CRO Or CMO: Which Is Best For Your Preformulation Needs?

By Nigel Walker, Managing Director, That’s Nice

The quality of a drug’s final formulation depends on (among other things) the quality of the studies completed in the preformulation stage. Thus, careful selection of outsourcing partners for preformulation work is crucial, but it’s also challenging.

The preformulation stage of drug development is an intermediate stage between the efforts to identify novel new drug substances and the efforts focused on developing a safe and effective drug product. As such, the information obtained in this stage plays an important role in determining whether or not a drug candidate becomes a commercial medicine, which occurs for only a very small percentage of lead compounds.

The preformulation stage of drug development is an intermediate stage between the efforts to identify novel new drug substances and the efforts focused on developing a safe and effective drug product. As such, the information obtained in this stage plays an important role in determining whether or not a drug candidate becomes a commercial medicine, which occurs for only a very small percentage of lead compounds.

MANY OUTSOURCING CHOICES

As cost pressures have increased in recent years, the level of outsourcing across and beyond the drug development cycle has grown. As a result, more pharmaceutical companies are outsourcing preformulation studies with the intention of determining the candidates with real potential as early in the process as possible and getting those with the greatest likelihood of success into clinical trials all the sooner. These companies can choose among three types of providers: CROs that focus on discovery services, CMOs that emphasize manufacturing at a larger scale, and CDMOs that offer the full range of services from discovery to commercial production.

Many CROs may have greater expertise in molecule characterization but typically lack familiarity with both final drug products and their dosage forms and the commercialization process. In addition, there will be additional costs associated with selecting a manufacturer and potential risks with technology transfer and scale-up. On the other hand, CMOs that offer preformulation services still tend to have a greater focus on commercialization and may move too quickly to formulation and clinical trial studies. CDMOs theoretically offer the advantages of both — expertise in both investigative techniques and commercialization — and thus should provide the right balance that maximizes the speed of development and reduces overall costs while maintaining the highest level of quality and regulatory compliance.

The choice of a CRO, CMO, or CDMO thus depends largely on the preferences of the pharmaceutical company and its comfort level with other aspects of the drug development process, such as technology transfer and scale-up. A manufacturer that has strong expertise in commercialization or a pre-existing strategic relationship with a CMO that is focused on these aspects of the process may prefer a CRO. On the other hand, a company that is looking to support its own preformulation expertise but lacks capabilities in technology transfer and scale-up may prefer to outsource to a CMO. Virtual companies that rely completely on outsourcing partners, and pharmaceutical companies that are looking to reduce the number of service providers they work with, may find a CDMO very attractive.

Important points to keep in mind when choosing an outsourcing partner are the potential difficulties and cost associated with switching to another provider. For instance, in some cases, and particularly for biologic APIs and drug products, nonclinicial and clinical study data may no longer be valid; or at the very least, bridging studies may be required. Therefore, regardless of the type of partner, conducting a careful evaluation is necessary to ensure that the right one is selected the first time.

MORE THAN ONE RIGHT ANSWER

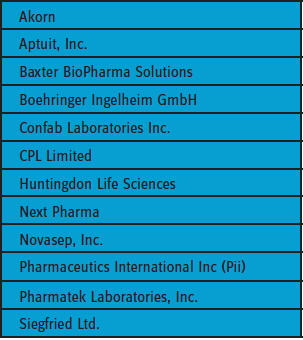

A look at the types of service providers that pharmaceutical and biotechnology companies currently outsource preformulation studies to clearly reveals that no one particular type of organization is preferred. Table 1 lists twelve companies that were frequently selected by respondents to Nice Insight’s 2015 pharmaceutical and biotechnology outsourcing survey as firms they would consider for formulation/preformulation projects.

The list includes CROs, CMOs, and CDMOs and also contract service providers that are business units of major pharma/biotech companies. This result is not surprising, since nearly threequarters (73 percent) of survey respondents indicated that their companies outsource to both CROs and CMOs, with only 11 percent and 12 percent, respectively, outsourcing just to CROs or CMOs.

Notably, all of the firms preferred by the respondents to the 2015 Nice Insight pharmaceutical and biotechnology outsourcing survey are located in North America or Western Europe. The companies for which the respondents work are also all located in these two regions, with nearly half (47 percent) of pharmaceutical companies and a little over a third (38 percent) of biopharmaceutical manufacturers. Seventy-three percent outsource to both CROs and CMOs.

TABLE 1: SERVICE PROVIDERS FREQUENTLY CONSIDERED FOR FORMULATION/ PREFORMULATION PROJECTS

QUALITY RULES

Given the significant impact the preformulation studies can have on drug development with respect to the development of safe and effective product formulations and the reduction of cost and time to market, it is not surprising that quality is considered the top priority when survey respondents consider CROs and CMOs for preformulation projects. In fact, an industry reputation for doing quality work is very influential when a CRO/CMO is being evaluated for a preformulation project. Service providers that have a demonstrated understanding of their customers’ requirements and clearly have good communication skills and are transparent with their clients also receive more attention.

Having a track record of success, financial stability, and experience, and being able to adapt to changing project needs and are also important attributes that survey participants consider when choosing a CRO or CMO for preformulation studies. These results are also not surprising given the central role that preformulation studies play in determing success or failure of a drug candidate to become a commercially viable, safe, and effective drug.

When evaluating the performance of CROs and CMOs that survey respondents have used for preformulation studies, quality is once again the most important metric by far. Interestingly, though, other factors that are not ranked by survey participants as being important when selecting a service provider are considered as important performance attributes, including their safety/compliance audit history and cost-effectiveness. Respondents to Nice Insight’s 2015 pharmaceutical and biotechnology outsourcing survey also indicated that the ability of CROs and CMOs to communicate and their technical expertise are other factors of importance when evaluating performance on preformulation projects. Finally, according to survey participants, both CROs and CMOs can enhance their service by resolving issues in a timely manner, avoiding unexpected charges, and improving product quality.

Survey Methodology: The Nice Insight Pharmaceutical and Biotechnology Survey is deployed to outsourcing-facing pharmaceutical and biotechnology executives on an annual basis. The 2014-2015 report includes responses from 2,303 participants. In addition to measuring customer awareness and perception information on specific companies, the survey collects data on general outsourcing practices and preferences as well as barriers to strategic partnerships among buyers of outsourced services.

Reference:

2015 Pharmaceutical and Biotechnology Outsourcing Survey, Nice Insight, January 2015

If you want to learn more about the report or how to participate, please contact Nigel Walker, managing director, at That’s Nice by sending an email to nigel@thatsnice.com.