What Is Pharmaceutical Innovation, Anyway? Italy's New Algorithm & The Global Trend

By Yulia Privolnev, manager, global market access, Decision Resources Group (DRG)

Innovation has long been a topic of focus in the pharmaceutical industry, with developers striving for it, regulators and payers demanding it, and everyone — from patients to manufacturers — worrying about who is going to pay for it. Something that often gets lost in the conversation is: What exactly do we mean when we talk about “innovation”?

Although the term “innovative” implies some superior properties — perhaps worthy of premium price and increased use — there is little consensus among differing stakeholders as to what constitutes a true pharmaceutical innovation. Naturally, this leads to confusion about what sort of novel pharmaceutical products should be pursued by developers and encouraged by regulators and payers. After all, a drug that is considered innovative and novel during its development phase may fall flat when it comes to market access and payer evaluations.

However, the growing interest in prioritizing and incentivizing innovative pharmaceuticals from countries around the globe has necessitated a more specific definition, one that helps developers understand what is expected from them, and perhaps even lead to an eventual consensus on the term.

Italy’s New Innovation Algorithm

In April 2017, after many years of discussion and debate, the Italian Medicines Agency (Agenzia Italiana del Farmaco, or AIFA) introduced a new algorithm for assessing a drug’s level of innovation prior to its entry into the Italian market. Although AIFA already had a previous innovation algorithm in place, it was widely thought to be too rigid and lacking in transparency. The new algorithm aims to be more user friendly than the previous iteration, with more flexibility and room for reviewer discretion — and more clear about what constitutes innovation. The new algorithm was introduced concurrently with a €1 billion ($1.2 billion) Innovative Drug Fund (€500 million allocated to oncology therapies, €500 million to other indications), from which innovative drugs will be funded.

The new innovation assessment method should theoretically allow faster market access for drugs that demonstrate clear therapeutic innovation compared to the available alternatives. These drugs will receive special perks, such as instant regional formulary inclusion.

The innovation assessment occurs independent of the market authorization and reimbursement processes, though it is largely based on the same evidence provided for those evaluations and is also conducted by AIFA’s Scientific and Technical Committee (Commissione Tecnico Scientifiche, or CTS).

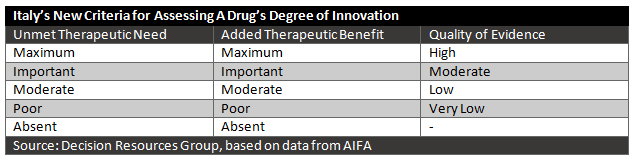

The judgment of innovation will be based on three evaluation criteria: unmet therapeutic need, added therapeutic value, and quality of evidence.

Unmet Therapeutic Need

The unmet therapeutic need evaluation determines the availability of other therapies for that disease and the extent to which that a new therapy is needed for that patient population. It can be graded through five levels, from maximum (no therapeutic options for that specific indication exist) to absent (alternative treatments for that indication that modify disease outcomes and have a favorable safety profile are available). The manufacturer proposes a level of unmet therapeutic need to AIFA and must describe the rationale for their choice.

Added Therapeutic Value

The added therapeutic value is the magnitude of clinical benefit provided by the new drug compared to available alternatives, if any exist. The outcomes must be clinically relevant and validated for the indication. Demonstrating added therapeutic value compared to other available therapies is particularly important in the treatment of diseases that are seen as a potentially fatal, that cause repeated hospitalizations, or that cause disability or significantly impair quality of life. As with unmet therapeutic need, the added therapeutic value is measured on a scale from maximum (demonstrates greater efficacy than alternative treatments in clinically relevant outcomes, ideally curing the disease or altering its course) to absent (demonstrates no greater clinical benefit than available alternatives).

Quality of Evidence

AIFA uses the GRADE (Grading of Recommendations Assessment, Development and Evaluation) method to determine evidence quality. The manufacturer is again asked to propose a level and justify it. Based on the GRADE method, the quality ranges from very low to high.

It should be noted that for orphan drugs, the quality of evidence will play less of a role, given the difficulty of conducting trials for rare diseases. In cases where an orphan drug meets the other two criteria, a drug can still be considered innovative, even if the quality of evidence is low.

Impact for Manufacturers

Overall, such a clear and flexible algorithm is an opportunity for drug developers, presenting a clear framework within which to develop drugs and bring them to market in Italy. One notable concern is that elements that many manufacturers consider to be innovations — such as changes in the mode of administration or the mechanism of action of a drug — do not appear explicitly in the algorithm, although they will presumably fall under the added therapeutic value category.

Although it remains to be seen in practice, there is reason to be optimistic about the new algorithm. But what about outside of Italy? How are other countries defining and assessing innovation, assuming that they are at all?

Innovation: The Global Perspective

Italy is by no means the only major pharmaceutical market preoccupied with innovation, although its new approach to assessing and defining it is one of the most recent. Innovation is undoubtedly a global preoccupation, and we see it becoming increasingly more pervasive across all of the major markets.

In July 2017, the U.S Food and Drug Administration (FDA) announced that it would be unveiling an FDA Innovation Initiative, focused on ensuring that the FDA’s regulatory processes are modern and efficient, ideally removing regulatory barriers that prevent patients from accessing innovation. The FDA has long expressed an interest in innovation, and in a way, the agency has already defined innovation in a way similar to AIFA’s. In Italy, a successful innovation assessment comes with many perks, ranging from rapid uptake to access to a special innovative drug fund. Obviously, such perks would not be possible in the current U.S. healthcare system, but the FDA does have something else it can offer — faster approval. The FDA offers streamlined approval through four distinct approaches: priority review designation, breakthrough therapy designation, accelerated approval, and fast track designation. The purpose of these approaches is to speedi the availability of drugs that treat serious diseases, especially if those drugs are the first available treatments or if they have advantages over existing treatments. In many ways, these criteria very similar to the new AIFA algorithm, with a strong focus on unmet need and strong clinical superiority.

This focus is similar across the globe. The French pricing and reimbursement system depends on a drug’s ASMR (improvement of medical benefit assessment) and SMR (therapeutic value assessment). In Germany, the 2011 Arzneimittelmarkt-Neuordnungsgesetz (AMNOG) law created a system where a drug’s negotiated price depends on the assessment of additional benefit that the drug provides compared to existing products. In Canada, Patented Medicine Prices Review Board (PMPRB) guidelines are more lenient towards incremental innovation, but the Common Drug Review (CDR) and provincial formularies still demand strong therapeutic value over existing treatments. In Japan, a drug is rewarded a premium price if it is deemed to provide an innovative improvement in therapeutic or clinical effectiveness.

Despite the differences in how, when, why, and by whom a drug is assessed around the globe, what we see emerging from these different evaluations is one trend, and perhaps an inkling of a common definition for innovation. All of these countries — from the universal healthcare systems of Europe to the FDA in the U.S. — focus on therapeutic benefit and unmet need. What they do not focus on is new mechanisms of action or new modes of administration. Innovation, like beauty, is in the eye of the beholder, and it is possible that the qualities that excite at one stage of the development process may fail to excite stakeholders at the regulatory and payer stage. Ultimately, these stakeholders control a drug’s success on the market, so their evaluation criteria are important to consider when developing a novel pharmaceutical.

How Should Manufacturers Respond?

It is without question that innovations in the life science industry have greatly improved patient outcomes in recent decades. However, as developers continue to develop new treatments for diseases, regulators and payers increasingly worry about the costs of healthcare. As per-capita spending on prescription drugs grows year after year in the U.S., there is an increasing need to justify these expenditures. The value of a drug comes from the health outcomes that it generates. This is why novelty and new mechanisms of action are often discarded when innovation is considered, and the focus turns to the novelty of effectiveness.

This is where and why clear and easily assessed definitions of innovation become crucial. If a manufacturer or other stakeholders is able to clearly evaluate a drug’s innovation value based on transparent guidelines, algorithms, or criteria — and manufacturers are able to work toward the targets established by these guidelines — the end result is more advantageous for everyone.

With this in mind, manufacturers of novel, innovative therapies have to consider two very important factors during development, in order to maximize likelihood of innovation status, in whatever form it takes and in whatever country awards it:

- Take advantage of opportunities to communicate and collaborate with stakeholders — regulators, payers, etc. — at every stage of the development process.

- Focus trial design on yielding high-quality evidence, ensuring that the design reflects expectations through early communication with stakeholders.

As the global pharmaceutical industry shifts its focus from volume to value, truly innovative therapies should have a chance to shine. But first, we would benefit from reaching a consensus on what innovation in pharma truly is.

About The Author:

Yulia Privolnev is a principal analyst on the Global Market Access Insights team at Decision Resources Group (DRG). She is responsible for monitoring, analyzing, and reporting on global market access through the production of DRG’s Global Market Access Solution (GMAS) and Access & Reimbursement products. Yulia’s specific focus is on all aspects of market access in Western and Eastern Europe, as well as external reference pricing (ERP) and managed entry agreements (MEAs) on a global scale. Yulia holds a bachelor’s degree from the University of Toronto and a master’s from the London School of Economics.

Yulia Privolnev is a principal analyst on the Global Market Access Insights team at Decision Resources Group (DRG). She is responsible for monitoring, analyzing, and reporting on global market access through the production of DRG’s Global Market Access Solution (GMAS) and Access & Reimbursement products. Yulia’s specific focus is on all aspects of market access in Western and Eastern Europe, as well as external reference pricing (ERP) and managed entry agreements (MEAs) on a global scale. Yulia holds a bachelor’s degree from the University of Toronto and a master’s from the London School of Economics.