Guidelines For Launching A Successful Biotech Company

By James Smith, Ph.D., president, NanoSmart Pharmaceuticals, Inc.

Every young start-up wants to make the next blockbuster product. We analyze the market, identify a huge patient population with an unmet need, and attempt to create a product that will meet that need. It sounds feasible at first glance; after all, what better way to get a return for investors than to deliver a product with a huge, sustainable customer base that has no other alternatives for treatment?

Every young start-up wants to make the next blockbuster product. We analyze the market, identify a huge patient population with an unmet need, and attempt to create a product that will meet that need. It sounds feasible at first glance; after all, what better way to get a return for investors than to deliver a product with a huge, sustainable customer base that has no other alternatives for treatment?

Of course, this is easier said than done. Such a grandiose endeavor comes with a tremendous development cost and often a very high regulatory bar. The drug development process is inefficient, almost seemingly by design, tolerating countless dead-end iterations during the molecule discovery phase. And the larger the market, the larger the clinical trial burden will be, with ever growing numbers to reach statistical significance, particularly if the product only has a modest clinical benefit.

While this paradigm may have worked in the past for established pharma companies with deep pockets and vast research and development infrastructures, it is a recipe for disaster for a budding start-up. Time and again, young companies fall into the unfortunate trap of overextending scarce resources to develop a product for a huge market, not realizing the unrealistic burden that they have undertaken, and ultimately running out of funding before they can finish what they started.

There are various ways that entrepreneurs can improve their chances of success. The successful start-up will have a well-defined commercialization strategy that is efficient and flexible, balancing commercialization progress with innovation, and leveraging partnerships and collaborations with industry experts. With funding most commonly being so tight during product development, an efficient commercialization strategy can prove to be the difference between failure and completing the only goal that really matters: crossing the line of market approval and introducing the product to the public.

Design An Efficient And Flexible Development Plan

As desirable as it sounds, a single, straight path to market simply does not exist. Inevitably, companies will encounter challenges and roadblocks that will delay progress. The setbacks could be seemingly endless: finding the right drug profile during discovery may not happen quickly, lead candidate prospects may have unfavorable safety profiles, or the product may have other undesirable characteristics or not be stable enough to meet expected requirements. However, you can mitigate these risks through careful comprehensive planning in which multiple possible pathways to market — with their own relative risks and benefits — are mapped out and evaluated in advance. This “guided flexibility” approach allows a company to maintain a development strategy that remains efficient in the face of obstacles while capitalizing on new opportunities as they present themselves.

NanoSmart Pharmaceuticals, Inc. for example, has employed a highly flexible commercialization strategy as it takes on the challenge of developing a tumortargeting drug delivery platform. The plan to achieve regulatory approval of the platform is to reformulate an existing FDAapproved drug by enclosing it within the antibody-targeted lipid nanoparticle. NanoSmart considered various APIs with which to commercialize its platform and began formulation efforts. When the first formulation candidate presented unacceptable stability issues that were found to be inherent to the API, the company was able to continue development of the platform by elevating the priority of other APIs that exhibited more favorable biochemistry. Due to the initial design of the project and adequate contingency planning, the unanticipated flaws of the API have not substantially delayed development of the platform.

Find A Cost-Effective Regulatory Path

The regulatory path of a drug product has critical relevance in the clinical phase of development, as it directly affects the most costly aspect of commercialization: clinical trial size and length. For example, per capita Phase 3 clinical trial costs exceeded $40,000 in 2011, a staggering 70 percent increase from 2008 (Cutting Edge Information, 2011). Careful clinical trial planning is therefore crucial to the survival of the company.

Perhaps the best option to leverage existing regulatory pathways is the orphandrug pathway. Orphan indications — rare diseases that have very small patient populations with unmet medical needs — offer substantial financial incentives such as tax benefits and additional patent protection. But more importantly, the orphan pathway allows companies to tap into rapidly growing support networks that increase a company’s chance of success.

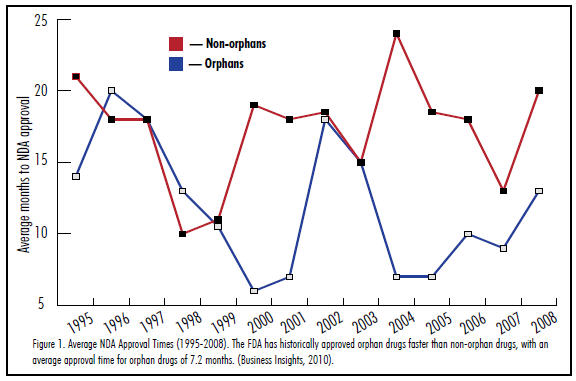

Because products developed for orphan indications benefit a patient population that has no other treatment alternatives, the FDA has been historically flexible in evaluating efficacy, allowing data collected from smaller and/or shorter trials and allowing expedited review. In fact, a 2011 study performed by NORD (National Organization for Rare Disorders) found that 66 percent of approved noncancer orphan drugs between 1983 and 2010 received FDA approval with flexible evaluation criteria. This is an attractive incentive that could reduce a product’s time-to-market. With few exceptions, the FDA has reviewed and approved orphan drugs much more quickly than non-orphan drugs (Figure 1).

The orphan-drug pathway can be strategically used to accelerate a company’s time-to-market while decreasing the overall commercialization cost both before and after FDA approval. Revenues can then be used to pursue further clinical trials to expand the drug’s indications for use with additional orphan or non-orphan indications.

Similarly, NanoSmart plans to commercialize its drug delivery platform by achieving its initial approval with a reformulation of an FDA-approved drug already approved for an existing orphan indication, such as a rare pediatric cancer. The initial approval will validate the platform’s potential to improve therapies, thereby mitigating the regulatory burden of future orphan and non-orphan filings, and facilitating licensing agreements with other pharmaceutical companies looking to extend patent life.

Balance Progress vs. Innovation

For a start-up, much of its true value lies in its intellectual property, not just the size of its potential customer base. While constant, measurable progress toward defined goals is a key element that drives investments, start-ups should also be concerned with simultaneously enhancing their valuation. Therefore, whenever practical, a company should focus on developing an IP portfolio that will facilitate additional regulatory approvals, increase future revenue potential, and extend the company’s potential beyond the life cycle of any single product. Importantly, broad intellectual property also mitigates the investor’s risk of any single failure or substantial challenge to product development. Focus on the product pipeline and continuous discovery efforts are, therefore, hallmarks of success for both start-up and established large pharma companies.

An example of this is NanoSmart’s IP expansion in the face of development challenges. NanoSmart initiated operations with a platform technology when the initial discovery phase of its targeting antibody was complete. The company is now working to use the targeted delivery system to reformulate various cancer drugs. In order to accommodate a larger array of APIs with different biochemical properties, the company innovated a novel approach to the delivery mechanism. The lessons learned from formulation challenges resulted in the expansion of the company’s intellectual property portfolio with a second platform technology, which opened up additional paths to commercialization and increased prospects for collaborative or licensing opportunities.

Leverage Partnerships

The lesson learned from countless other companies that successfully crossed the line of market approval is that development and commercialization goals are most attainable when there is a network of trustworthy, proven experts supporting the project. Generally, it is much more difficult to cultivate all the necessary expertise in-house, and so the industry is witnessing a shift toward external partnerships and collaborations. In fact, much of the industry’s focus over the past 10 years has been on developing the infrastructure, capabilities, and regulatory frameworks through external consortiums and innovation incubators. Such developments mean that new start-up companies have resources and support options that were not previously available. The collaborative environment between industry, government agencies, and academia is rapidly growing and establishing new paradigms for interactive product development. This very exciting trend is precisely why innovator companies are being increasingly seen as potential engines for advancing future pharmaceutical drug development.

A Shift Toward Rare Diseases

The pharmaceutical industry as a whole is seeing an increasing focus on rare diseases. In recent years, personalized medicine has dominated much of the industry’s focus for both large and small pharma. In fact, the proportion of all drug approvals that receive orphan indications has been steadily increasing over the past 15 years. Large companies like Novartis, Roche, and Genentech have used the orphan pathway to efficiently expand their pipelines and grow their markets.

In conclusion, product development in a start-up setting is never easy, and only a fraction of companies that attempt to commercialize their novel technologies is able to accomplish that goal. As daunting as the obstacles may be, now more than ever, the tools, resources, and industry infrastructure exist to support and guide start-up operations through the very challenging process of product development and commercialization.

In order to succeed, start-ups must be able to advance effectively and efficiently on limited funding as well as mitigate the risks inherent to the development process as much as possible. In this way, companies can maximize the potential for successful product development and give their supporters the return on investment they deserve. With the right commercialization strategy, it is possible to cross the line of market approval with a fraction of the funding that was once believed necessary.