Can Single-Use Technologies Solve Downstream Bottlenecks?

By Eric Langer, president and managing partner, BioPlan Associates, Inc.

By Eric Langer, president and managing partner, BioPlan Associates, Inc.

Downstream operations continue to be a source of bottlenecks in the bioproduction process, with much of this attributable to an inability to keep up with increased upstream productivity and yield. Our just-released 9th Annual Report and Survey of Biopharmaceutical Manufacturers evaluated ways in which the industry is tackling this problem, specifically with regard to new downstream processing (DSP) technologies being considered.

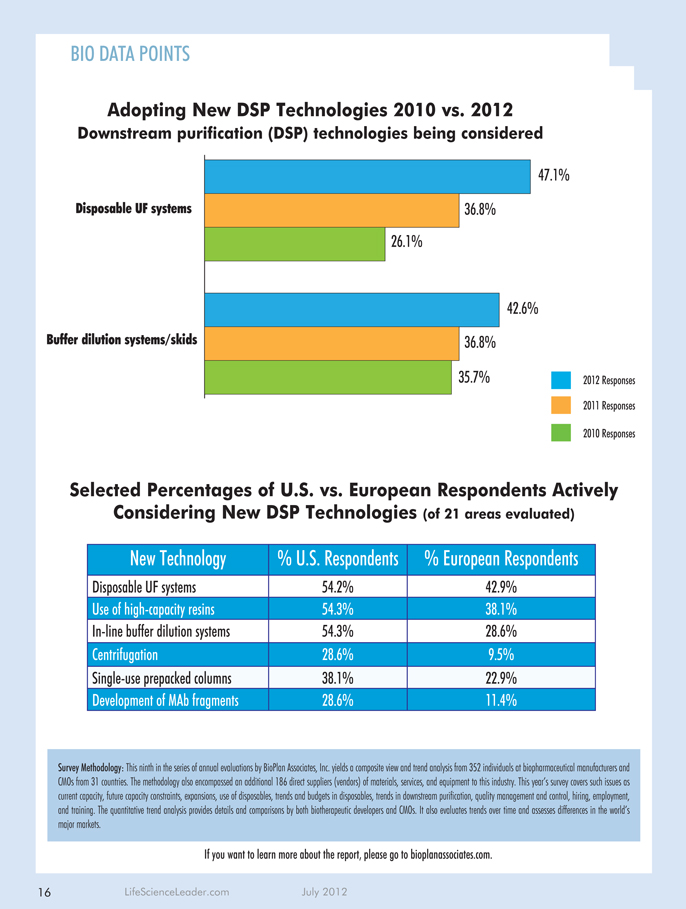

Topping the list of 21 different new technologies under consideration this year are disposable ultrafiltration (UF) systems, with close to half (47.1%) of the more than 300 global biomanufacturers we surveyed indicating they are at least considering this as a solution this year. After disposable UF systems, the next tier of solutions being considered include buffer dilution systems/skids (42.6%) and use of high capacity resins (41.2%). Following these were 18 other alternatives, many of which are single-use.

At least a quarter of the respondents are evaluating single-use technologies such as prepacked columns and membrane technology, while relatively fewer are drawn to chromatography alternatives, precipitation, and simulated moving beds, among others. It is interesting to note that single-use/disposable solutions continue to be prominent, accounting for 4 of the top 10 technologies being considered by the industry.

Annual Trends

A comparison of this year’s data to last year’s shows interest in disposable UF systems (47.1% as mentioned above), which continues a strong multiyear rise, from 36.8% last year and 26.1% in 2010. Buffer dilution systems/skids, which took the number two spot this year at 42.6% of respondents, also sees a year-over-year jump, from 36.8% in 2011.

Beyond these top two, though, we have to move down the list to find solutions that are seeing active growth in the percentage of respondents evaluating each new technology. This year’s seventh-most considered solution — online analytical and control devices — saw a modest rise in interest from last year. And membrane technologies, in the #9 spot, also saw a slight gain.

When we limit our analysis to evaluation of single-use technologies, the picture is clearer. Interest in disposable UF systems and single-use disposable tangential flow filtration (TFF) membranes both grew. Although a slightly smaller proportion of respondents this year said they are actively considering single-use prepacked columns, this appears to be simply a leveling off of interest after a large jump in 2010. In fact, the only single-use technology to see a marked drop in interest this year was single-use filters, which fell from 43% last year to 36.8% this year.

The drop-off in consideration experienced by the majority of downstream processing solutions does not necessarily mean the industry is any less invested this year in tackling the persistent problem of downstream bottlenecks. Rather, the hikes in interest in some technologies, coupled with the marked decline of others, might simply mean that the industry is either beginning to develop solid preferences for some technologies over others or figuring out what works and what doesn’t.

Global Differences

Clearer differences are in view when sorting the responses on a regional basis. We compared answers from U.S. and Western European respondents, finding these groups agreeing on relatively few new technologies. Significantly, a majority of U.S. respondents are actively considering technologies such as disposable UF systems, use of high capacity resins, and in-line buffer dilution systems. By contrast, Europeans’ level of interest for disposable UF systems, buffer dilution systems/skids, and single-use disposable TFF membranes, although at the top of their new technology list, stand at a somewhat lower level compared with U.S. biomanufacturers.

These regional differences also can be seen, though to a lesser degree, when we look at how U.S. and European respondents are actually implementing new downstream solutions. In a separate question, we found that a far greater percentage of U.S. than European biomanufacturers are cycling columns more frequently (64.1% vs. 16%) and developing more efficient harvest/flocculation operations (30.8% vs. 12%). On the other hand, Europeans are far more likely to have used or evaluated membrane-based filtration technologies (52% vs. 35.9%) and investigated process development to shorten cycle times (44% vs. 33.3%).

CMOs and Biotherapeutic Developers Show Their Differences, Too

It’s not only U.S. and European respondents who are looking at the downstream problem through different lens; CMOs and developers also differ on many downstream processing (DSP) technologies under consideration. For example, while two-thirds of the CMOs responding to our study said they were actively considering the use of high capacity resins this year, just 37.3% of developers said the same.