As Biologics Development Rise At Pharma Companies — What Does It Mean For Outsourcing?

By Kate Hammeke, director of marketing intelligence, Nice Insight

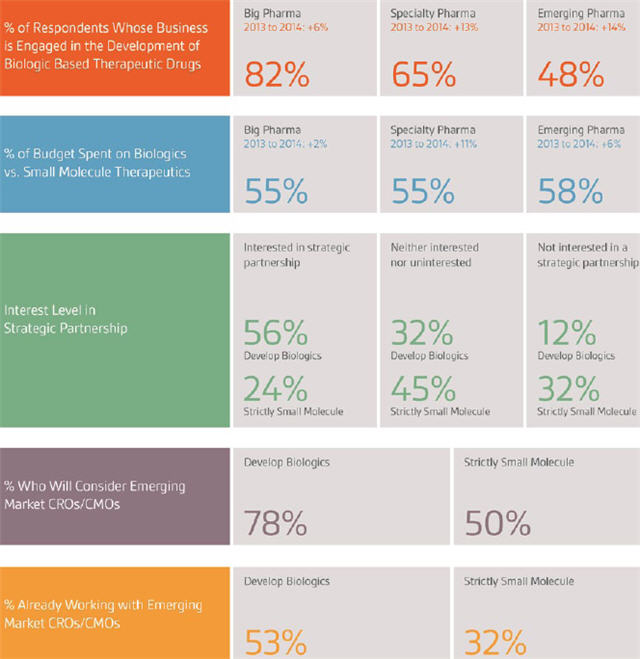

Over the past two years, research results from Nice Insight’s annual Pharmaceutical and Biotechnology Outsourcing survey indicate a rise in the percentage of respondents who work at traditional pharmaceutical companies that are engaged in the development of biologic-based therapeutic drugs. Perhaps surprisingly, the largest increase comes from respondents who work for emerging pharmaceutical companies, up 14 percentage points over last year (34 percent, 2013 to 48 percent, 2014), followed by specialty pharmaceutical companies with a 13 percentage points increase (52 percent, 2013 to 65 percent, 2014), and Big Pharma with an increase of 6 percentage points (76 percent, 2013 to 82 percent, 2014).

Over the past two years, research results from Nice Insight’s annual Pharmaceutical and Biotechnology Outsourcing survey indicate a rise in the percentage of respondents who work at traditional pharmaceutical companies that are engaged in the development of biologic-based therapeutic drugs. Perhaps surprisingly, the largest increase comes from respondents who work for emerging pharmaceutical companies, up 14 percentage points over last year (34 percent, 2013 to 48 percent, 2014), followed by specialty pharmaceutical companies with a 13 percentage points increase (52 percent, 2013 to 65 percent, 2014), and Big Pharma with an increase of 6 percentage points (76 percent, 2013 to 82 percent, 2014).

These changes coincide with an increase in the percentage of one’s outsourcing budget spent on biologics as compared to small molecule therapeutics — up a substantial 11 percentage points among specialty pharma respondents, 6 percentage points in the emerging pharma group, and a modest 2 percentage points among Big Pharma respondents. This makes sense, considering biologics have traditionally been more expensive to develop than small molecule therapeutics, but as the patents for existing biologics continue to expire — an expected market value of $54 billion will go off patent in the next five years — the need for reducing costs in biologic development will become more crucial. So, while both outsourcing expenditure and the percentage of expenditure going toward biologics development have both risen over last year, it should not necessarily be interpreted as rising costs; rather, it is more likely a reallocation of internal versus external spend on biologics development.

The Reason For Partnering With CMOs/CROs Has Changed

During the past few years, Nice Insight research has highlighted a change in the theory of outsourcing. A practice that started off as a purely client-vendor relationship centered on commoditized activities has evolved into more of a partnership, in which CROs and CMOs are engaged, in part, because of access to external knowledge, not just because of the ability to complete tasks. As a matter of fact, when asked to consider a dozen different quantifiable traits, 74 percent of survey respondents whose business is involved in the development of biologics stated “technical expertise” was very important when selecting an outsourcing partner, second only to having a “track record of success,” 75 percent. Meaning, access to knowledge and experience, or technical expertise, are not only essential qualities, but they also drive CMO engagement when it comes to biologics. That being the case, it makes sense that businesses involved in developing biologics are considerably more interested in forming strategic partnerships — defined as a long-term, win-win commitment between two organizations — than those that focus strictly on small molecules (56 percent vs. 24 percent).

Who Outsources To Emerging Markets?

Interestingly, respondents whose business includes the development of biologic-based therapeutics are also significantly more likely to consider CROs and/or CMOs in emerging markets such as Brazil, China, or India (78 percent) than businesses that are strictly small molecule (50 percent). In addition, this group is more likely to already be working with emerging market providers than their counterparts (53 percent vs. 32 percent). Among respondents who outsource to emerging markets, almost two-thirds of the work is allocated to emerging markets, while one-third remains in established markets. The practice of outsourcing complex biologics projects that contain intellectual property further represents the shift in outsourcing beliefs. This change in outsourcing ideology — from subcontracting commoditized work to seeking expertise for specialized products — was bolstered by improved patent laws in developing countries, along with the strong education systems and access to an expanding pool of available patients to participate in clinical trials.

Survey Methodology: The Nice Insight Pharmaceutical and Biotechnology Survey is sent to outsourcing-facing pharmaceutical and biotechnology executives on an annual basis. The 2013-2014 report includes responses from 2,337 participants. The survey comprises of 240+ questions and randomly presents ~35 questions to each respondent in order to collect baseline information with respect to customer awareness and customer perceptions of the top 100+ CMOs and top 50+ CROs servicing the drug development cycle. Five levels of awareness from “I’ve never heard of them” to “I’ve worked with them” factor into the overall customer awareness score. The customer perception score is based on six drivers in outsourcing: Quality, Innovation, Regulatory Track Record, Affordability, Productivity, and Reliability. In addition to measuring customer awareness and perception information on specific companies, the survey collects data on general outsourcing practices and preferences, as well as barriers to strategic partnerships among buyers of outsourced services.

If you want to learn more about the report or how to participate, please contact Nigel Walker, managing director, or Salvatore Fazzolari, director of client services, at Nice Insight by sending an email to niceinsight.survey@thatsnice.com.

If you want to learn more about the report or how to participate, please contact Nigel Walker, managing director, or Salvatore Fazzolari, director of client services, at Nice Insight by sending an email to niceinsight.survey@thatsnice.com.