CMOs Leading The Way In Biopharma Innovation – No Herd Mentality

By Eric Langer, president and managing partner, BioPlan Associates, Inc.

Innovation is often driven by the end users most in need of new and better technologies and tools. In biomanufacturing, the CMOs are often the most active scouters seeking better, more cost-effective ways to support their clients’ needs, differentiate themselves from other CMOs, and remain more efficient and competitive. CMOs, therefore, are a leading indicator of future trends and what new technologies are to come.

Innovation is often driven by the end users most in need of new and better technologies and tools. In biomanufacturing, the CMOs are often the most active scouters seeking better, more cost-effective ways to support their clients’ needs, differentiate themselves from other CMOs, and remain more efficient and competitive. CMOs, therefore, are a leading indicator of future trends and what new technologies are to come.

This year at the BIO meeting in Chicago, we sought out 10 globally recognized CMOs to determine how they are implementing novel technologies today and how these will impact future bioprocessing for all biomanufacturers. We asked, “Where are CMOs investing in new technologies that will improve bioprocessing today and over the next five years?” We were surprised at the breadth of innovation being adopted and the fact that none of the CMOs are handling new technology adoption the same way. This is likely to accelerate new manufacturing methods and breed more and better approaches — something often lacking in this generally conservative, regulations-bound industry.

Below is a summary of new technology offerings listed alphabetically by company. Much of the innovation at CMOs is not associated with individual technology adoption but rather the integration of multiple novel approaches that create improvements synergistically. A number of world-class CMOs are absent from this list, but we believe comments are representative of the industry at large.

AMRI Global (Albany, NY) “We consider innovation on the fill/finish side of the CMO process to be most important to our clients. At AMRI, we have invested in drugdelivery technology. For example, our prefilled, bubblefree syringe technologies enable predosed, easier, faster use and greater patient compliance. This is the future of fill/finish.” Daniel Conlon, senior director of business development

Boehringer Ingelheim Pharma (Biberach, Germany) “We are integrating new technologies, such as column-free downstream processing to replace protein A, and continuous- downstream processing technologies that can reduce time-to-clinic and time-to-market significantly. This focus on speed is where CMOs need to direct efforts today and in the future.” Dr. Alexander Jung, senior manager, BD Technologies

CMC Biologics (Bothell, WA, and Copenhagen, DK) “We are especially focused on integrating new upstream technologies, including our CHEF1 expression system for mammalian production, with our active development programs for perfusion and other continuous bioprocessing. By continually increasing upstream productivity, our clients find they can reduce overall costs in clinical and later on in commercialstage production.” Morten Munk, VP business development

Cook General BioTechnology (Indianapolis) “The biotechnology industry today is seeking innovation for container systems in cryopreservation, and we currently have a completely closed-system cryogenic vial. Also, we are actively developing an automated filling system for disposable vials permitting scalability and aseptic practices while maintaining cell quality.” Dr. Erik Woods, Ph.D., president and CEO

DSM (Portsmouth, NH) “We are introducing innovative technologies particularly in up- and downstream process intensification. For example, we combine our upstream XD technologies and simpler downstream processing via our Rhobust technology for the direct capture of proteins. Together, these technologies enable pharma companies to reduce costs and will permit companies in emerging markets to produce biologics domestically with limited capital expenditure.” Tom Hindle, senior director, business development

Fujifilm Diosynth Biotechnologies (Billingham, UK) “The biopharma industry needs more than just incremental technology improvements. Advances are very complex, and the value is in integrating the various component technologies into a logical and simplified solution. For example, evaluating and selecting the right technologies associated with antibody drug conjugate development and manufacturing requires in-depth knowledge of each technology and how they will fit together to deliver a better overall solution.” Mark Douglas, director, strategic business development

Laureate Biopharma (Princeton, NJ) “We’ve invested in new single-use fill/finish technologies. We employ filling technologies where all product contact equipment is singleuse. By going 100% disposable, we are eliminating the need for cleaning validation. This virtually eliminates associated cross-contamination risks and keeps costs down. Clearly, the future of innovation is in these single-use technologies.” Robert Broeze, chief commercial officer

Lonza Custom Manufacturing (Allendale, NJ) “One critical area of investment today is in the overall facility design for scale-up of new process platforms, such as antibody drug conjugates (ADCs) with novel linker/payload technologies. Beyond just the linker technology, CMOs need to provide the scale-up capabilities for ADC production. Combining the antibody and the cytotoxic is important, but designing a commercial-scale process around the technology is even more vital. This is an opportunity for CMO process design.”

Rentschler Biotechnologie (Laupheim, Germany) “Innovation is vital to any CMO. For example, at Rentschler, we feel that speeding the evaluation process in the early stages of development is critical. We developed our TurboScreen stable CHO system to provide faster results, reaching stable clones in only nine weeks using a parallel selection process.” Erik Laursen, director of business development

Therapure Biopharma, (Mississauga, Ontario) “The innovation in the biopharma CMO industry involves integration of modular approaches to manufacturing — flexible spaces, clean rooms, RAB systems, disposables, and single-use technology, all of which are scalable and permit carrying of a campaign all the way from preclinical to commercial scale, all in the same facility. This reduces tech transfer costs and risks while speeding up the development process.” Safa’a Al-Rais, director of project management

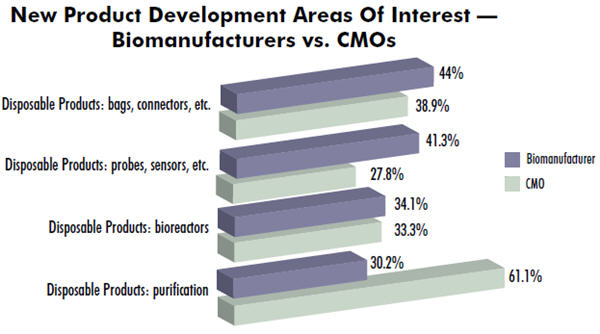

In our 10th Annual Report and Survey of Biopharmaceutical Manufacturers, we measured 21 different areas where new product development was sought. We evaluated the categories by biomanufacturer (drug innovators) vs. CMOs. We found significant differences in responses. For example, regarding standard, common bags and connectors, CMOs already had implemented these devices years ago and are now seeking innovation in emerging areas such as single-use purification.

By using CMOs as a leading indicator and tracking how they are integrating innovative new technologies and evaluating their adoption strategies, we can project where many of these new technologies will be in two to five years within the overall industry.

Survey Methodology: The 2013 10th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production is an evaluation by BioPlan Associates, Inc. that yields a composite view of and trend analysis from 300 to 400 responsible individuals at biopharmaceutical manufacturers and CMOs in 29 countries. The respondents also include more than 185 direct suppliers of materials, services, and equipment to this industry. Each year the study covers issues including new product needs, facility budget changes, current capacity, future capacity constraints, expansions, use of disposables, trends and budgets in disposables, trends in downstream purification, quality management and control, hiring, and employment. The quantitative trend analysis provides details and comparisons of production by biotherapeutic developers and CMOs. It also evaluates trends over time and assesses differences in the world’s major markets in the U.S. and Europe.

If you want to learn more about the report, please go to bioplanassociates.com.