J&J And Merck Detail How They Are Investing For Impact

By Rob Wright, Chief Editor, Life Science Leader

Follow Me On Twitter @RfwrightLSL

Many would argue that since their existence, biopharmaceutical companies, by their very nature, are impact investors. After all, aren’t they trying to meet unmet medical needs with a wide variety of therapeutic options? But that’s just what they do, as that’s the business they are in. So, let’s not confuse “enterprise impact” of drug discovery and development with impact investing.

That being said, biopharmas have gained a formal interest in becoming impact investors. Let’s learn more, beginning with how Merck started with impact investing.

HOW MERCK ENTERED IMPACT INVESTING

Ken Gustavsen is the chief of staff and strategy officer for social business innovation for Merck (Merck operates as MSD outside of the United States and Canada). His first exposure to impact investing was 20 years ago when working for World Relief, a nonprofit organization in Kosovo where he helped launch a microfinance-lending bank to assist with rebuilding and stabilizing the country after the Kosovo war. His interest in finance at the time was tied to the tools available to address a particular impact investment situation. “Different tools can be used to serve the population through a combination of short- and long-term transitional time frames,” he elaborates. In a post-war situation, immediate needs are things like food aid, while slightly more longer-term needs might involve economic development, housing reconstruction, or getting ready for winter.

About five years ago, Gustavsen observed growing corporate interest in health impact investing. “But Merck wanted to learn before doing, so we contacted the Business Council for the United Nations [BCUN],” he explains. BCUN works with members like Merck to focus on the complementary private sector contributions to social issues in which the U.N. has interest. At the time, the U.N. was navigating the transition from the Millennium Development Goals (MDG) to the Sustainable Development Goals (SDG), which have a big focus on partnership, including collaboration with and between the private sector. “The BCUN can play a role in catalyzing the role of the private sector in coordination with the public sector to help advance the objectives embodied in the SDGs. Within that context, impact investing is increasingly seen as a tool that bridges public and private sectors to help drive social impact.”

Merck and the BCUN jointly organized a lunch and then set out to identify the right audience and key stakeholders with which to have the discussion. “We wanted to make sure we made the connections to create the platform for where we are now,” Gustavsen explains. That’s because at Merck, impact investing is viewed as another facet for how to express corporate responsibility (CR). The lunch was attended by about 20 people and included representation from the private sector, including banks, other biopharmas, and investors. Gustavsen notes a key contact from that meeting was the Global Impact Investing Network (GIIN), a hub for investors and investment vehicles. “GIIN is not only helping to advance best practices in impact investing, it’s developing impact investing criteria and a means of measuring that,” he elaborates. But impact investing misperceptions remain.

IMPACT INVESTING AS A COMPONENT OF MERCK’S CORPORATE RESPONSIBILITY

There are a lot of ways to do CR. For example, there is traditional philanthropy, which can be done through financial grants. Companies also can donate products like Merck does for its river blindness program. “While those donations can have an impact, they are definitely philanthropy,” he clarifies. “If we give a financial grant that will deliver some form of social return, that’s not impact investing because a grant, by definition, does not allow for a financial return.” According to Gustavsen, impact investing is applying a business solution that can deliver a social impact and also provide financial return. “At Merck, impact investing represents an opportunity to deploy financial capital through various investment vehicles in a way that will benefit underserved populations. You get the same social impact you get through philanthropy, but because you’re doing it commercially, financial returns, if achieved, can be deployed to support and sustain other CR initiatives, giving us a second bite at the apple.”

As impact investing is part of Merck’s CR initiatives, you might be curious about governance. Gustavsen is part of the company’s social business innovation team as the chief of staff and strategy officer. He also serves as the secretary for impact investing. Overall, Merck has a five-person impact investment committee consisting of a range of senior leaders with various facets of business responsibility, representing different therapeutic areas, different geographies, etc. The committee’s responsibilities include reviewing and approving new impact investment opportunities and then monitoring performance once an investment is made.

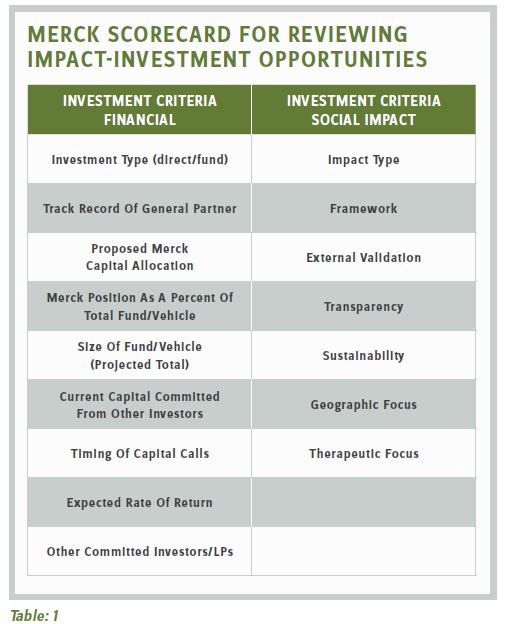

When evaluating one of these opportunities, Gustavsen takes the lead on facilitating the first steps of due diligence (i.e., basic legal, compliance, and financial review). The company then uses a scorecard to evaluate each opportunity along financial and health/social impact elements (see Table 1). The scorecard information is then presented to the impact investing committee for review.

WHERE HAS MERCK HAD IMPACT INVESTMENT SUCCESS?

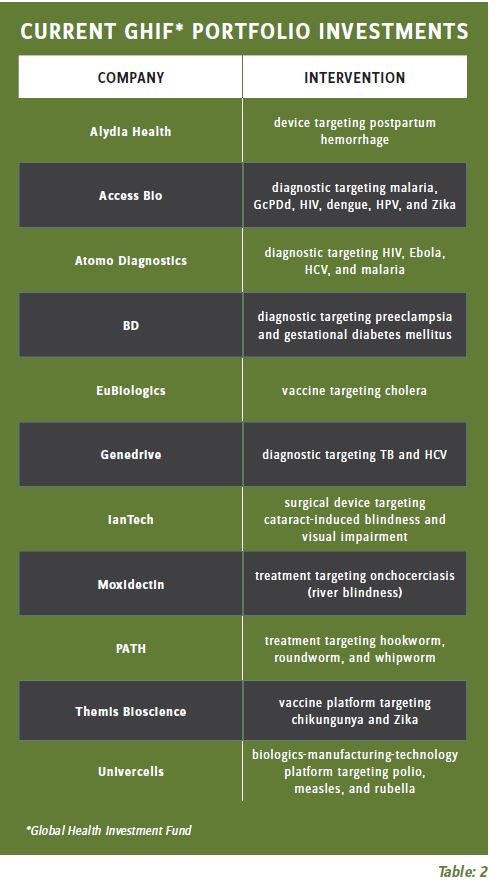

One of Merck’s successful impact investments is the Global Health Investment Fund (GHIF) (www.ghif.com). Backed by the Bill and Melinda Gates Foundation, Merck, and others, GHIF is a $108 million fund currently invested in 11 companies (see Table 2) developing products or diagnostic tools to address health challenges primarily in the developing world. Started about five years ago, the portfolio is at the point where some investments are starting to mature and looking to either IPO or be acquired. “When that happens, investors like Merck will enjoy a financial return on its investment,” he states. “Most impact investments are equity, meaning the fund acts like a mutual fund by investing in individual companies and, if sold, you get a return, which could be more or less than the initial investment.”

However, there are other types of impact-investment funds. For example, the UNICEF USA Bridge Fund (www.unicefusa.org/unicef-bridge-fund) uses debt to address the timing gaps that emerge between the commitment of donor support to UNICEF and the receipt of pledged cash. The bridge fund takes money from investors which is then deployed to do good. Then, as pledges come in from donors, UNICEF repays investors for their investment plus interest. “It’s like putting your money in the bank to do good things,” he summarizes. Since its inception in 2011, the Bridge Fund has spanned scores of transactions representing more than $210 million in UNICEF program activity.

![]() "Impact investing is increasingly seen as a tool that bridges public and private sectors to help drive social impact."

"Impact investing is increasingly seen as a tool that bridges public and private sectors to help drive social impact."

Ken Gustavsen

Chief of Staff and Strategy Officer for Social Business innovation, Merck

While Gustavsen can’t take credit for identifying the GHIF impact investment opportunity, he notes the UNICEF Bridge Fund was identified through GIIN, which was a direct result of having the lunch-and-learn event with BCUN. “Merck primarily uses funds — rather than direct investments into individual companies — for impact investing,” he explains. By investing in a portfolio of companies via a fund versus attempting to identify individual companies, Merck can rely on the expertise of fund managers to identify good impact-investment opportunities while providing diversification to balance risk. “We see impact investing as an opportunity to help advance on the U.N.’s third SDG [i.e., good health and well-being] in a sustainable way that is good for our business and good for the world,” he concludes. For more information about Merck’s impact investing, be sure to visit www.msdresponsibility.com.

J&J GETS SERIOUS ABOUT IMPACT INVESTING FOLLOWING G8 TASK FORCE

“The impact investment ‘aha’ moment came during the company’s participation in a G8 Task Force meeting,” begins Jane Griffiths, Ph.D. The former global head of Actelion, a Janssen Pharmaceutical Company of J&J (the executive stepped down from her role in October 2019, prior to publication of this article), Griffiths also chaired the Johnson & Johnson Foundation in EMEA, which is responsible for managing the company’s global community impact programs and activities across the EU, Middle East, and Africa.

“In conversations with many stakeholders, the message was that maybe the health sector is more nascent than energy, agriculture, or microfinance,” she says. J&J also heard that what was needed was some scientific knowledge around health, along with various other expertise the company could bring. “Because if you know how impact investing works, it’s not just about investing money, but time, energy, and mentorship for the benefit of the outcome you are trying to achieve, which really struck a chord with us.”

Not long after the G8 Task Force meeting, the Foundation invested in Patients Know Best, a small U.K. tech social enterprise run by a physician, which aims to provide patients access to their own medical records through the country’s National Health Service (NHS). “We invested £1.5 million to help expand their services,” Griffiths says. By enabling patients to have access to their own records, the hope is people will not only begin taking more responsibility for their own healthcare but gain a greater understanding of it. J&J had previously supported the company, so they believed it was on to a very interesting model. Since then, Patients Know Best has signed up many more patient records. Only patients have access to their data, but Griffiths anticipates soon being able to see anonymized, aggregated metrics reported by Patients Know Best, such as the number of people being signed up and reductions of waiting times for appointments or missed appointments.

THE ACCOUNTABILITY APPEAL OF IMPACT INVESTING

To be accountable internally for impact investing, the Foundation uses an advisory committee. Composed of external people involved in impact investing, they are tasked with advising J&J’s group on potential impact investments. “They do their work pro bono, and we rely on them heavily,” Griffiths attests. Here’s how it works. When the Foundation comes across an opportunity deserving serious consideration, the impact investment group conducts due diligence on the organization. If things look promising, the external advisory group is convened and the impact investment group presents the company, providing an overview of the business model, leadership, and so on. “One of the things we pay closest attention to is the impact the organization is seeking to make in terms of the U.N. SDGs,” she adds. “Then we ask questions such as, is the leadership of the company known in the impact investment community? What is their reputation? What other metrics should we be looking at if we invest in this company?” If interested in pursuing further, the impact investment group will use J&J legal resources to draw up a contract. “One of the benefits of being at a company like J&J is that we have teams of people with a wealth of expertise that the impact investment group can tap into regularly (e.g., legal), thereby keeping our overhead low.”

During recent discussions regarding some potential impact investments, one member of the external advisory committee to the Foundation was emphatic in reminding the impact investment group as to the importance of relatively simple metrics to demonstrate impact. “You can’t get bogged down in overly detailed metrics that startups might have difficulty in capturing,” Griffiths notes them stating. “Say you’re looking to invest in a midwifery group that is going to provide maternity services to remote parts of Kenya, and assume we know that a patient is carrying their baby with a very low-lying placenta (i.e., placenta previa). In such a situation, the woman should be admitted prior to going into labor.” So, simple metrics could be admissions prior to delivery and mother and child mortality, which should be tied to improving the education of pregnant women about their pregnancy, providing the wherewithal to get them to a hospital or bringing delivery services to villages of expectant mothers. “Perhaps charging a little for such a service results in the building of sustainable rural maternity service,” she ponders. Imagine the Foundation wanted to invest in something around childhood nutrition, as we know children going to school on empty stomachs don’t learn as well. Metrics around literacy or school performance of participants could be useful in assessing impact. “I’m currently mentoring a group of people involved in providing sanitary protection for girls,” she shares. In many emerging countries, when girls reach puberty, they stop attending school because they can’t properly manage their sanitary protection. “The impact we want to have is to help these girls understand how to use sanitary protection, and a simple metric could be how many girls stay in school after puberty,” she relates. According to Griffiths, such relatively simple interventions can make an enormous difference. “Organizations can become dependent on grants, but an impact investment can help build a more sustainable and viable business model,” she contends.

Speaking of accountability, J&J’s impact investment group is responsible for providing regular updates on its activities to the company’s CFO, Joe Wolk, and Head of Global Corporate Affairs Michael Sneed. In addition, the group provides an annual report for all J&J CSR activities.

SOME FINAL THOUGHTS AND ADVICE

As one of the largest and broadest healthcare companies, J&J tries to use its big footprint for global good. “But for our impact investment strategy to be successful, it requires being quite focused,” Griffiths attests. For this reason, the Foundation has been deliberate in trying to make a big impact in small places and thus why the bulk of its impact investments are presently being done in Kenya and why there is dedicated impact investment staff located there. “One of the early learnings is it is not good to have people who aren’t local running such projects,” she shares. In her experience, you want local involvement in any impact investment project as soon as possible, as they understand the culture and can be helpful in working with people on the ground. For example, sometimes it’s necessary to liaise with governments as you might need enabling things to happen for an impact investment project to prosper. “One of the reasons we picked Kenya is J&J already had operations there, making it easier for us to get started and put local people to work, thereby increasing the probability of success,” she confesses. “Plus, it helped us gain a better understanding of the types of impact investments to be making in emerging markets.”

![]() "Organizations can become dependent on grants, but an impact investment can help build a more sustainable and viable business model."

"Organizations can become dependent on grants, but an impact investment can help build a more sustainable and viable business model."

Jane Griffiths, Ph.D.

Former Global Head of Actelion, a Janssen Pharmaceutical Company of J&J

While Griffiths suspects the Foundation will soon invest for impact in other geographies, its mantra for now is to focus on areas it knows reasonably well. And though the company has yet to have an impact investment “failure,” Griffiths notes that inevitably there will be times when an invested-in startup doesn’t go as planned. “Where things tend not to go well is when the chemistry isn’t good between the investor and the company, or the entrepreneur isn’t the right person to be leading, or the finances are a bit stretched, or the way it is being run is really not impacting the goal we were hoping it would.” From what Griffiths has seen thus far, one of the best predictors of impact investment success seems to be the leader of the startup and the team they’ve assembled. However, they aren’t alone in being accountable for success. “When you invest at the scale the Foundation does, you often get a seat on the invested company’s board,” she states. Though it might be a nonvoting seat, it still provides an opportunity to mentor the entrepreneur. “That’s where a company like J&J has to bring the benefit of its business experience and knowledge of healthcare and healthcare systems to bear, as it’s as much our responsibility to try to make the impact investment successful as it is the entrepreneur’s,” she asserts.

Thinking about getting your company into impact investing? “Don’t overlook the importance of explaining within your organization what impact investing is,” Griffiths advises. “Provide a framework so employees understand not only the why behind it, but the difference between it and grants.” Not only will this head off questions, but by improving understanding you might find employees eager to help. “One of the things we’ve learned is that many of our employees are highly motivated by getting involved in projects having some sort of social impact, and that engagement is heartening to see,” she concludes.

Editor’s Note:

This is part three of a three-part series. Parts one and two can be found in our October and November 2019 issues, respectively.

Sidebar 1

8 RECOMMENDATIONS

From The G8 Social Impact Investment Task Force To Spur Economic Growth And Solve Some Of The World’s Most Pressing Social Problems

- Set measurable impact objectives and track their achievement.

- Investors should consider three dimensions: risk, return, and impact.

- Clarify fiduciary responsibilities of trustees: to allow trustees to consider social as well as financial return on their investments.

- Pay-for-success commissioning: governments should consider streamlining pay-for-success arrangements such as social-impact bonds and adapting national ecosystems to support impact investment.

- Consider setting up an impact-investment wholesaler funded with unclaimed assets to drive development of the impact investment sector.

- Boost social-sector organizational capacity: governments and foundations to consider establishing capacity-building grants programs.

- Give profit-with-purpose businesses the ability to lock-in mission: governments to provide appropriate legal forms or provisions for entrepreneurs and investors who wish to secure social mission into the future.

- Support impact investment’s role in international development: governments to consider providing their development finance institutions with flexibility to increase impact investment efforts. Explore creation of an “impact finance facility” to help attract early-stage capital, and a “development impact bond (DIB) social outcomes fund” to pay for successful DIBs.

"Impact investing is increasingly seen as a tool that bridges public and private sectors to help drive social impact."

"Impact investing is increasingly seen as a tool that bridges public and private sectors to help drive social impact." "Organizations can become dependent on grants, but an impact investment can help build a more sustainable and viable business model."

"Organizations can become dependent on grants, but an impact investment can help build a more sustainable and viable business model."