Hiring In Biopharma — Where Are The Jobs Going Next?

By Eric Langer, president and managing partner, BioPlan Assocites, Inc.

Biopharma organizations are hanging out the long-awaited “Help Wanted” sign as they start hiring production and processing staff. After dismal waves of layoffs, budgets for hiring in production areas are up significantly this year. In fact, our 8th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production shows that the budget cutting has reversed from just three years ago, when the global industry was showing a 2.3% cut in budgets for hiring of production staff. Now, we’re seeing a dramatic upswing, and budgets for hiring are up 3.5%. This represents one of the biggest turnaround swings among the 12 budget areas we measured this year.

BioPlan Associates’ 8th annual biopharma manufacturing report aggregates responses and trends from 352 biopharmaceutical manufacturers and CMOs in 31 countries and 186 suppliers to this industry. The study covers new product needs, budget changes, capacity constraints, disposables, downstream purification, quality management, hiring issues, and others.

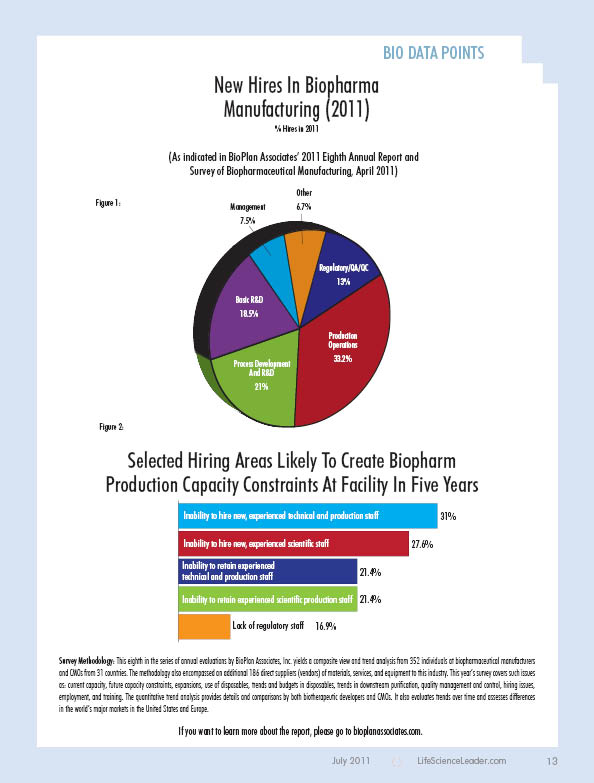

This year our study found the #1 factor creating manufacturing capacity constraints was “Inability to hire new, experienced technical and production staff.” Over 31% of companies indicated this is a problem, up from 24% last year. This suggests that budget cuts may have gone too far, and that the economic uncertainty has stabilized to the point that hiring is becoming a critical operations factor now.

Strategic Staffing Directions

Staff acquisition is the biggest budget growth area this year. And, the largest slices of the new employment pie go to production operations (33.2% vs. 34.8% last year) and process development & R&D (21% vs. 16.2% last year and 15.6% in 2009). Regulatory or QA/QC departments will account for 13% of new staff (vs. 14.8% last year and 15.8% in 2009).

This year, we are finding that companies are continuing to build their organizations, but are doing so more strategically. The focus on productivity directly ties to decisions in staffing. As the staffing spotlight continues to focus on productivity by retooling and training existing staff resources, this should serve not only to improve performance but also aid in retention of personnel.

Production Constraint Concerns Drive Hiring Focus

Figure 2 shows that hiring problems may be creating capacity problems, and perhaps that past budget cuts may have gone too far. The economic uncertainty appears to have stabilized, and hiring is becoming a critical operations factor.

The growth in the biologics sector over the past ten years has led to demand for scientists with operations and process engineering backgrounds. This demand, exacerbated by fewer applicants to these positions, is creating some concern about shortages in biopharma manufacturing and process personnel. This gap is reflected in respondents’ concerns about inability to meet capacity requirements. The enormous pressure to avoid manufacturing bottlenecks may be resulting in the budgetary (salary) increases we are seeing in the study. It is possible that these positions will become hot opportunities if the demand pressure continues to increase salaries.

This is also reflected in the study, where we asked respondents, “Which job positions at your facility are you currently finding it difficult to fill?” Topping the list was “process development professionals.” Companies want to make their processes more efficient and less expensive. So it is not surprising to see in this year’s data (as well as last year’s) that the top three most-difficult-to-fill positions are process engineers and specialists for both upstream and downstream process development. These employees are difficult to find, difficult to recruit, and difficult to retain. Salaries are reportedly higher than in other similar positions because of this shortage.

Some biopharma companies, hit by competitors’ poaching, have decided that it is a better proposition to join the bidding process than invest in training that will ultimately not pay off. This has the effect of shrinking the numbers of process engineers, relative to the demand, thus escalating the problem. It is unlikely these hiring problems will ease in the near future, especially as biosimilars come online, and developing regions such as China and India increase demand for skilled operations staff.