Experiential Data Sheds Light On The CRO Selection Process

By Rebecca McAvoy

Picking the best service provider for your unique outsourced clinical development work can sometimes feel like playing pin the tail on the donkey. Don a blindfold. Spin around. Wander with no clear sense of direction toward your target. Luckily, it doesn’t have to be this way. Data and tools are available to better inform your provider search. Industry Standard Research (ISR), a full-service market research provider to the pharma and pharma services industries, has collected information from outsourcing decision makers via an online survey regarding their selection and evaluation of CROs.

Respondents relay the attributes they consider critical when selecting a service provider and then rate, along the same dimensions, the performance of providers with which they have recently worked. Using selection- driver data and provider-performance ratings in tandem enables sponsors to make an educated outsourcing decision.

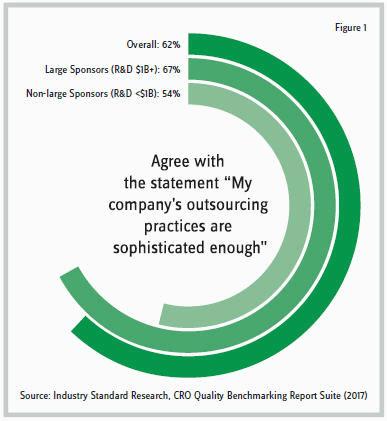

As part of this research, ISR gathered respondents’ opinions on the sophistication of their companies’ outsourcing practices (Figure 1). Overall, 62 percent of decision makers believe their company employs sufficiently sophisticated outsourcing practices. Not surprisingly, those from large sponsors (annual R&D spend $1B+) are generally more pleased with their company’s level of outsourcing sophistication than are those at smaller companies where nearly half of respondents do not consider their company’s outsourcing practices to be sophisticated enough.

One method to enhance outsourcing sophistication is for decision makers to determine the qualities that are most important for their provider to exhibit before broaching provider evaluation and selection. Beginning with defined attribute goals will narrow the search and make it easier to find a well-matched provider. ISR’s research offers the industry’s viewpoint on selection driver importance across several different scenarios: 1) choosing a provider from a preferred provider list, 2) choosing a provider that is not on the preferred provider list, and 3) choosing a provider in the absence of a preferred list. Those with preferred provider agreements (PPAs) convey what is important when choosing a provider from their preferred list as well as what drivers are important when choosing a provider that is not on their company’s list.

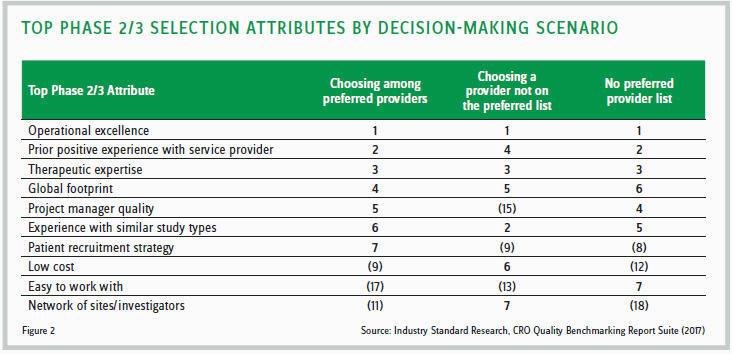

Figure 2 contains the seven most important attributes for each decision-making scenario when selecting a Phase 2/3 provider. For comparison and completeness, ranks for attributes that are in the top seven attributes for one scenario but not for others are shown in parentheses. Several interesting findings come to light when selection attributes are approached in this manner:

- Operational excellence is king. There’s no getting around it. This attribute is the most important selection driver regardless of the decision-making scenario. Providers need to prove that they are operationally proficient to win sponsors’ trust.

- Also universally important are Prior positive experience with service provider and Therapeutic expertise, ranking between slots 2 and 4 in each scenario.

- Experience with similar study types is important for all scenarios but carries the most weight when sponsors are choosing a provider that is not among their preferred providers. One reason why sponsors may choose to use a provider outside of their list is for a specialized study type with which their preferred providers might not have much experience. Ranking Experience with similar study types so highly is likely due to the search for providers with a specific expertise or skillset.

- Easy to work with has its highest importance ranking when a company does not have preferred providers. When a sponsor selects a company as a preferred provider, there are many decision points that can be universally agreed upon and then do not have to be discussed or negotiated at the start of every project. Furthermore, as sponsors tend to use their preferred providers again and again, efficiencies in the working relationships can be realized. However, when there are no PPAs in place, details must be hammered out anew for each project, and there may not be a pre-established working relationship. These factors may play large roles in why those with no preferred provider agreements place more importance on being Easy to work with.

For decision makers whose companies have sophisticated outsourcing processes, using peer-based data can assist in evaluating CROs. Those at larger, more sophisticated sponsor organizations often focus much of their work on a set of preferred providers but may need to consider a broader set of CROs when preferred providers are not available.

Utilizing data from peers’ experiences can arm decision makers with the knowledge to make more educated decisions throughout the outsourcing process. The data and resources are there. All you need to do is lift the blindfold.

Survey Methodology: ISR’s CRO Quality Benchmarking research is conducted annually via an online survey. For the 2017 CRO Awards data, more than 60 service providers were evaluated on over 25 different performance metrics. Research participants were recruited from biopharma and medical device companies of all sizes and are screened for decision-making influence and authority when it comes to working with CROs. Respondents evaluate only companies with which they have worked on an outsourced project within the past 18 months. This level of qualification ensures that quality ratings come from actual involvement with a business and that companies identified as leaders are backed by experiential data.