Change On The Horizon For Biomanufacturing

By Eric Langer, president and managing partner, BioPlan Associates, Inc.

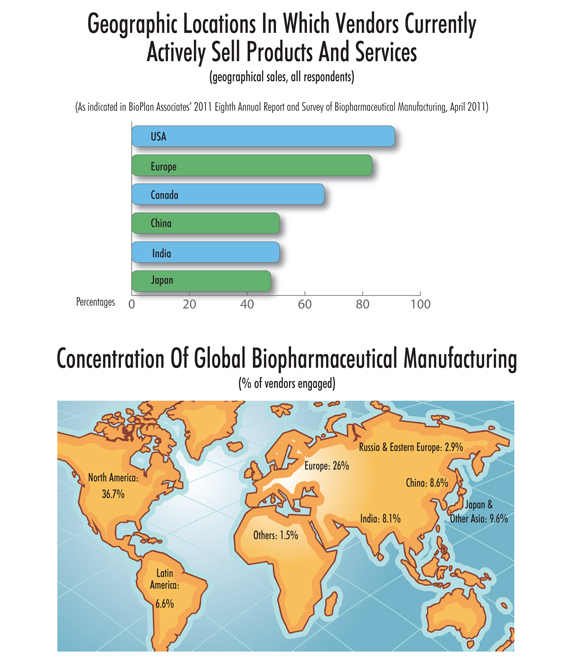

A leading indicator as to where the global bio industry is headed, geographically, is where its global vendors are setting up shop. In our 8th Annual Report and Survey of Biopharmaceutical Manufacturing, along with 352 biomanufacturers, we also surveyed 186 suppliers to the industry.

This year, more than half of the industry’s suppliers are actively selling products and services in both China and India (51.2% each). The percentage is up from just three years ago when 38.7% of vendors were actively selling in India and 37.7% in China. This mirrors the global optimism associated with these large markets. It also suggests that vendors recognize the strategic importance of establishing a presence within domestic foreign markets. We also found this year that there is modest growth in the percentage of suppliers selling to these geographies: South America (41.1%), the Middle East (36.7%), and Central America (35.7%).

This growth is also seen in our analysis of global biopharmaceutical manufacturing concentration, at our industry WIKI site: www.top1000bio.com. Here, we find that as of Dec. 1, 2011, Chinese biomanufacturers made up 8.6% of the concentration of biologics production (aggregated capacity, employment, and pipeline products).

DIFFERING REASONS FOR WORLDWIDE BIOPHARM GROWTH

While the United States and other major biopharmaceutical markets tend to grow by rapid adoption of new products and new indications for existing products, growth in most of the rest of the world tends to be driven more by overall economic improvement, including the development of a middle class, and other broad economic and social trends supporting improved healthcare in these countries. The majority of biopharmaceutical manufacture and consumption in emerging markets currently involves biogenerics or other copies of products developed by Western innovator companies, as most lesser-developed counties are not able to afford costly Western innovator biological products.

Even so, developing markets, although still relatively small, are growing at a more rapid pace than major Western markets, and most major biopharmaceutical companies either have established or are establishing a presence in these foreign markets. Some are forming joint ventures and collaborations with local companies. Other collaborations can involve outsourcing of R&D, the licensing of manufacturing rights to developing countries, or establishment of local clinical research operations, all of which drive industry growth and opportunity in local geographies.

We measure these market developments into manufacturing clusters that compete with the traditional powers — United States and Western Europe — using our constantly updated Top 1,000 Global Biopharmaceutical Manufacturing Facilities index.

Our index currently shows China at 8.6% of global concentration, India at 8.1%, and Japan and other Asia at 9.7%. Almost two-thirds of worldwide biomanufacturing (based on cumulative facilities index scores) remains concentrated in the United States (36.7%) and Europe (26%). Indeed, our index shows that relatively few of the top-ranking facilities exist outside of the United States and Western Europe.

Despite the current scores, in the short term, developing regions such as China and India will have trouble narrowing the considerable gap in facility types, complexity, and capabilities that exist in the United States and Europe. Eventually, though, biopharmaceutical manufacturing will be done by outsourcing partners in developing countries at GMP-level quality and in areas that require greater skill and expertise.

Certainly, as local industries in lesser-developed countries continue to develop, they will attract more world-class facilities and make inroads into our top facilities index. These will be in addition to local companies developing commercial-scale biopharmaceutical manufacturing facilities to serve domestic and regional needs, a trend that is already being seen with vaccines, as some foreign companies develop their own fully innovative biopharmaceuticals. And when regulatory barriers fall, Asian markets, in particular, will become powerful centers within the biomanufacturing market. India provides an excellent case in point — with several Indian vaccine manufacturers having gained pre-qualification from the WHO, the country is now estimated to account for 60% of the world’s vaccine production and 60% to 80% of annual United Nations vaccine purchases.

This much is clear: globalization is firmly entrenched in the biopharmaceutical industry. Stay tuned to our index for more.