Prospects For Healthcare Capital Markets In 2017

By John Nolan, MPH, co-portfolio manager and Steve Brozak, DMH, co-portfolio manager, WBB Asset Management

The election of Donald Trump has raised prospects for reduced government regulations in a wide range of areas, including the possibility for a more lenient process for drug and biologic approvals and the repatriation of trillions of dollars now stranded offshore. At the same time, increasing patient dissatisfaction with their care, financial uncertainty, and uncertainty around the ability of Congress to pass meaningful legislation (healthcare or otherwise) mitigate our view. Uncertainty, however, is opportunity, and we believe this is an opportune time for healthcare investors who have the skill and insight to take advantage of the growing dispersion between “winners” and “losers” in the narrative that is unfolding.

STRANDED OFFSHORE CAPITAL

One of the drivers of upside return is the strong possibility of a large cash infusion into the capital markets, increasing the prospects for massive acquisition and investment opportunities. This would be particularly beneficial to the smaller and mid-cap biotechs, which serve as the engines of innovation and as an outsourced developmental pipeline for the larger pharma firms that eventually acquire or partner with them.

The potential large infusion of capital would come from U.S. corporate profits — estimated at ~$2.6 trillion — now stranded offshore. Corporations have been loath to repatriate these funds because the current 35 percent statutory corporate income tax would force a sacrifice of $91 billion, far too much for corporations to forego. The election of Trump, who repeatedly pledged to repatriate the offshore-held funds, increases the likelihood that those funds may come home.

Valuations in the healthcare sector and industries like biotech are also attractive. At a little above 16 times forward earnings, the S&P 500 healthcare sector is admittedly trading at levels approximately 15 percent higher than its 10-year average; however, on a relative basis, the sector is trading at a significant discount to the overall S&P 500. Even the absolute valuation opportunity in biotech is also attractive, with the S&P Biotechnology Select index selling at a discount to its inception average of 6.1 times on a price-to-book basis and down almost 25 percent from its valuation highs of 2014 through 2015.

A RALLY IN THE MARKETS

We believe these factors have, in part, precipitated the turnaround in the healthcare and biotech financial markets. During 2016, healthcare was the worst performing sector in the S&P 500, returning approximately -2.7 percent, despite the late-year Trump rally. In the first quarter of 2017, that trend has clearly reversed. The S&P 500 healthcare sector finished the first quarter of 2017 with a total return of approximately 8.4 percent. Biotechnology has fared even better. After losing more than 16 percent last year, the S&P Biotechnology Select index returned over 17 percent in the first quarter.

Much of the rally in biotech and healthcare, however, has been fueled by the belief that the Trump administration will be less likely to push through substantial legislation curtailing pharma prices. Additionally, we believe that current market valuations assume the administration and Republican-controlled Congress will facilitate a probusiness agenda by enacting corporate tax reform and potentially reducing the regulatory burden for drug approval.

The cautiousness in our confidence arises from the mitigation of positive trends by several negative occurrences. President Trump called out the pharma industry on high drug prices on January 11 and March 7, which resulted in a -3.5 percent and -1.7 percent pullback in the S&P Biotechnology Select index. The failure of the House to take a vote on the first iteration of the American Healthcare Act (AHCA) and the immediate objections to the subsequently passed version could portend an inability of the administration and Congress to pass any sweeping legislation. Corporate tax reform, much like healthcare reform, may not come so easily or as expeditiously as the market may expect. With such impediments, there is a very real risk that the current rally could lose and potentially reverse momentum by the end of the summer.

THE EFFECT OF THE AHCA

Even if the AHCA becomes law in its present form, it could have a significant effect on the pharma and biotech markets. In a Forbes commentary, we observed that while the proposed legislation did not specifically address drug manufacturers, many of the largest biotech firms would be directly impacted through changes the law would impose on the Medicaid system, causing a loss of up to 15 million beneficiaries by 2026 and billions of dollars less revenue for several biotech and pharma companies.

In 2015, CMS reported that Medicaid spent approximately $57 billion on prescription drugs for more than 73 million beneficiaries, with the majority (65 percent) of spending directed toward 155 drug products. While these sales figures do not include rebates for net spending, we do know that from 2014 data that Medicaid spent approximately $42 billion on prescription drugs and received $20 billion in rebates from manufacturers, for a net drug spend totaling $22 billion. While it is not clear how new iterations of the AHCA will take shape regarding its impact on Medicaid enrollment, we are cognizant of the risk that this may pose to the biotech industry.

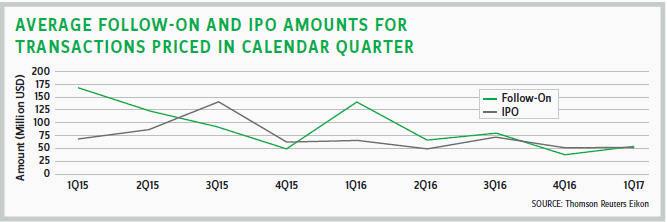

Healthcare equity transactions also have been more challenging during the last few quarters, both through follow-on offerings and IPOs. The number of deals has marginally dipped lower, and the amount per transaction has steadily declined. This could suggest a change in investor risk appetite for healthcare offerings or possibly, changes in the quality of the offerings themselves.

The pace of M&A for biotech companies also has been slower than expected despite the attractive valuations noted previously. Pharma and biotech acquisitions totaled $44 billion in the first quarter of 2017, down 13 percent from a year earlier, and 35 percent below the first quarter of 2015, according to Bloomberg. However, cash on hand for large-cap U.S. pharma firms remains close to all-time highs (>$105 billion), while overall leverage, though increasing, still remains at moderately low levels. We do not believe that the diminished M&A environment is the result of a lack of innovation; 12 drugs received approval by the FDA in the first quarter, which is >50 percent of the number of approvals for all of last year and on pace to approach the 45 approved in 2015. Instead, many companies may be waiting for legislation to repatriate their overseas cash, which could unlock a wave of activity.

All told, we remain cautiously confident for the remainder of 2017, despite the potential obstacles and uncertainties, because we believe the impact of legislation, rising interest rates, and lower transactional volumes are somewhat counterbalanced by the continued demographic tailwinds and attractive valuations in biotech and healthcare. Plus, we see the potential for upside optionality attributable to tax reform that could lead to cash repatriation and an environment that is more conducive to M&A activity.