Biomanufacturing Industry Not Providing Employees The Tools To Succeed

By Eric Langer, President and Managing Partner, BioPlan Associates, Inc.

Biopharmaceutical manufacturing is almost always viewed as a technical discipline. But the industry is surprisingly dependent on the creativity of people who stoke its energy and direction. Indeed, as with many scientific sectors, the effectiveness of the bioprocessing industry is very much reliant on the hiring, training, and retention of high-quality staff. But with all the focus on new technologies and systems, it seems those very employees may be getting the short end of the stick.

Biopharmaceutical manufacturing is almost always viewed as a technical discipline. But the industry is surprisingly dependent on the creativity of people who stoke its energy and direction. Indeed, as with many scientific sectors, the effectiveness of the bioprocessing industry is very much reliant on the hiring, training, and retention of high-quality staff. But with all the focus on new technologies and systems, it seems those very employees may be getting the short end of the stick.

IN-DEPTH TRAINING IS DECLINING

There’s a relentless push for efficiency in the biopharma industry, which requires companies to constantly reinvent leaner versions of themselves. Sometimes this reinventing can cut across several areas — and job training may be one of them.

As part of our 11th Annual Report and Survey of Biopharmaceutical Manufacturers, in which we surveyed 238 qualified biomanufacturers from around the world, we asked respondents how much training their organization provides to new staff or manufacturing employees.

We found that the majority of respondents (61 percent) provide 1 to 10 days of training, with this fairly evenly split between those providing 1 to 5 days (29 percent) and 6 to 10 days (30 percent). Although just 2 percent of companies provide less than a single day, in-depth training of more than 20 days is offered only by about one-quarter of respondents.

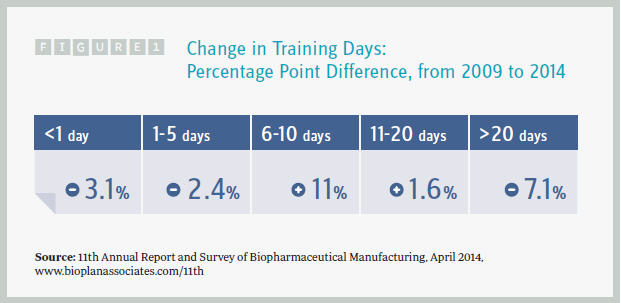

Surprisingly, just during the past five years, we have seen a marked decrease in the percentage of respondents who offer in-depth training. Back in 2009 and earlier, employees were receiving more than 20 staff days of training per year. Now, new hires are receiving somewhere between 6 and 10 days of training. That’s essentially a half-day per month. One conclusion is that the industry is now hiring from a larger pool of pretrained operators and managers. But to the contrary, the hiring data from our study indicates that the pool of eligible, trained employees is actually shrinking.

So the issue is whether a few hours of training per month is sufficient to ensure high-level performance and productivity from new staff.

IS THIS CAUSE FOR CONCERN?

The difference between university education and training in bioprocessing is the direct applicability of that education or training. Certainly in commercial manufacturing, the need for trained, experienced bioprocessing operators has been growing. This expertise has traditionally been learned while on the job, often taking years to reach the desired level of expertise. The drop in training days for new hires is a problem area in need of addressing to assure availability of future, skilled operators.

However, there are several mitigating factors. The decline in training days may be the result of budget cuts, but might also reflect the evolution of standardized and simplified manufacturing processes. In addition, many companies and suppliers are developing more-effective online training programs and webinars. These tend to be cost-effective and time-efficient ways to deliver training on highly targeted topics. Even YouTube videos are now being offered to provide specific unit-operations training.

Separately, many governments — particularly those at the state level — are now finding it beneficial to have local universities and community colleges offer industry-targeted bioprocessing training at all levels. These programs provide a larger pool of trained workers which, in turn, improve the attraction of biotechnology companies to their areas. As a result, there are a host of bioprocessing training programs being initiated, funded, and managed by state-run or other taxpayer-supported programs.

WHO’S INVOLVED IN TRAINING

Educational efforts also include industry-academic partnerships such as internships, apprenticeships, and industry-oriented, collaboratively developed training and certification programs. State and local educational institutions also may be offering training for new hires and current workers, with these programs directed at providing industry-needed expertise rather than the usual academic/ research orientation.

Moreover, many college- and university-based programs are providing industry-oriented certification courses rather than purely academic programs. In other words, they are beginning to teach biotechnology — ultimately an industrial and production-oriented activity — rather than molecular biology or other disciplines that have a bias towards research rather than product development and manufacture. As a result, declines in the number of training days may actually be a reflection of improvements in the workforce’s education, such that the industry is finding there is less training needed.

Efforts by some states such as North Carolina to improve the industrial-hiring readiness of the workforce are often specifically targeted at supporting the local biotechnology industry and may be paying off. The Johns Hopkins University in Maryland has been offering its M.S. in Biotechnology for more than 15 years and provides basic, applied, and lab science, with an industry focus. The Zurich University for Applied Science (ZHAW) in Switzerland offers continuing education that is both scientifically and practice-oriented.

Additionally, practical hands-on training for biotechnology and bioprocessing is no longer college-based; many high schools (particularly in biotechnology-intensive regions) are starting to offer students lab and other hands-on training and even local company, cooperative, and apprentice programs.

GOOD BIOPROCESSING HIRES HARD TO FIND

While these are all encouraging signs, our report reveals that these efforts have yet to reduce the difficulties of hiring process- development staff. When we asked industry participants in our study about the positions most difficult to fill, they were most likely to cite:

- process-development staff, upstream (42 percent)

- process-development staff, downstream (35 percent)

- process engineers (27 percent).

Compared to last year, more respondents are finding it more difficult to hire downstream process development staff and process engineers. Over the past few years the problems appear to be gradually worsening.

The pain in hiring is even more acute in Western Europe:

- process development staff, upstream (53 percent of Western European respondents citing difficulties versus 32 percent in the U.S.)

- process development staff, downstream (47 percent in Western Europe; 29 percent in the U.S.).

Differences between the U.S. and Western Europe may reflect the varying stages of development in different regions. For example, one can expect hiring status and patterns to differ when comparing a near-mature biotechnology cluster (with marketed products) to a region with many start-ups.

WHERE TO GO FROM HERE

Companies continue to make their processes more efficient, productive, and less expensive. This is often done by implementing new initiatives such as PAT (process analytical technology) and QbD (quality by design), which require specialized and experienced staff. As a result, it is not surprising to see the data continue to show that the most difficult positions to fill involve process improvement specialists for upstream and downstream processing. These employees appear to continue to be difficult to find, recruit, and retain.

Things are not likely to change soon. Skilled employees are produced primarily through internal training, a process that frequently leads to “poaching” from one company to another. Anecdotally, industry observers feel this cycle will only be broken by stronger relationships between employers and top universities that result in more qualified candidates being available who have some industry exposure. Encouragingly, those partnerships seem to be increasing.

In the end, whether or not training programs are conducted in-house by biopharmaceutical manufacturers or in educational institutions, it’s important that these programs provide broad knowledge and ensure students are capable of problem-solving and independent thinking. As seen elsewhere in our report, the human side of things also must not be overlooked. Bioprocessing professionals require many “soft” and less-defined skills, such as the ability to communicate well, to write coherently, to learn to lead teams, and to work effectively in a team environment.

Survey Methodology: The 2014 Eleventh Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production yields a composite view and trend analysis from 238 responsible individuals at biopharmaceutical manufacturers and contract manufacturing organizations (CMOs) in 31 countries. The methodology also included over 173 direct suppliers of materials, services, and equipment to this industry. This year’s study covers such issues as new product needs, facility budget changes, current capacity, future capacity constraints, expansions, use of disposables, trends and budgets in disposables, trends in downstream purifi cation, quality management and control, hiring issues, and employment. The quantitative trend analysis provides details and comparisons of production by biotherapeutic developers and CMOs. It also evaluates trends over time and assesses differences in the world’s major markets in the U.S. and Europe.