An Updated View of The Federal Segment: DHA Formulary Management

By Shannon Matwiyoff and Cheryl Nagowski Middleton

This article is the second installment of a three-part series aimed at helping drug and device manufacturers better navigate and understand the VA and DOD health systems. The first installment in the series is available here.

From its humble beginnings on the battlefields of the American Revolution to its current status as a global healthcare enterprise, the Military Health System (MHS) has a rich history of service and innovation. MHS was established to support readiness by ensuring a healthy and fit fighting force that is medically prepared to provide the Military Departments with the maximum ability to accomplish their deployment missions. MHS also aims to create and maintain high morale in the uniformed services by providing medical care for members, certain former members, and for their dependents.

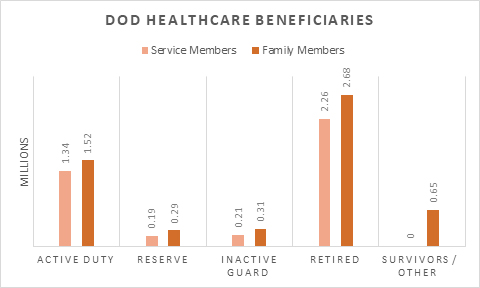

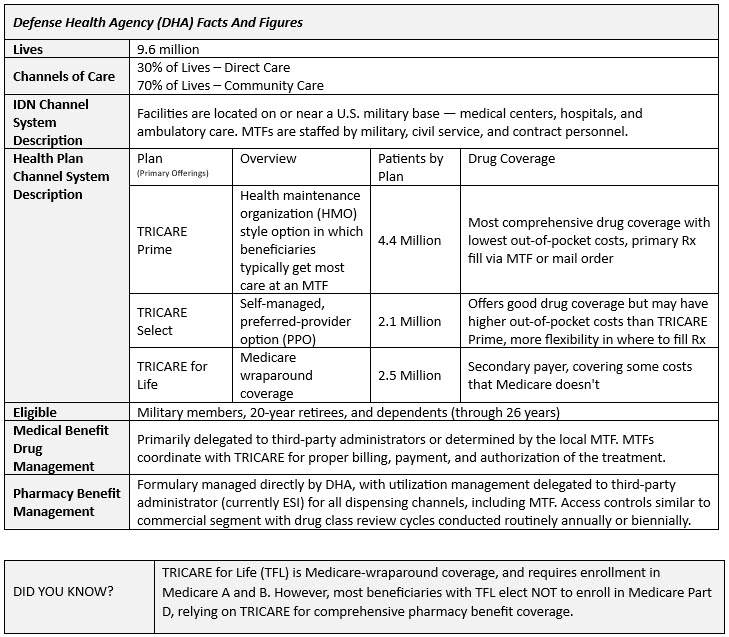

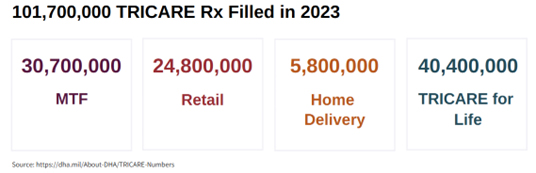

Today, MHS is a growing, vast and complex organization, with a budget of over $60 billion, serving approximately 9.6 million beneficiaries. There are more than 700 military treatment facilities including 45 hospitals globally (~80% in the U.S.), more than 300 military pharmacies, and the Defense Health Agency (DHA) employs more than 130,000 military and civilian healthcare providers, making it one of the nation’s largest health system employers. In fiscal year 2023, TRICARE spent over $8 billion on prescription drugs for about 6.6 million (70%) of its beneficiaries.

Pharmaceutical manufacturers seeking business opportunities within this closed health system face challenges understanding the rapidly evolving market dynamics. To effectively navigate this landscape, manufacturers need answers to key questions regarding market access, contracting, patient populations, and demand generation. This installment within the 3-part series, “Updated View of The Federal Segment,” will explore DOD formulary management, to include key controls, stakeholders, and contracting and pricing levers available to impact access.

Background

The Department of Defense (DOD) provides servicemembers, military retirees, and family members healthcare benefits and services through both MHS-operated hospitals and clinics, referred to collectively as military treatment facilities (MTFs) and commonly referred to as ‘direct care’, or through contracted civilian healthcare providers participating in the TRICARE health plan, which is commonly referred to as the ‘community setting.’ While DOD uses commercial payers and pharmacy benefit managers (PBMs) to manage certain aspects of its healthcare system, it has resisted complete privatization due to the need for specialized care to support the unique needs of the U.S. military — including readiness, service-related injuries and ailments, etc.

The DHA is a U.S. federal government agency that administers health services to the United States military. It is a component of the MHS and is responsible for the overall management of the MHS, including its drug management program. DHA was established in 2013 to align resources across the individual services and, since that time, has grown its workforce to over 130,000 healthcare professionals and streamlined care delivery to nine Defense ‘Health Networks.’ A unique-to-government element of DOD healthcare is TRICARE. TRICARE offers comprehensive healthcare coverage through its 11 different healthcare plan options depending on where an individual lives and that individual’s connection to the military. TRICARE is accepted at both direct care sites and participating community care providers. It functions similarly to traditional commercial health insurance with its tiered drug formulary and co-pays. However, while TRICARE functions like private health insurance, it is not technically health insurance due it is funding source and targeted beneficiary population.

While the majority of care today is provided in the community setting, DHA is aiming to reattract at least 7% of beneficiary care back to the MTFs by the end of 2026.

Drug Pricing & Contracting

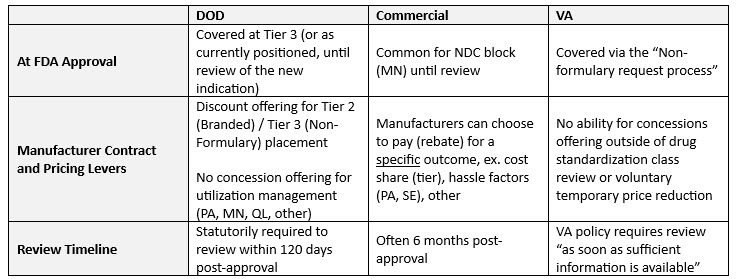

By law, all brand drugs (those approved by the FDA under a New Drug Application (NDA) or Biologics License Application (BLA) pathway) purchased by DHA are price capped at a ceiling price of 24.1% off of the non-Federal Average Manufacturer's price (non-FAMP). DHA primarily orders pharmaceuticals through four purchasing vehicles:

- Federal Supply Schedule (FSS) — contracts established through the Department of Veterans Affairs

- National Contracts — voluntary participation in selected Department of Veteran Affairs single-source contracts

- Blanket Purchase Agreements (BPA) — agreements established directly between the manufacturer and DHA with participation only available during DOD Pharmacy and Therapeutics (P&T) review, providing supplemental discounting for both the direct hospital purchasing and an additional rebate for the retail fills

- Distribution and Pricing Agreement — pricing agreements (not contracts) established with the Defense Logistics Agency (DLA), providing voluntary discounts for hospital network purchasing (MTF)

"Robust systems have been put in place to discern the relative clinical effectiveness and relative cost effectiveness of drugs placed on the Uniform Formulary. When the DOD P&T is making formulary placement recommendations, manufacturers must view their response to the solicitation as a one-shot-on-goal scenario to develop a strong clinical story that promotes superiority over both generically and therapeutically equivalent products, while emphasizing discount reasonableness.”

- Col. James Young, RPh (Ret), Consultant & Former Chief Pharmacist for DOD

Formulary Management

DHA maintains one national formulary — the “DoD Uniform Formulary.” There are two sub-formularies that affect military treatment facility stocking, the Basic Core and Extended Core Formularies. The Basic Core Formulary is a list of drugs that are considered to be first-line treatments for most common conditions. All drugs on the Basic Core Formulary must be available at all full-service military pharmacies. The Extended Core Formulary is a list of drugs that are used to treat certain conditions that are not covered by the Basic Core Formulary and are not required (e.g. optional) to be carried by MTF pharmacies.

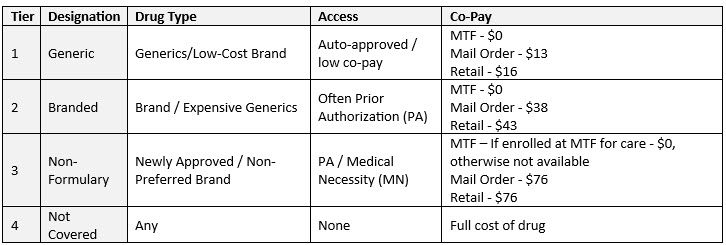

The DOD Uniform Formulary is analogous to a commercial plan, with most expensive new market entrants being placed in the “non-formulary” tier 3 category. It’s important to remember that exclusion tier aside (Tier 4), the DOD formulary is essentially a three (3) tier drug management system. That means that the “branded” tier on DOD is akin to a preferred brand tier and the non-formulary tier is comparable to a commercial branded or specialty tier.

The DOD P&T Committee meets quarterly to review newly approved drugs, existing drug classes in totality and, at times, evaluate utilization management. The DOD P&T Committee includes a multidisciplinary panel of physicians, pharmacists and other healthcare professions that guarantee consistent medication availability across the system through placement on the DOD Uniform Formulary. It includes 20 voting members from DHA, Navy, Army, Airforce, Coast Guard, and TRICARE representing a variety of both healthcare operation functions and medical specialties as well as non-voting members, such as VA physicians or pharmacists, and invited guests such as other Federal Agencies to include Indian Health Services.

The DOD P&T Committee’s recommendation are not the final decision. The Beneficiary Advisory Panel (BAP) reviews and comments on the DOD P&T Committee recommendations before a final decision is issued by the DHA Director. For newly approved drugs, this process can take up to 120 days depending upon timing of FDA approval relative to next scheduled DOD P&T Committee meeting date.

For oral medications, self-injections, and other direct-to-patient pharmacy benefit products, the DHA implements common utilization management techniques:

- Prior Authorization

- Step Therapies

- Quantity Limits

- Medical Necessity

- Others such as drug utilization reviews, and medication adherence monitoring

"For prescriptions requiring prior authorization currently being adjudicated, the process can be laborious. My experience with this is that the length of time for the wait is drug dependent. It is also drug urgency dependent and of course cost dependent.”

- DOD physician perspective on shift to ESI utilization management at the MTF level

Medical Drug Benefit

DHA allows MTFs to make independent decisions regarding medical benefit drugs. In the community care setting, DHA outsources most of medical benefit drug management to third-party administrators (TPAs). These PBMs operate under separate divisions, distinct from commercial. The DHA establishes the overall framework for medical benefit drug management, including those they wish to determine policy on and those which the TPAs will handle. What’s new for 2025 are the U.S. Tricare T-5 TPAs, which are TriWest (West) and Humana Military (East) with six states migrating to the West region effective January 1, 2025.

Moving Forward

By engaging with the DHA, leveraging available contracting options, and demonstrating value through clinical and economic data, manufacturers can successfully navigate the MHS landscape and contribute to the health and well-being of those who serve and have served our nation. The evolving nature of the MHS, including the transition to a new electronic health record system and the increasing utilization of specialty medications, further emphasizes the need for ongoing dialogue and collaboration between manufacturers and the DHA to ensure optimal patient access and cost-effective care.

In Part III of this series, we’ll explore more around what a manufacturer can influence in a new installment titled: “Access Levers Manufacturers Can Leverage.”

About The Authors:

About The Authors:

Shannon Matwiyoff is a tenured pharmaceutical industry expert with expertise in the federal channel, both locally and nationally.

Cheryl Nagowski Middleton is a consultant at Revolve Access, specializing in the development of Federal launch and growth strategies.

Cheryl Nagowski Middleton is a consultant at Revolve Access, specializing in the development of Federal launch and growth strategies.