Bio Data Points May 2011

By Eric Langer, president and managing partner, BioPlan Associates, Inc.

Nearly all biopharmaceutical developers use outsourcing services of some kind, whether for manufacture of clinical or commercial supplies, assays, process development, or many other activities. Outsourcing and offshoring are becoming part of mainstream operations strategy. Yet our recently released 2011 Eighth Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production indicates there has been virtually no headway made into improving relationships between clients and customers. This relationship is showing up as a substantial roadblock. As clients demand higher-level outsourced activities and increasingly greater value from their partners’ services, senior managers on both sides of the fence will need to figure out a solution.

In the past, outsourcing allowed companies to focus on their core competencies by removing lower-end, repetitive tasks from their operations. Today, however, our study shows that outsourcing is migrating into much higher-end, technical activities. The global study indicates that biomanufacturers are putting greater emphasis on productivity and internal resource usage. However, the study also shows that if executives are to leverage outsourcing to improve productivity and reduce costs, companies must do a better job at managing their relationship between the client and their CMO/service supplier.

Selecting a Service Supplier in 2011

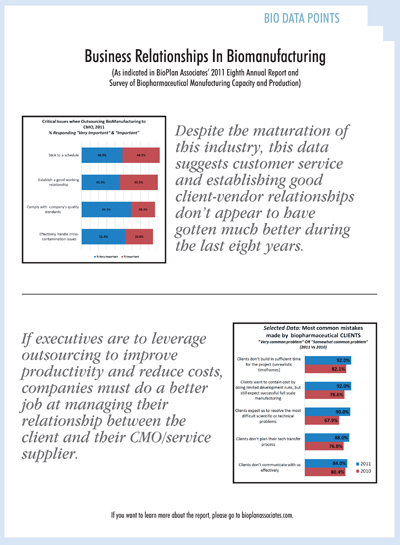

In the survey, we evaluated responses to critical issues concerning outsourcing of biopharmaceutical manufacturing. Although the responses cover CMO-client relationships, we believe these responses are very consistent with experiences of other service suppliers and their clients. The top issues this year also have been at the top of the list during the past eight years: “Stick to a schedule” and “Establish a good working relationship” are at the top of the list (with 93.2% and 91%, respectively, considering the issue “important” or “very important”).

Relationship building is critical in any customer-CMO relationship because of the flexibility and cooperation required for a project to end successfully. Collaborations include technical aspects such as process improvements, but other criteria are important as well to selecting the “right fit.” Do the partners have similar project management styles? Compatible quality, documentation, and compliance processes? Efficient and collegial tech transfers? But beyond these, many in the industry rate the “general fit” higher than minor differences in “systems.”

Despite the maturation of this industry, this data suggests customer service and establishing good client-vendor relationships don’t appear to have gotten much better during the last eight years. Maintaining good client-vendor relationships is increasing in importance to clients, and it is likely that poor communications between clients and vendors is a major factor in the persistent “working relationship” issues.

The current economic situation has certainly contributed to a less collaborative vendor-client environment. With money tight, schedules shorter, and expectations higher, “sticking to a schedule” is a bellwether for client relationship problems that, the report shows, are not getting resolved.

The problem is that a “good relationship” is hard to define, it’s a moving target and can depend on individual personalities. So both vendors and end users need to figure out what is needed to succeed and reverse the dysfunctional relationships many customers appear to be describing.

Strained Relationships: CMOs’ Problems with their Clients

CMOs and service providers have a different vantage point, and in our study, vendors reported new pressures that are straining working relationships. However, many of these pressures could be resolved with improved communication and by setting expectations more effectively. At the top of the list of critical problems seen by CMOs was, “Clients don’t build in sufficient time for the project (unrealistic time frames).” This was indicated by 92% as very common (60%) or somewhat common (32%). The following was indirectly a communications problem: “Clients want to contain cost by doing limited development runs, but still expect successful full-scale manufacturing” (very common — 74%; somewhat common — 18%). This problem is likely due to inadequate communications during the negotiation or project initiation stages, when CMOs would be best served by clearly defining the problems associated with cutting corners like limiting development runs.