How Moving Up Through The Ranks Can Shape A Biotech CEO

By John Maslowski, president and CEO, Fibrocell Science, Inc.

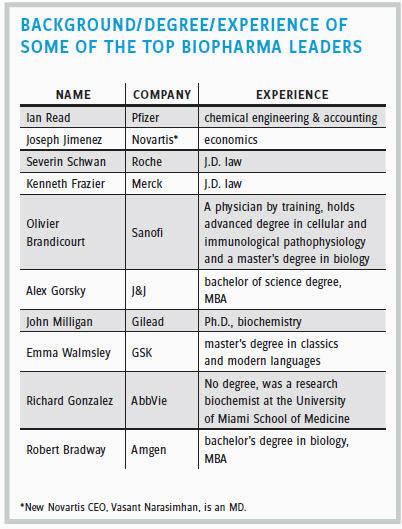

All CEOs of small, publicly traded biotechs (those with 50 employees or less) are required to wear many hats in the office every day. That’s why I believe that having a leader with a diverse background and experience in a variety of functional areas is an asset that can help guide a company to meeting its milestones. Let’s look at some of the various areas of expertise that can help create a more diverse C-suite executive.

All CEOs of small, publicly traded biotechs (those with 50 employees or less) are required to wear many hats in the office every day. That’s why I believe that having a leader with a diverse background and experience in a variety of functional areas is an asset that can help guide a company to meeting its milestones. Let’s look at some of the various areas of expertise that can help create a more diverse C-suite executive.

QUALITY ASSURANCE

Working in quality assurance (QA) during an earlier phase in my career taught me how a background in this area can be advantageous to biotech CEOs. It helps, for example, when a company is mapping its product development strategies, leading up to a potential FDA approval and the processes supporting it. Specifically, this can involve advising on such areas as auditing and cleanroom design and in optimizing and scaling up the manufacturing process in anticipation of commercialization of a drug. Oftentimes, the challenge involves ensuring goals are met within strict time frames and on tight budgets — a challenge familiar to anyone who has a working background in QA.

On a related note, a QA background can instill a CEO with an enhanced ability to manage expectations regarding hitting a company’s clinical and regulatory milestones. QA is a science, after all, and doing science — as working researchers can attest — is sometimes hard and unpredictable. In providing periodic reports of the company’s progress to the street, it is vital for the CEO not to overpromise. Having firsthand QA experience, complete with knowledge of the challenges and setbacks this endeavor can entail, provides a sense of what is possible within a given time frame. Thus, there is less of a temptation to exaggerate how much can be accomplished in the next quarter.

PATIENT ADVOCACY

Having also had previous experience with patient advocacy, the value of this activity to a CEO’s background is clear to me, as well. Working with the heads of various advocacy groups (in my case, those focusing on a rare skin disorder) involves being introduced to patients and also becoming familiar with their expectations (as well as those of their families) about potential treatments. A CEO of a small biotech can likely personally meet with these groups on a regular basis rather than rely on a separate director of advocacy initiatives.

Patient advocacy experience also is a feather in the cap of someone who moves into the role of a biotech CEO because it means these groups know they have a friend at the very top of the organization who understands their needs. Some CEOs without this experience might appear less approachable to the heads of advocacy groups. In contrast, when an advocacy group has established a clear line of communication to CEOs — being able to email and call them, for example — there is an additional bond between the company and these external groups that helps each work in tandem more efficiently. A patient advocate CEO is a valuable humanizing factor.

INVESTOR RELATIONS

Another rung in my personal ladder to CEO was serving as head of operations at my company, which in turn, served as a conduit that exposed me to the investment community. For any biotech CEO, having previous experience interacting with investors is a tremendous advantage. This experience can come in the form of attending bank/investor meetings, industry talks, nondeal and deal road shows, as well as being involved in financial raises for the company. And because the investment community is becoming so well-educated these days — even going so far as to recruit their own M.D.s/Ph.D.s to ask questions — it is always a plus for the CEO to have some scientific background, as well, when dealing with investors.

Another rung in my personal ladder to CEO was serving as head of operations at my company, which in turn, served as a conduit that exposed me to the investment community. For any biotech CEO, having previous experience interacting with investors is a tremendous advantage. This experience can come in the form of attending bank/investor meetings, industry talks, nondeal and deal road shows, as well as being involved in financial raises for the company. And because the investment community is becoming so well-educated these days — even going so far as to recruit their own M.D.s/Ph.D.s to ask questions — it is always a plus for the CEO to have some scientific background, as well, when dealing with investors.

Being able to view milestones and other expectations from the perspective of investors can give a CEO a leg up when dealing with them. When you are helping to raise money for your company, you really get a taste of how the financial culture works. When someone with this type of experience reaches the CEO’s chair, it can help them focus on how activities are conducted internally, keep clinical trials moving efficiently, and maintain a level of discipline that maximizes hitting milestones in a timely fashion. A CEO without extensive investor relations experience should not shy away from enlisting the help of financial professionals to bolster this task.

TEAM BUILDING

Finally, any CEO who has risen through a biotech company’s ranks is bound to develop a stronger sense of what makes the entire company — viewed as a set of teams working in tandem — operate well. Particularly with smaller biotechs, which run relatively lean compared to larger companies and have fewer levels of management between workers and C-suite, it is beneficial for the CEO to interact directly with the entire staff on a regular basis. Having experience leading individual teams, such as those working on research and clinical study design, can create a more practical management style for a CEO.

Having that experience also means it will be easier to manage teams tasked with achieving goals related to manufacturing and production. There is a converse benefit as well: Current members of these teams, being aware that the CEO was once part of the rank and file, may be more willing to appreciate their efforts to facilitate their tasks. This “been there, done that” factor works wonders for the CEO when meeting one-on-one with workers as they discuss their concerns and seek advice in turn. Overall, this lends itself to a greater sense of camaraderie and sense of purpose.

CEOs who are able to leverage their background experience in various areas, as discussed here, are in a good position to move their company forward. The wider the experience they can draw on, the stronger they and their business ultimately become.