Use Peers' Experiences To Make Educated CRO Selections

By Rebecca McAvoy, Market Research Director, Industry Standard Research

Life Science Leader (LSL) and Industry Standard Research (ISR) have recently partnered to bring readers a robust methodology for evaluating and selecting CROs. ISR collects and analyzes data from users with hands-on experience working with service providers within the past 18 months to provide LSL and the pharmaceutical industry with detailed insights into CRO performance. LSL uses this data to identify service providers that have earned leadership positions and award them in various categories of service.

"Users with hands-on experience” is an important phrase to note in the above paragraph. Imagine a scenario in which you need to choose a restaurant to host an important event but you’ve never personally eaten at any of the restaurants on your short list. Gathering opinions on the restaurant from prior patrons who have sampled the fare and experienced the service and ambiance would provide an excellent proxy for the experience of actually dining in the restaurant. Fortunately for those choosing a restaurant, websites with user reviews allow this information to be at your fingertips within moments. In the pharmaceutical outsourcing industry, information from users takes substantially more effort to come by – but the knowledge gained is well worth the effort.

Utilizing information from recent users of CROs is the same idea as utilizing user reviews to make a more educated product purchase or select an appropriate restaurant for your needs. However, the data ISR has collected about CROs’ performance is much more structured and detailed than the wide-ranging open-end responses found on most user review websites. Recent users of CROs provide ratings along 25+ performance attributes across a variety of categories. They are also asked to rate their satisfaction with each provider they’ve used, the likelihood that they would use the provider again, and the likelihood that they would recommend that provider to a colleague. Furthermore, respondents are asked to explain their satisfaction ratings in an open-ended fashion, enabling the reader to understand details regarding how the service provider’s performance may have impressed a given user or what a particular pain point may have been. This approach provides a comprehensive look into what it would be like to work with a provider for an outsourced clinical development project.

Having access to performance data from CROs’ users is crucial in making an informed CRO selection. However, it is a lot of information to process, and it is helpful to have a plan for evaluating this information. To further aid in the process of choosing a CRO, ISR collected information regarding the criteria considered most important to industry decision-makers when selecting a provider for their outsourced work. CRO selection decisions are not made in a vacuum. They’re most often made by a team of people with a variety of factors to consider. Additionally, many decisionmaking units have company guidelines to which they must adhere.

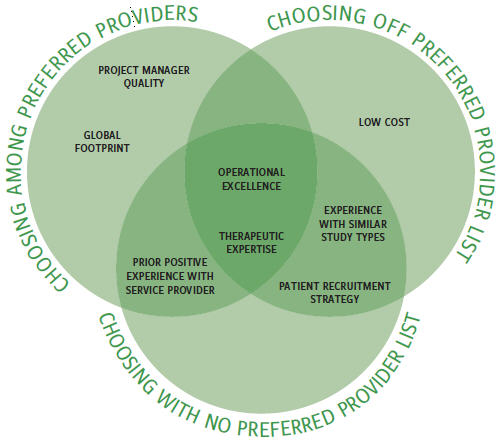

Not all selection environments are equal. The same rules and preferences may not necessarily apply as the selection environment differs. Selecting among preferred providers, selecting a provider that is not on the company’s preferred list, and selecting a provider when a preferred list does not exist may lead to different priorities and interests taking precedence in the decision. To investigate this further, ISR asked respondents with Phase 2/3 decisionmaking responsibilities about selection criteria when choosing providers in each of the aforementioned selection environments. Figure 1 displays the five most important attributes in each of the decision-making scenarios and illustrates how each scenario can allow selection attributes to become more or less relevant.

Operational excellence and therapeutic expertise rank among the top-five most important selection drivers in each decision-making environment. In fact, operational excellence is the #1 most important attribute in each of the environments. Not surprisingly, these areas are critical for selection regardless of how a provider is chosen.

Now to examine the nuances of each of the scenarios: When choosing among preferred providers, project manager quality and global footprint are among the top-five most important attributes, but this is not the case for the other scenarios. A decision-making scenario could easily be imagined where stakeholders know that the providers have the necessary operational and therapeutic experience (due to the vetting process they underwent to be included on the preferred list) and now need to further narrow the list of potential providers based on whether the project managers are of sufficient caliber and whether the geographic scope can be managed successfully.

Choosing a provider that is not on the company’s preferred list and choosing a provider in absence of a preferred list yield similar results in terms of the most important attributes. Decisionmakers are looking for providers to have experience with similar study types and for strong patient recruitment strategy. Desiring experience with similar study types is logical, since the providers have not already been through a preferred provider vetting process to ensure that they have sufficient experience.

Low cost also comes into play when choosing a provider not on the company’s preferred list. As preferred provider agreements often include prenegotiated rates, decision-makers may be more price-sensitive when choosing a provider with which they do not already have an agreement.

CRO performance ratings and an understanding of CRO selection criteria are essential tools in an organization’s choice of service providers. Decisionmakers at sponsor companies can use the experiences and insights of their peers as a lens through which to examine and enhance their own approaches to clinical outsourcing. For CROs, knowing where their business exceeds expectations and where it falls short will aid in marketing their abilities and improving potential shortcomings.

Figure 1

© Industry Standard Research

Survey Methodology: Industry Standard Research is a full-service market research provider to the pharma and pharma services industries. ISR’s CRO quality benchmarking research is conducted annually via an online survey. For the 2016 CRO Awards data, more than 60 service providers were evaluated on over 25 different performance metrics. Research participants were recruited from biopharmaceutical companies of all sizes and screened for decision-making influence and authority when it comes to working with CROs. Respondents only evaluate companies with which they have worked on an outsourced project within the past 18 months. This level of qualification ensures that quality ratings come from actual involvement with a business and that companies identified as leaders are backed by experiential data.

For more information, please visit www.ISRreports.com.