The New Economics Of Cell And Gene Therapy

By Sanjay Srivastava, Ph.D., Accenture and Jason C. Foster, Ori Biotech

Dawn of a New Era

The current market access model for small molecules and biologics is predicated on the assumption that if we can manufacture these products to serve a large proportion of the patient population and if we get good clinical efficacy, we will attain market authorization, get reimbursement, payers will cover it and clinician will prescribe it. However, this standard model has proven not to be true for advanced therapies. For example, 7 out of 25 approved gene therapies have been removed from the market in Europe for commercial, not clinical, reasons and without any cell therapy products reaching blockbuster status even while some are reaching their 7-year launch anniversary2. Even today, we are still trying to demonstrate commercial viability for most cell and gene therapies.

With each new cell or gene therapy that is priced at >$400K per patient, we are limiting our ability to get widespread coverage and early line usage for these therapies. These products are frequently struggling as last line therapies with no real path to coverage at first line, even though the clinical data suggests that many are as good or better than the current standards of care.

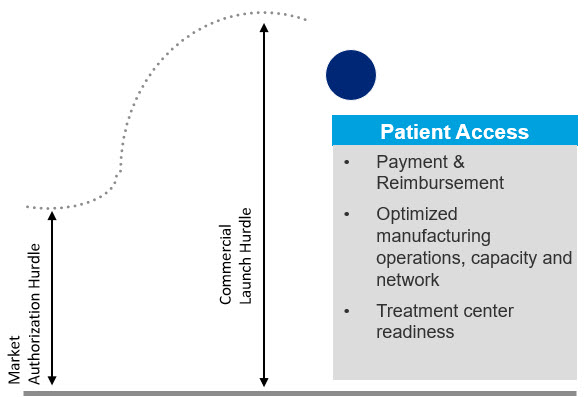

The market access challenges in advanced therapies are well-documented. The current payer system is not well suited to accommodate single-dose, curative therapies for which long-term efficacy and safety remain relatively unproven. Additionally, patients face a complex and costly path to treatment, which includes the problem of relatively few, qualified treatment centers. CGT (cell and gene therapy) companies also face challenges around ecosystem partner engagement, circular supply chain, manufacturing and distribution challenges as they try to ensure they have the right therapy, at the right place, at the right time for the right patient (Figure 1).

Figure 1. Commercial success hurdles for advanced therapies are unique and much higher than the regulatory hurdle for attaining market authorization.

Industry Predicament

As a rule, CGTs face steeper challenges at launch than traditional small molecule drugs and biologics do, which can limit their early adoption. If the industry doesn’t get market and patient access right, CGTs could be relegated to the dustbin of history as a fantastic science project that never lived up to their potential.

When we are seeing more withdrawals than blockbusters, we know there is a problem but why are advanced therapies so different? In traditional pharma manufacturing, we source standard ingredients to make millions of doses that are effective for any patient who needs to be treated. In autologous cell therapy, we identify a unique patient who needs therapy, source starting material from that patient and then manufacture a personalized medicine for only that one individual, which is inherently different and much, much more complicated than traditional manufacturing.

New Paradigm for Drug Development

- Today’s cell therapies are personalized for the most part so we can only manufacture 1 product for 1 patient at a time

- Circular supply chains are new and have proven difficult for industry vs the one way supply chains we are used to

- Living cellular/genetic starting materials introduces variability, complexity and costs

- The centralized manufacturing models we developed for biologics and small molecules are not particularly well suited for personalized, living medicines

- Requiring freezing of starting material can impact efficacy

- Complicated logistical coordination adds time, cost and complexity

- Manufacturing personalized medicines within the constraints of GMP has proven to be very difficult

- Personalized therapies must be batch released one at a time by hand (usually on paper), vs a standard release process for thousands of doses at the same time

In this article, we will argue for earlier focus on manufacturing to overcome common challenges like: high out-of-spec rates, long waiting lists, inability to meet demand, and extremely high cost of goods (COGs), amongst many others. When the time comes for commercialization, the CGT manufacturing processes of today are not robust enough to efficiently support production at the desired scale. Therapy developers need to recognize and address the manufacturing complexity (i.e. CMC) associated with cell and gene therapies much earlier in the development process – either at the R&D phase, at PD/preclinical or the latest at during the earliest clinical phase. Waiting until the asset is in Phase 2/3 to address manufacturability and COGS is a recipe for commercial disaster.

Recent draft FDA guidance entitled Manufacturing Changes and Comparability for Human Cellular and Gene Therapy Products addresses this issue by stating “We recommend that any extensive manufacturing changes be introduced prior to initiating clinical studies that are intended to provide evidence of safety and effectiveness in support of a BLA.” This guidance reinforces the points above but is often in conflict with pressure therapy developers receive from their investors to get the asset into the clinic as fast as possible to hit the clinical stage value inflection point. Evidence suggests that the old model of rushing into the clinic with an immature manufacturing process and hoping to fix it later is a recipe for commercial failure for advanced therapies.

The Old Biotech VC Investment Model No Longer Applies

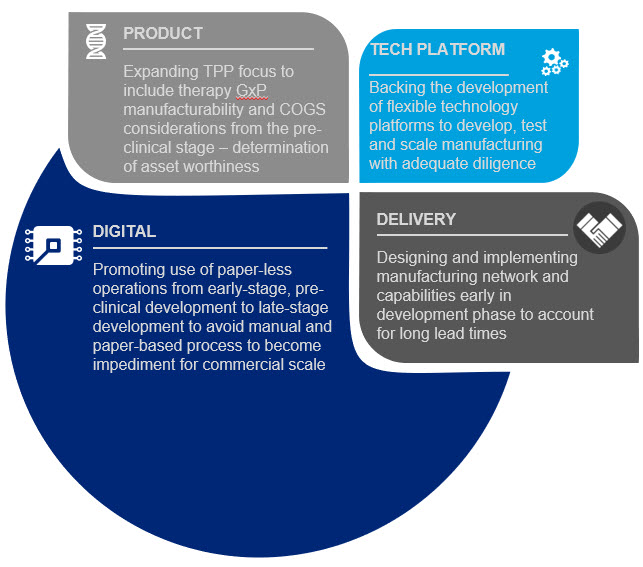

Given that CGTs commercial success continues to be hampered by significant manufacturing and market access challenges, the investor community could assist not only by providing necessary funds for development but also by taking an active role in ensuring company management focus not only on scientific development but also on process and manufacturing development. Investors could positively influence early-stage development and de-risk future commercialization in multiple ways, some of which are listed below (Figure 2).

Figure 2. Investor community areas of influence

- PRODUCT: Insist that academic research labs and early-stage biotech companies focus on CMC/manufacturability from the earliest R&D/PD phases. Additionally, investors need to give therapy developers the time to optimize their process before entering clinical trials so that they can develop a robust, repeatable, reliable and scalable process otherwise they risk entering the clinic with a non-scalable process that leads to a dead end for the product once approved.

- TECH PLATFORM: Push for the adoption of more flexible technology platforms to develop, test and scale manufacturing of these products from pre-clinical development through clinical testing and then through commercial launch – and insist that their portfolio companies use them. Using lab scale tools to develop processes will likely lead to a dead end at commercial launch.

- DELIVERY: Press early stage companies for details on how they expect to manufacture and to reach the market at scale – and invest only in companies that can reach the market at a volume and price that will gain market access. Focus on ensuring there is a target COGS in the Target Product Profile and that companies have a good understanding of market access/coverage/pricing even at pre-clinical stage to see if a product is worth developing.

- DIGITAL: Insist on fully digital processes (no more paper lab notebooks and batch records) from early development so these paper-based processes don’t become a barrier to scale later in the process.

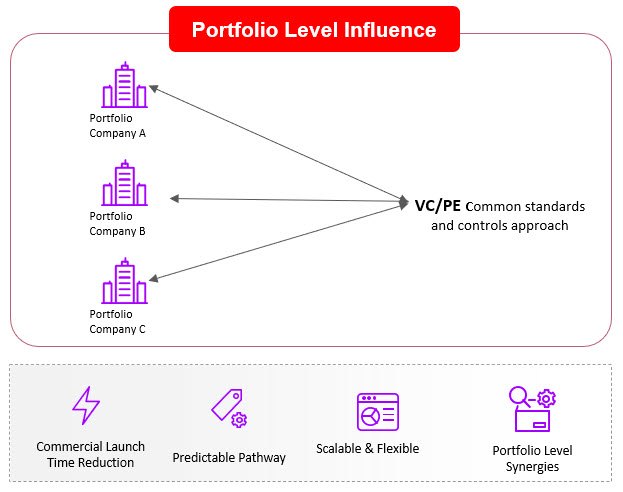

If investor community helps develop these approaches on a single technology or biological pathway within a portfolio company, the impact could be limited in providing meaningful leverage at the portfolio level. Instead, investors could consider a portfolio-based approach by also playing a critical role in ensuring that these other considerations are prioritized by portfolio companies early in development phase. Furthermore, the investor portfolio team could set similar standards and requirements across portfolio companies to gain efficiencies and ensure consistency in approach. For example, securing common manufacturing capabilities/ approaches/ technologies to define controls and processes across the portfolio companies various assets and create consistency and predictability in operations. Investors may even want to consider an approach that leverages shared infrastructure, sometimes called Infrastructure as a Service (IaaS), allowing portfolio companies to share resources ranging from cleanrooms and people (via CDMOs or direct) to software and regulatory support. Such models have been adopted by leading investors like Deerfield and Alexandria as well as companies such as ElevateBio, Resilience, Roivant, and others. Investors who take an IaaS approach can avoid redundancy of resources being paid for by each portfolio company which then often go underutilized and become a waste of precious investor capital.. An IaaS approach could help drive standardization and de-risk a portfolio of investments to hopefully avoid the fates of many companies that spent a lot of money on infrastructure and then ran out of cash while trying to reach the next clinical milestone.

Figure 3. A Portfolio Model for CGT Portfolio Company Influence

If we continue to follow the old therapeutics investment playbook for advanced therapies, we will likely continue to get products that are approvable but not accessible and more companies will fail commercially being unable to deliver an ROI back to their investors via significant sales of a marketed product. Marketing approval does not guarantee market access/commercial success any longer (even in the US) and it certainly doesn’t guarantee a buyout from big pharma. The good old days are gone so we need new approaches to deal with the new economic realities facing advanced therapies.

References: