Why Proactive Risk Mgt. Is The Only Solution To The New Regulatory Reality

By Dan Brettler, life science practice leader, Conner Strong & Buckelew and Kenneth Piña, managing principal, Core Risks Ltd.

Two decades ago when the FDA suspended a pharmaceutical company’s operations, it sent a shudder through the industry. While not entirely infrequent, shutdowns were widely publicized and often financially crippling, especially for middle-market firms.

While suspension in manufacturing is no less devastating today than it was 20 years ago, the number and frequency of facility shutdowns has increased at a disturbing rate despite advancements in technology, increased access to skilled labor abroad, and the growth of the quality assurance function. As a result, the FDA has sharply increased the frequency of facility inspections, and manufacturing quality control has emerged as a significant and ongoing challenge for the industry.

This new regulatory reality should cause biopharmaceutical companies to reexamine their risk infrastructures and adopt proactive approaches to risk management that will enable them to better anticipate, manage, and mitigate business interruption risks that are likely to accompany heightened regulatory scrutiny. Two valuable tools that should be included in today’s biopharmaceutical risk management program are: a) a comprehensive, long-term enterprise risk management (ERM) strategy, and b) new insurance coverages that might provide a critical financial safety net when manufacturing challenges arise.

LIVING ON A FAULT LINE

Many people have met calamity due to denial. Think of the number of people who live in hurricane, flood, and earthquake zones who convince themselves that the “big event” won’t happen during their lifetime. The same holds true for business leaders. Applying this notion to FDA site inspections, there recently have been a number of noteworthy “calamities” in the biopharmaceutical industry despite what were believed, at the time, to be robust internal quality and compliance initiatives.

Despite the evidence that it can and may happen, company leaders often do not spend enough time understanding the nature of their manufacturing risks (impact and likelihood) or becoming knowledgeable about insurance products that could help them effectively manage such risks. Instead, many CEOs and CFOs elect to transfer traditional risks of loss, such as physical damage of property, to their insurers, while foregoing insurance coverage for what might be one of their most material vulnerabilities — nonphysical damage loss, such as is experienced during a regulatory shutdown. Traditional property insurance policies don’t address nonphysical damage losses — those that are not oriented in accidental causation in one form or another, like fire, wind, earthquake, or a mechanical breakdown of equipment.

UNDERSTANDING AND PREPARING FOR NONPHYSICAL DAMAGE LOSS

A regulatory shutdown of a key manufacturing facility or a line at such a facility can prove devastating, even catastrophic, for a biopharmaceutical company.

One of the most notable examples was the suspension of operations at Johnson & Johnson’s McNeil-PPC, Inc.’s Fort Washington, PA, plant in 2011. The site was the company’s primary facility for producing Tylenol and several other medicines. When the FDA took action, J&J was forced to lay off 400 workers and has spent more than $100 million on improvements over the last five years.

Moreover, as biopharmaceutical companies increasingly outsource manufacturing to foreign facilities, noncompliance identified during foreign facility inspections has become a mounting concern. In recent years, a flurry of noncompliance issues in India has raised red flags with the FDA, leading to increased scrutiny. The most notorious case was the U.S. Department of Justice fining New Delhi-based Ranbaxy Laboratories $500 million in 2013 for manipulating data and selling contaminated drugs. The Financial Times recently reported that there are now 39 drug-making facilities in India that have lost clearance to develop drugs for U.S. consumers due to regulatory problems.

Oftentimes, companies don’t know that a third-party facility has been ruled noncompliant until months after these drugs have already been produced. But once noncompliance is discovered, it can be damaging to the finances and reputation of the manufacturer. This again leads to two important questions: a) Does your risk management program adequately and proactively identify manufacturing issues that could result in a material loss? b) If the company incurs such losses, will they be covered under the company’s current insurance program?

ADOPTING A TOP-DOWN AND BOTTOM-UP APPROACH TO RISK

Considering the enormous costs associated with the shutdown of a key facility or manufacturing line, it is critical that today’s biopharmaceutical management team “kick the tires hard” and make sure they truly understand the risk variables at play (e.g., revenue loss, reputational harm, civil and criminal penalties, litigation).

While most large organizations have adopted some form of an ERM program to proactively identify and manage risk events before they become catastrophes, many midsize and small biopharmaceutical companies have put in place rudimentary programs, if any at all. Yet these companies are the most vulnerable to being crippled by a manufacturing event. What many executives do not realize is that a comprehensive ERM program does not have to be expensive to be effective. A pragmatic ERM program can provide many middle-market companies with an effective method to identify and assess cross-functional risk and reduce the vulnerabilities that typically result from siloed departments, supply chain challenges, and underresourcing.

Many middle-market companies will limit their risk identification exercise to a top-down assessment, usually via questionnaires completed by senior business leaders. But today’s environment demands a more in-depth assessment, one that challenges management perceptions while also merging the knowledge of senior leaders and those on the front line to develop a more realistic perspective on risk. This is a top-down, bottom-up ERM approach.

Applying Quality Risk Management (QRM) in Manufacturing — A Proactive Approach

September 15, 2016 — Recorded Session Now Available!

This interactive online session will help attendees understand risk management principles, risk management tools, methods, and processes applicable to a manufacturing environment.

Once manufacturing risks are better understood and appreciated, the next key questions are: a) What more can the company do to further minimize or eliminate such risks? b) Will the company’s current insurance program respond to these risks? c) Are there other insurance products that the company should consider that will allow it to economically transfer such risks?

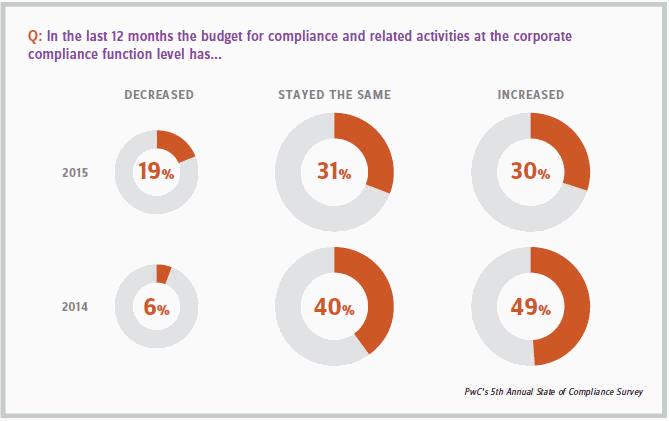

Getting buy-in and budget for a sophisticated ERM strategy and/or increased insurance coverage can be challenging. A 2015 PwC study of pharmaceutical companies reported that nearly a third saw a year-over- year increase in their compliance budget (see chart below). Yet many organizational leaders would prefer to direct compliance funds into technology initiatives and building out QA staff and procedures.

History shows that even the largest firms with significant resources experience sizable interruptions that don’t involve physical damage. That’s why it’s crucial for risk management and compliance professionals to get their board or audit committee invested in proactive risk management. It is critical to not only take a proactive, holistic view of the organization, but to also challenge corporate management to reexamine what protections are in place should regulatory issues arise. With the backing of the board, risk managers can play an increasingly important role in protecting their company.

Significantly, the insurance industry is also attempting to proactively respond to industry needs and concerns, underwriting policies that might permit biopharmaceutical and other life sciences companies to transfer nonphysical damage losses, such as are experienced during a regulatory shutdown. For example, since fall 2015, Munich Re has offered an insurance policy that provides several unique triggers for policy coverage, including lost income from an FDA-mandated manufacturing suspension. This coverage is available for the suspension of manufacturing (at either a company’s own facility or a third party’s facility), product recalls, and accidental contamination, and it is specifically designed to protect earnings over the period of time dedicated to resolving the incident. Importantly, this insurance product also covers the cost of bringing in experts and resources to help manage the company through to a resolution. As this type of protection is not typically included in a traditional business interruption policy (because the event does not stem from physical damage to a facility or property), this new insurance could be an important addition to the existing insurance programs of a biopharmaceutical/life sciences company.