, digital health, in vitro diagnostics (IVDs), oncology, and respiratory.

Maya Desai is an associate director and Launch Excellence Practice co-lead at Navigant. For more than a decade, Desai has successfully provided product launch readiness and commercialization strategies for companies to remain competitive in the evolving healthcare environment, working directly with founders, CEOs, and investors of pharmaceutical and biotechnology companies. Her experience also includes corporate strategy, portfolio planning and optimization, business development, and life cycle management across multiple therapeutic areas.

Maya Desai is an associate director and Launch Excellence Practice co-lead at Navigant. For more than a decade, Desai has successfully provided product launch readiness and commercialization strategies for companies to remain competitive in the evolving healthcare environment, working directly with founders, CEOs, and investors of pharmaceutical and biotechnology companies. Her experience also includes corporate strategy, portfolio planning and optimization, business development, and life cycle management across multiple therapeutic areas.