A Recap On 2014 Outsourcing Trends And What To Expect In 2015

By Kate Hammeke, VP of Market Research, Industry Standard Research (ISR) @ISRreports

2014 was an exciting year in outsourcing. Several high profile mergers and acquisitions in both the CRO and CMO world will mean some familiar names will go through big changes — Huntingdon acquired Harlan, and PRA acquired RPS in the CRO world; Patheon acquired both DSM and Gallus Biopharma, and AMRI acquired Cedarburg and OsoBio in the CMO world.

Consolidation is nothing new to the industry, but as CROs and CMOs move toward functioning as strategic partners, is consolidation best for the relationship? Sure, it enables a more end-to-end service offering from a single provider, but the advantages of the “one-stop-shop” sometimes come with a host of disadvantages, too. Nice Insight data has shown how M&A activity can impact buyers’ perception of CRO/CMO performance postmerger, so it will be interesting to see whether these businesses are able to fully integrate the company while maintaining the strengths of its acquisitions.

Consolidation is nothing new to the industry, but as CROs and CMOs move toward functioning as strategic partners, is consolidation best for the relationship? Sure, it enables a more end-to-end service offering from a single provider, but the advantages of the “one-stop-shop” sometimes come with a host of disadvantages, too. Nice Insight data has shown how M&A activity can impact buyers’ perception of CRO/CMO performance postmerger, so it will be interesting to see whether these businesses are able to fully integrate the company while maintaining the strengths of its acquisitions.

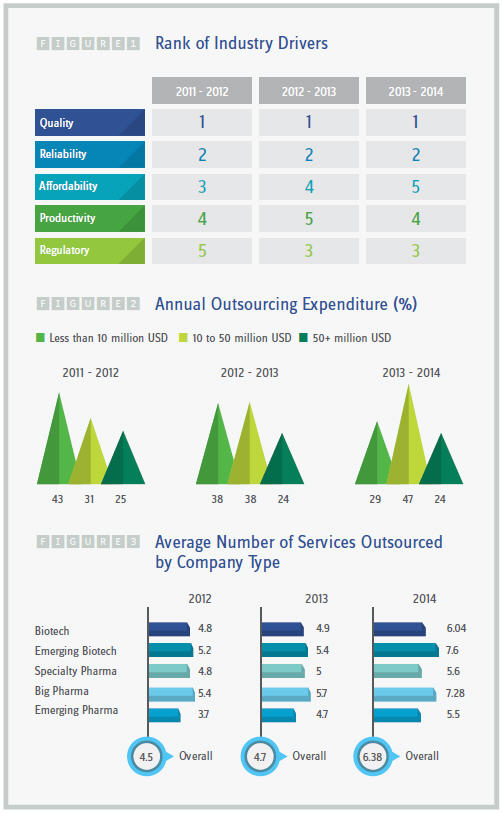

A continued increase in expenditure compared to the prior two years was another exciting factor in 2014 outsourcing. This rise in spending coincided with a decrease in the prioritization of affordability when selecting an outsourcing partner. Biopharma companies boosting their budgets and the number of services they entrust to CROs and CMOs follows a new pattern in outsourcing — engaging contract businesses for access to scientific expertise that is not possessed in-house. Shifting priorities in partner selection and rethinking the big picture regarding the long-term strategy for time and cost savings show that the dynamic of these relationships is still evolving toward a true partnership.

Nice Insight research data shows that interest levels in strategic partnerships vary by the type of business. Not surprisingly, emerging biotechs showed the greatest interest in forming partnerships with three-quarters of emerging biotech respondents expressing interest. Biotechs also showed strong interest, with more than half (53 percent) stating their company is interested in forming long-term, win-win relationships with CROs/CMOs. Biotechs are likely interested in forming partnerships for different reasons than pharma companies, as these businesses have limited in-house staff, a more focused pipeline, and are often cost-driven. Biotechs may also lack internal expertise and seek specific skillsets through contract partners.

Pharma companies showed more indifference to forming new strategic partnerships, with a near-even split between the percentage who are interested and those who are not interested. This tepid interest could be influenced by the high number of existing partnerships among pharma companies, considering these respondents noted they are currently allocating a larger portion of work to strategic partners than to biotechs. It may also be influenced by the corporate culture at long-established pharma companies where there is a significant amount of expertise available in-house, a standard set of internal procedures, and a more rigid structure for a contract business to fit into.

The results from Nice Insight’s 2015 Outsourcing survey are currently being tabulated and analyzed to identify any behavioral changes to the way buyers engage contract suppliers, as well as how these companies are perceived by the industry they serve. The 2015 data will include industry feedback on nearly 200 companies and 44 services.

Survey Methodology: The Nice Insight Pharmaceutical and Biotechnology Survey is deployed to outsourcing-facing pharmaceutical and biotechnology executives on an annual basis. The 2013-2014 report includes responses from 2,337 participants. The survey comprises of 240+ questions and randomly presents ~35 questions to each respondent in order to collect baseline information with respect to customer awareness and customer perceptions of the top 100+ CMOs and top 50+ CROs servicing the drug development cycle. Five levels of awareness from “I’ve never heard of them” to “I’ve worked with them” factor into the overall customer awareness score. The customer perception score is based on six drivers in outsourcing: Quality, Innovation, Regulatory Track Record, Affordability, Productivity, and Reliability. In addition to measuring customer awareness and perception information on specific companies, the survey collects data on general outsourcing practices and preferences as well as barriers to strategic partnerships among buyers of outsourced services.

If you want to learn more about the report or how to participate, please contact Nigel Walker, managing director, or Kate Hammeke, director of marketing intelligence, at Nice Insight by sending an email to nigel@thatsnice.com or kate.h@thatsnice.com.

If you want to learn more about the report or how to participate, please contact Nigel Walker, managing director, or Kate Hammeke, director of marketing intelligence, at Nice Insight by sending an email to nigel@thatsnice.com or kate.h@thatsnice.com.