The Future of Healthcare Or Alice in Wonderland?

By Suresh Kumar

The latest Kaiser Permanente Report reinforces that healthcare is unaffordable. It is unaffordable for employers, patients, and governments. Annual cost of employer-provided healthcare now stands at $20,576. Employees contribute 29 percent of this premium (i.e., $6,015) and pay an additional $1,655 every year on deductibles. The annual premium and out-of-pocket price paid for drug and procedures consistently outpaces inflation. Breaching $20,000 makes healthcare a rate-limiting factor in starting and sustaining small companies that are lifelines to employment and prosperity.

The latest Kaiser Permanente Report reinforces that healthcare is unaffordable. It is unaffordable for employers, patients, and governments. Annual cost of employer-provided healthcare now stands at $20,576. Employees contribute 29 percent of this premium (i.e., $6,015) and pay an additional $1,655 every year on deductibles. The annual premium and out-of-pocket price paid for drug and procedures consistently outpaces inflation. Breaching $20,000 makes healthcare a rate-limiting factor in starting and sustaining small companies that are lifelines to employment and prosperity.

The healthcare industry can either ignore the crescendo of disapproval regarding the increasing divergence between the cost and value it provides, or (probably a worse option) fan the flames of confusion regarding its cost, billing, and pricing practices. It is a choice that CEOs and boards need to make, and make now, as part of their fiduciary and governance oversight to protect shareholders.

THE NEED FOR CHANGE

Someone once said, “Why simplify it, if you can complicate it.” Unfortunately, that statement often is used to describe the guiding principles for most drug and procedure pricing, which consequently has fueled healthcare debate. A doctor or hospital’s invoice must not intimidate or confuse; it should be discernible to everyone. All people want to know is:

- What is covered, and what is not?

- What is the price of coverage for doctor visits, drugs, and diagnostic, surgical, or other procedures?

- Who pays, and how much do they pay? What is the co-pay and deductible?

- How can they compare the costs of identical coverage among different plans and systems?

Most people are frustrated at not being able to get straight answers regarding their healthcare options. Their confusion should be the catalyst for change.

What can people and employers do besides continue to pay the ever-escalating health insurance premiums, deductibles, and other out-of-pocket expenses? What are their options? In principle, they must not condone or incentivize poor commercial behaviors in an imperfect market that includes intermediary decision makers placed between the buyer/user and seller. In practice, they must explore alternative-care models that provide equivalent value and outcome at lower cost.

THE CASE FOR, AND REALITY OF, MEDICAL TOURISM

Gaps in access to therapies and technology spawned inbound medical tourism and brought patients from developing countries to the U.S. and other Western locations. High costs of treatment, travel, and stay in these countries have caused an evolution of the business models; instead of bringing patients to facilities, the focus is on bringing facilities and access to patients.

- Initial thrust: international patient services at leading institutions (e.g., Sloan Kettering, Mayo Clinics in the U.S.)

- Revised focus: satellite facilities in a country closer to the patient population (e.g., joint ventures, branded clinics, and hospitals such as Johns Hopkins Aramco Health Center in Saudi Arabia and Cleveland Clinic Abu Dhabi)

- Newer initiatives: consultative and operating arrangements with U.S. and Western centers of excellence

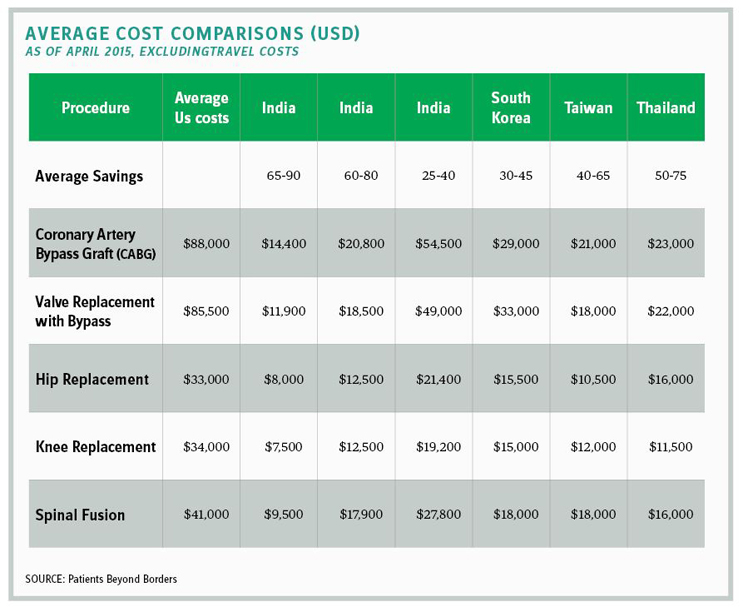

The continued escalation of healthcare costs, particularly in the U.S., has opened attractive cost-value arbitrage opportunities in alternative countries such as India, Thailand, Singapore, Malaysia, and Korea.

Outbound U.S. medical tourism has not gained the momentum here that inbound medical tourism has, mainly because of fear of the unknown:

- How good is my doctor? Is my doctor U.S.-educated and certified? How good are the doctor’s assistants and support team?

- How good is the facility where I will be treated? Is it accredited and credentialed by the same authority as in the U.S.?

- Are the brands and quality of supplies, products, implants, devices, etc. commensurate with the ones used in the U.S.?

- How will my travel and stay be covered for the duration of my treatment (i.e., from leaving to returning home?) What will the quality of my living facility be?

- What happens if there are complications? What recourse do I have to my doctor or care teams?

THE ASHLEY FURNITURE MODEL

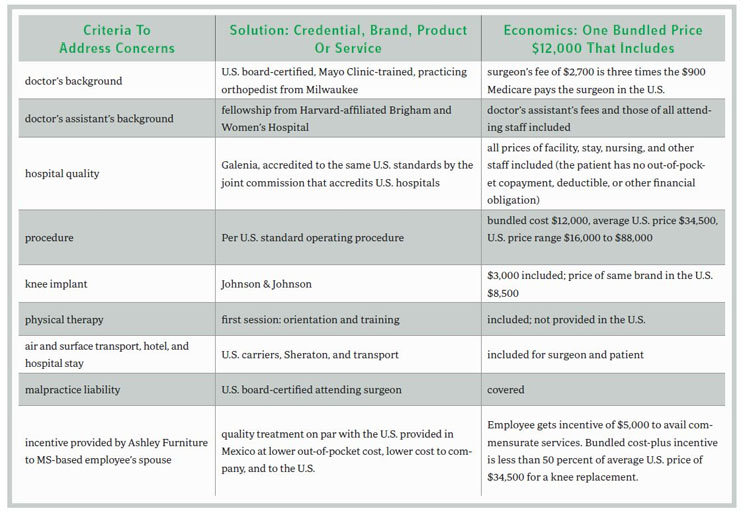

In an effort to control costs, should U.S. payers offer Mexico or other destinations as outbound medical tourism opportunities for patients? Self-insured employers such as Wisconsin-based Ashley Furniture have taken a stand that could make this a mainstream option in the future, or at least a catalyst to rein in U.S. costs (see chart above). Approximately 153 million American employees are provided healthcare insurance by their employer. Employers and employees are under siege, being held hostage by uncontrolled premiums and other price escalations.

By authenticating providers, facilities, procedures, supplies, medicines, and support staff, and coordinating travel and stay logistics for a fixed fee, Denver-based North American Specialty Hospital (NASH) has created a business model that financially benefits employers, patients, providers, and insurers. The decision to avail outbound medical tourism-based treatment conforming to U.S. SOPs at substantially lower prices than in the U.S. is made collaboratively between these stakeholders.

The all-inclusive, price-value differential for the same knee-replacement surgery performed to U.S. standards and protocols by a U.S. board-certified surgeon on an American with the endorsement of a U.S. employer/payer at a certified hospital in Mexico versus one in the U.S. is over 50 percent. For perspective, excluding travel, heart-valve replacement with bypass in India is 14% of US cost. In Singapore it is 58% of that cost. Similarly, gastric bypass procedure is 38% of US cost in India and 75% in Singapore.

Healthcare affordability is the number one issue for employers, employees, and retirees. Alternative care models require collaboration among all stakeholders, and are not for the fainthearted. They require personal, professional, and institutional courage and the willingness to confront current practices and change.

SURESH KUMAR serves on the board of Jubilant Pharmaceuticals and Medocity. Formerly, he was U.S. Assistant Secretary of Commerce and executive VP at Sanofi.