How A Real Estate Strategy Can Fuel A Biopharma's Growth

By Roger Humphrey

The life sciences industry is receiving record-breaking investment for new scientific innovations, making it a prime time for innovation in real estate strategies. As facility availability continues to drop, and rents rise, many leaders are seeking new ways to expand and put the infusion of investment to good use.

The life sciences industry is receiving record-breaking investment for new scientific innovations, making it a prime time for innovation in real estate strategies. As facility availability continues to drop, and rents rise, many leaders are seeking new ways to expand and put the infusion of investment to good use.

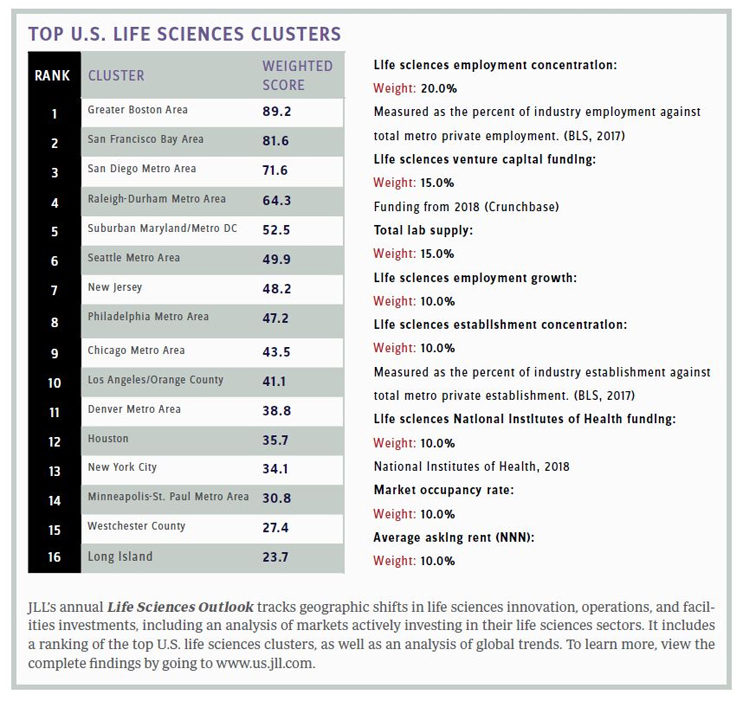

Last year, life sciences firms poured a record- breaking $179 billion into biopharmaceutical R&D in the U.S., according to JLL’s Life Sciences Outlook 2019 report. More momentum is in store, too, with pundits estimating R&D investment to grow another $34 billion by 2024.

Smart real estate strategies can help life sciences leaders tap into this momentum, even in a world where getting a new drug to market doesn’t come cheap. Big Pharma R&D returns have dropped to their lowest levels in nine years, but a state-of-the-art lab in an innovation-rich ecosystem can offset the cost of innovation — mitigating the drop in average returns.

4 WAYS REAL ESTATE CAN HELP UNLOCK INVESTMENT MOMENTUM

Where you are, and the facilities you offer, play a significant role in attracting talent, as well as supporting access to capital.

The following are key considerations in the quest for a future-friendly real estate strategy:

- Give talent what it craves. Faster, tech-fueled R&D is only possible with the right people on the job. Today’s innovators appreciate livework- play environments where they’ll rub shoulders with innovators from world-class academic research centers and tight-knit medical and pharmaceutical communities. Although pricey, markets like San Francisco and Boston are home to coveted, naturally flowing talent pools. Meanwhile, modern, satisfying facilities with next-generation lab capabilities can appeal to the bright minds who may be responsible for that next big medical breakthrough.

- When the going gets tough … the tough get creative. It’s getting tougher to find suitable space in the nation’s most desirable markets. In addition to the Big Pharma occupiers, the onset of personalized medicine has sparked the growth of industry incubators and early-stage companies making small-batch pharmaceuticals that are also scooping up space within, or near, the top clusters.

Roger Humphrey, Division President, JLL

- But skyrocketing rents needn’t keep your firm out of a desirable hub — if you get creative. Consider, for example, Philadelphia’s King of Prussia submarket, where MLP Ventures’ Discovery Labs is poised to become the nation’s largest coworking ecosystem for healthcare, life sciences, and technology-enabled companies. Once complete, the $500 million, 1.6 million-square-foot campus will comprise 12 connected buildings, including 50,000- to 125,000-square-foot range R&D spaces.

- Think outside the top-market box. Top markets can be worth the pricey rent, but only when suitable space is actually available. Right now, average vacancy in the nation’s tightest life sciences submarkets is less than 2 percent — and rents reflect the demand. Rents in San Francisco’s Mid-Peninsula area, for instance, have almost doubled from $32 to $58 per square foot since 2014.

On the bright side, other clusters are also growing fast and nurturing innovation-rich ecosystems. In Houston, for example, the number of life sciences establishments jumped 15.5 percent over the past five years, trailing only Boston and Raleigh-Durham. Denver is also well positioned to support growth, with a 14 percent vacancy rate.

TOMORROW’S LIFE SCIENCES MAP

For an industry whose lifeblood is innovation, it makes sense to bring an innovative mindset to real estate. The map of where, why, and how life sciences organizations work is evolving, with advances in real estate data and insights contributing to all-new strategic possibilities.

Great drug discovery happens when you invest in great ideas. And that’s true for real estate discovery, too.

ROGER HUMPHREY is division president, industries, at JLL. He previously worked for Merck as executive director, global real estate and IFM governance.