Tax Considerations When Forming A Biotech Company

By Mark Simpson, CPA, CFP, MBA, controller, VertMarkets, Inc.

When a biopharmaceutical company is first being formed there are many important decisions to be made. For example, what type of entity should it be — corporation, partnership, an LLC? What should be the accounting method — cash, accrual, or some type of hybrid? You may be thinking about simply outsourcing some of these legal and accounting decisions.

After all, you are a busy biopharma executive, and your efforts should be focused on securing funds. Right? But during your company’s early years, you know how important it is to stretch investment dollars. So don’t give away part of your hard-won financing by failing to understand a few startup accounting basics.

After all, you are a busy biopharma executive, and your efforts should be focused on securing funds. Right? But during your company’s early years, you know how important it is to stretch investment dollars. So don’t give away part of your hard-won financing by failing to understand a few startup accounting basics.

From an accounting standpoint, during the first year of filing your biopharmaceutical company’s taxes, many business decisions, once made, are irreversible. While it should go without saying that you should take great care in preparing and submitting your first tax return in a timely manner, one particular startup issue you should not lose sight of is the federal tax accounting treatment of organizational and startup costs.

PAY ATTENTION TO ORGANIZATIONAL AND STARTUP COSTS

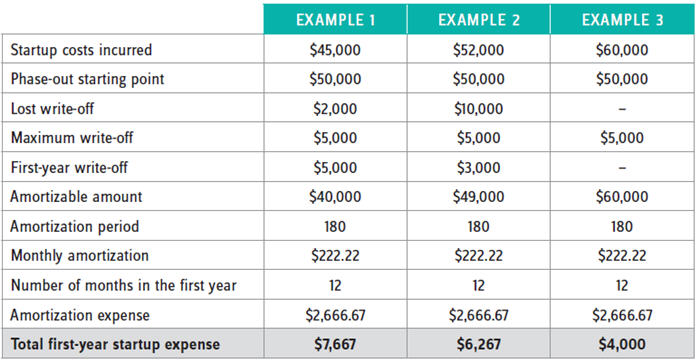

Organizational costs are expenses incurred in forming a business entity, such as legal fees, state filing fees, and organization meetings (travel, facilities, etc.). Once formed, costs incurred prior to the “grand opening” are considered startup costs and include rent, utilities, and payroll. For tax purposes, both categories of costs must be capitalized and amortized over 180 months once the business starts operations. Both types of costs are treated the same from an accounting standpoint. Under the current tax law, the entity may deduct up to the first $5,000 of costs incurred, with the balance amortized straight-line (i.e., evenly) over 180 months. However, the $5,000 immediate write-off is reduced dollar for dollar as the total organizational (or startup) costs exceed $50,000. All costs will eventually be deducted for tax purposes. However, it may take 15 years to eventually deduct the expenses. Why is this important? Let’s consider the startup costs examples (i.e., $45,000, $52,000, and $60,000) found in figure 1 to illustrate what a difference $15,000 (the difference between incurring $45,000 and $60,000 of costs) can make to your bottom line.

Not every CEO is an accounting whiz, and that’s okay. However, don’t let your lack of training in this discipline prevent you from realizing financial success. To help you maximize tax deductions, here are three key questions you must consider.

1. What costs are excluded based on the tax definition of organizational costs and startup costs?

Organizational Costs — Exclude costs incurred to issue securities such as syndication costs, brokerage commissions, and security printing costs. These costs remain on the tax balance sheet and are not currently deductible or amortizable.

Startup Costs – Exclude interest expense, real estate taxes, and R&D costs which are deductible as incurred/paid.

2. How is the election made to amortize the organization costs and startup costs?

For both startup costs and organizational costs, the election to amortize is automatic. No form or statement needs to be submitted. A taxpayer files the return, capitalizes the costs, and begins amortization on the initial tax return during which the business operations start (keep reading to see what year that actually is). There are a few technicalities to pay attention to. First, to be amortized, regardless of the accounting method used, the costs must be incurred by the end of the first tax year. Special planning needs to be taken for entities formed toward the end of the first tax year.

For example, if you finally get your funding in late October and are thinking of starting your company in December of that year (with a 12/31 year end), be sure to act quickly and have all of the legal documents completed before year end. If, for example, the organizational minutes are overlooked and legal counsel drafts the documents in January of the second year, these organizational costs must be capitalized and remain on the balance sheet and are not amortizable. No tax deduction will be allowed for the legal bill since not incurred in the first year. Second, once made, the election is irrevocable. If amortization is “forgotten” in the first operational year, your business, in essence, made an election to not deduct the startup amortization expense. Such a decision cannot be reversed or corrected by filing an amended return!

3. When does an active trade or business actually start?

Unfortunately, that is the million-dollar question to which we have nothing but subjective guidance. District courts, U.S. tax court, IRS letter rulings, and IRS revenue rulings reach different conclusions. The core issue is determining when an entity becomes a “going concern” (i.e., fulfilling the business purpose for which it was formed).

For example, in a 1965 circuit court case, a company formed in 1952 to operate a television station was held to have a four-year startup period. How was this determined? Well, the company did not begin broadcasting until 1956. The key determining factor was the year that company obtained its license, followed by when it began performing services for which it had been organized. Without the proper license, the broadcast company could never be a going concern. A similar conclusion was reached in an IRS technical advice memorandum ruling an electric utility company began operations when it began generating electricity.

A 1990 IRS letter ruling determined a manufacturing company began operations when its manufacturing equipment met quality standards, and it could begin production. In a 2009 case, a real estate business created to rent, buy, or sell property did not begin operations until the first piece of real estate was purchased. Expenses incurred prior to the first closing were held to be startup expenses.

The bottom line is, based on the various holdings, a business begins when (1) assets are ready, even though no income has been generated, or (2) when assets are ready and revenue is being generated.

Figure 1

DEFINE YOUR COMPANY’S PURPOSE

When you are faced with a lack of clarity, perhaps the key consideration to focus on is being sure to properly define the purpose of the business entity. If a business is created to develop, test, and manufacture a new drug, the IRS could take the position that operations do not begin until the drug is being produced and sold or perhaps, ready for production. This could result in many years — a decade perhaps — of startup costs. During this time period, time grants and other sources of income may have to be recognized. If you don’t have appropriate offsetting expenses, this can result in having an unnecessary taxable income. If, however, the process was broken up, such as one company being tasked with researching the potential drug, the startup period would be minimal, ending once the initial research begins. The research company would have normal, ordinary, and necessary business expenses that could be deductible, thereby offsetting various sources of income or creating net operating losses that could be carried forward until grants or milestone revenue is recognized.

So, what does all of this mean to a biopharmaceutical startup whose precious dollars should be put to good use instead of being turned over to the government by paying unnecessary taxes? The mechanics of the organizational tax deduction are relatively simple. Namely, you need to carefully plan the activities so all costs are incurred in the first year, and then you can actually begin to deduct the amortization in the first tax year. From a startup cost vantage point, the mechanics are the same. However, the critical startup period will be defined by the business purpose of the entity, and much care should be given to developing such a purpose. A narrowly focused business purpose could result in a few-month startup period resulting in more currently deducted operating expenses (i.e., research, manufacture, or product distribution). A broad business purpose could result in years of capitalized costs deducted slowly over 15 years.

As with any tax strategy, always check with your tax advisor to ensure decisions are made based on current tax law and guidance issued by the court system.