Emerging Trends In Cell & Gene Therapies For Immuno-Oncology

By Chris Dokomajilar, Christopher Leidli, and Jim Grady

The biopharma ecosystem is devoting significant resources to develop novel cell and gene therapies to treat cancer. While survival rates have increased for many cancers over the past two decades, there remains an unmet need for more effective therapies, especially for patients with metastatic disease that does not respond to available therapies.

Following the approval of five autologous cell therapies, establishing safe and effective off-the-shelf solutions remains a significant interest to offer readily accessible and economical therapies for more patients. Earlier this year, J&J and Legend’s BCMA CAR-T, Carvykti, was FDA approved, marking the industry’s second BCMA CAR-T approval, coming about a year behind BMS and bluebird’s Abecma. Yet the number of approved cell and gene therapy treatments are few. In this article, we examine the current state of clinical development and investment for novel immuno-oncology cell and gene therapies.

Investment In Cell And Gene Therapies Remains Robust

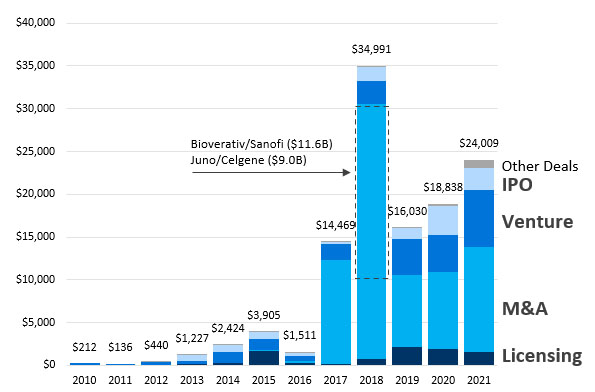

Cash continues to flow into cell and gene therapies (CGT). In 2021, CGT companies saw $24 billion in total cash and investment into the space, including $1.6 billion in up-front cash and equity for partnerships and $6.7 billion in venture capital. Values across licensing deals, M&A, venture, and IPO have been tracking higher for the last five years.

Figure 1. CGT deals and financing have increased significantly since 2010.

Source: DealForma.com Database. Financials based on disclosed figures through 3/10/2022.

Includes platforms and therapeutics in cell therapy, gene therapy, and vector tech.

DealForma tracks other modalities such as mAbs and broader immunotherapies separately as we do gene editing/CRISPR from gene therapy.

2021 cell and gene therapy deal activity saw $24 billion in upfront cash and equity. This included $1.6 billion in licensing upfronts, $12.3 billion in M&A cash, $6.7 billion in venture investment, $2.5 billion in CGT company IPOs, and $1 billion in academic partnerships and other transaction upfronts.

Two high-value cell and gene therapy acquisitions helped mark a record 2018, which included Juno/Celgene and Bioverativ/Sanofi, as CGT M&A totals continued to increase through to 2021.

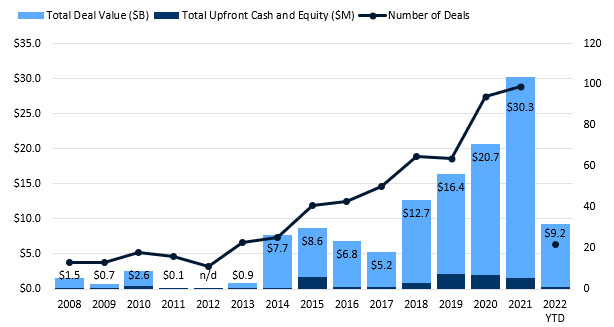

Figure 2. CGT partnerships set a new record in 2021. Source: DealForma.com Database.

Financials based on disclosed figures through 3/10/2022.

CGT partnerships set a record in 2021, with total announced deal values at over $30 billion. 2022 saw another $9 billion in the total headline figure through mid-March, with $300 million in up-front cash and equity. Medians for both cell therapy and gene therapy lead other modalities.

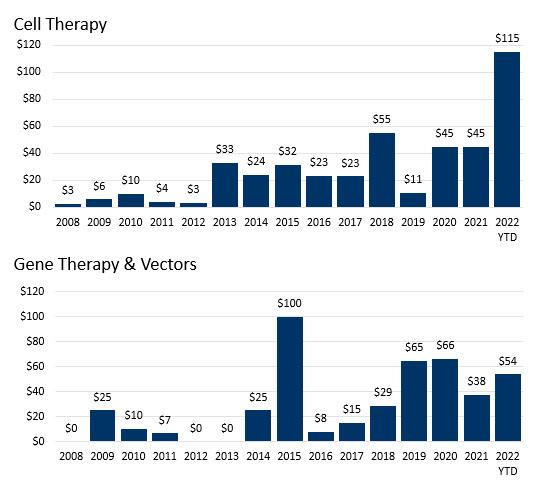

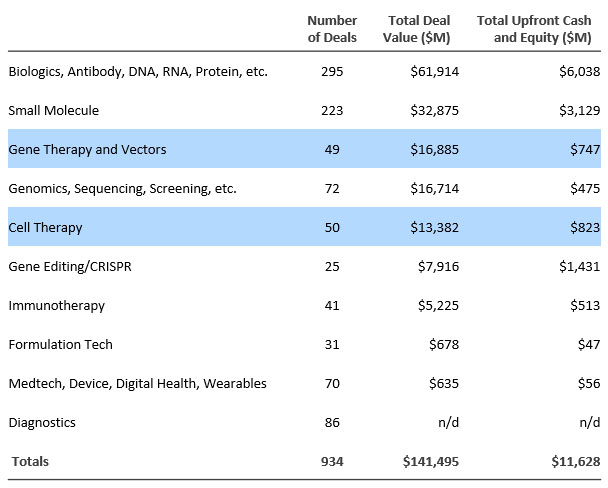

Figure 3. Primary technologies in licensing transactions signed in 2021.

Source: DealForma.com Database. Financials based on disclosed figures through 3/10/2022.

Cell and gene therapy R&D partnerships are increasing as a proportion of all partnerships. Fifty cell therapy deals totaled $823 million in up-front cash and equity, and 49 gene therapy deals brought $747 million in total up front.

Cell Therapy Clinical Development Landscape

Cell-based immuno-oncology therapies is an especially active area of clinical development, representing nearly 60% of clinical trials in the treatment of cancer. As of April 2022, there are over 1,200 active oncology or hematology clinical trials for cell therapies registered with ClinicalTrials.gov. Of these, the vast majority are in early phases of clinical development.

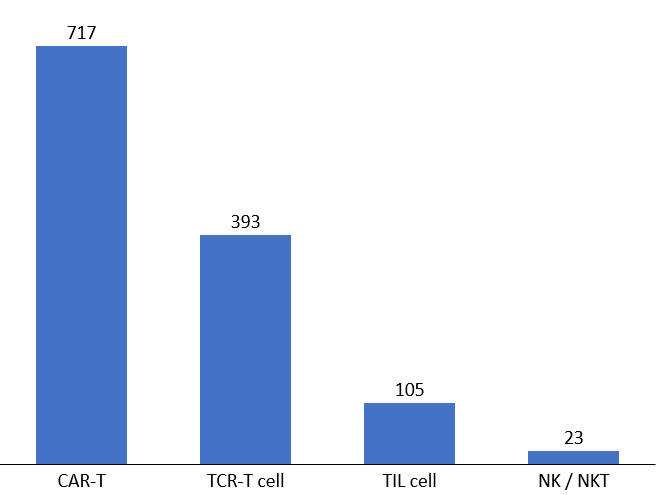

Figure 4. Active cell therapies in development pipeline. Source: clinicaltrials.gov, April 2022.

Though most development has been in standard CAR-T, the clinical landscape has broadened to include gamma delta T-, NK-, macrophage, and TIL therapies.

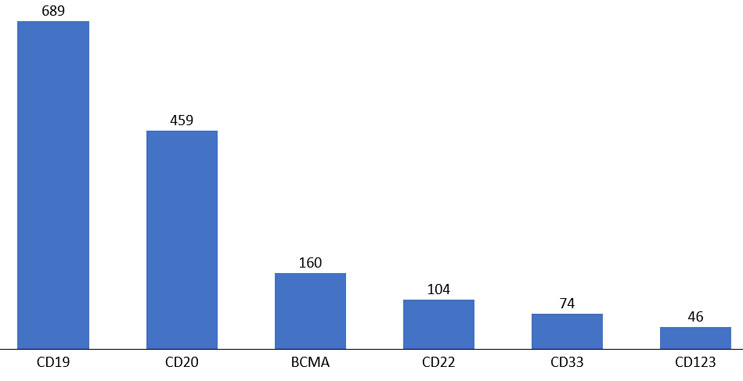

Figure 5. Top cell therapy targets for hematologic malignancies.

Source: clinicaltrials.gov, April 2022.

We also explored shared antigen targets for cell therapy products. CD19 and CD20 directed development is the dominant target for hematological indications, but there has been an increase in other targets, such as BCMA and CD22.

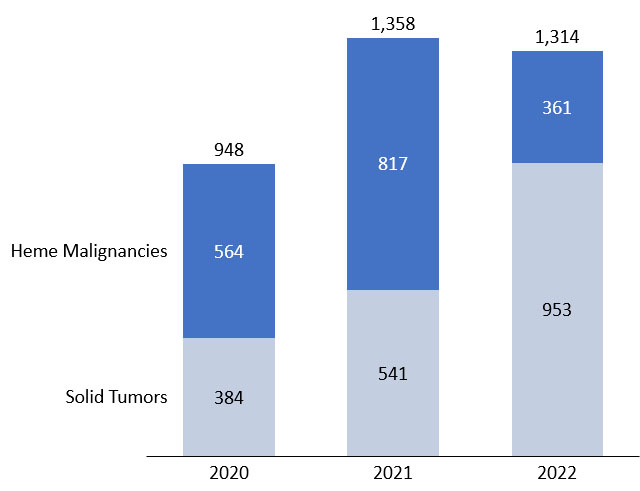

Figure 6. Comparison of cell therapies in development for hematologic malignancies vs. solid tumors

(number of active trials). Source: clinicaltrials.gov, April 2022.

Our analysis of the cell therapy clinical pipeline shows that development activity remains strong, but while year-on-year growth of the overall number of trials has slowed, there is an increasing contribution from trials in solid tumor cancers compared to hematological malignancies. We expect this trend to continue as there remains a high unmet need in solid tumors compared to the relatively crowded hematologic market.

Evolving Go-to-Market Strategies To Optimize CGT Commercialization

Despite success in commercializing the first generation of CAR T cell therapies, their efficacy has been demonstrated mainly in hematological malignancies within patient populations with relatively low prevalence. The hope is that both autologous and allogeneic immuno-oncology cell therapies will be approved soon to treat patients with solid tumors, given the high unmet need in these larger prevalent patient populations.

But the commercialization hurdles are high. The go-to-market framework for cell therapies is different than the traditional pharma launch playbook, and commercialization of cell therapies needs to begin much sooner – even several years prior to expected approval. Preparing the market requires building new ways of raising awareness and educating cancer centers, hospitals, and community healthcare providers to ensure patients have access to these specialized therapies. In most cases, a development and commercialization by design approach is necessary as “new to the world” workflows need to be established at authorized treatment centers. The “commercialization by design” framework collects the voice of the customer to develop workflows that transition cell therapy products from clinical manufacturing to commercialization.

While much of the focus in the cell and gene therapy space has been on clinical manufacturing and logistics, we flag the need for early focus on the downstream considerations for launch and commercialization.

About The Authors:

Chris Dokomajilar is the founder and CEO of DealForma. Prior to founding DealForma, he held research, management consulting, and industry analytics roles within biopharma and academia at Recap, Deloitte, Thomson Reuters, BioCentury, and the University of California San Francisco. He enjoys the opportunity to contribute to industry thought-leadership and is frequently invited to speak to industry groups about biopharma business development, licensing, and finance. He holds molecular biology degrees from the University of California Berkeley.

Chris Dokomajilar is the founder and CEO of DealForma. Prior to founding DealForma, he held research, management consulting, and industry analytics roles within biopharma and academia at Recap, Deloitte, Thomson Reuters, BioCentury, and the University of California San Francisco. He enjoys the opportunity to contribute to industry thought-leadership and is frequently invited to speak to industry groups about biopharma business development, licensing, and finance. He holds molecular biology degrees from the University of California Berkeley.

Christopher Leidli, MS, MBA, is founder of Boulder Biotech Launch Specialists, LLC. He has extensive experience in developing and commercializing biotech products and businesses focused on immuno-oncology, cell, and gene therapy and subject matter expertise in new product development, marketing strategy development, process design for six sigma, and omnichannel digital and social media communications. He has a history of success in designing and directing innovative product launches for major brands at biopharma companies including Amgen, Array BioPharma, Sanofi, Bayer, and Johnson & Johnson. He holds master's degrees from the University of Southern California and University of Cincinnati College of Medicine.

Christopher Leidli, MS, MBA, is founder of Boulder Biotech Launch Specialists, LLC. He has extensive experience in developing and commercializing biotech products and businesses focused on immuno-oncology, cell, and gene therapy and subject matter expertise in new product development, marketing strategy development, process design for six sigma, and omnichannel digital and social media communications. He has a history of success in designing and directing innovative product launches for major brands at biopharma companies including Amgen, Array BioPharma, Sanofi, Bayer, and Johnson & Johnson. He holds master's degrees from the University of Southern California and University of Cincinnati College of Medicine.

Jim Grady is an associate consultant at Boulder Biotech Launch Specialists, LLC. He possesses a diverse array of financial analysis, BD&L, general management, and consulting experience across corporate banking, enterprise software, and biotech companies. His main focus within biotech has been in the oncology and ophthalmology therapeutic areas, with an ever-growing base of knowledge in the development of CGT and biologics for the treatment of cancers and certain other intractable diseases. His educational background is in chemical and biological engineering and business administration (finance) at University of Colorado Boulder and University of Notre Dame.

Jim Grady is an associate consultant at Boulder Biotech Launch Specialists, LLC. He possesses a diverse array of financial analysis, BD&L, general management, and consulting experience across corporate banking, enterprise software, and biotech companies. His main focus within biotech has been in the oncology and ophthalmology therapeutic areas, with an ever-growing base of knowledge in the development of CGT and biologics for the treatment of cancers and certain other intractable diseases. His educational background is in chemical and biological engineering and business administration (finance) at University of Colorado Boulder and University of Notre Dame.