Innovation In Alternative Chromatography

By Eric Langer, president and managing partner, BioPlan Associates, Inc.

For years, many biopharma industry manufacturers have said the use of Protein A chromatography for purifying biologics (a mainstay process) isn’t broken, so why fix it? However, Protein A media remains a major thorn in the side of operators due to its high cost, as well as the cost of recycling and cleaning/ validation. Alternative technologies for purification of antibodies have been and are being developed with longer lifetimes and therefore, lower cost-per-unit of protein produced.

For years, many biopharma industry manufacturers have said the use of Protein A chromatography for purifying biologics (a mainstay process) isn’t broken, so why fix it? However, Protein A media remains a major thorn in the side of operators due to its high cost, as well as the cost of recycling and cleaning/ validation. Alternative technologies for purification of antibodies have been and are being developed with longer lifetimes and therefore, lower cost-per-unit of protein produced.

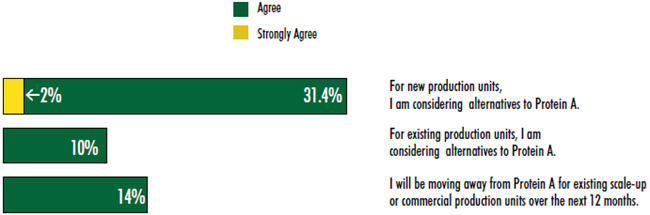

The industry continues to show significant interest in alternatives to Protein A this year, although that interest appears to have waned somewhat from prior years. Results from our 10th Annual Report and Survey of Biopharmaceutical Manufacturers (see www. bioplanassociates.com/10th) indicate that 33 percent of the industry is considering alternatives to Protein A for new production units. That’s a significant step back from a range of 51 percent to 61 percent expressing such an interest in the four previous years.

Furthermore, this year 1 in 10 respondents “agreed” or “strongly agreed” that they are considering alternatives to Protein A for existing production units. Consideration of alternatives for existing production has been on a decline for four consecutive years, down from 27.1 percent expressing interest in 2009.

While fewer respondents this year claimed active consideration of alternatives, the proportion planning to move away from Protein A for existing scale-up or commercial production units over the next 12 months has remained steady. This year, 14 percent of respondents indicated that to be the case, double last year’s percentage, but more in line with results from 2011 (15 percent) and 2009 (12 percent).

It should be noted that, this year, very few noted that they “strongly agree” with the statements. So, respondents don’t appear to have very committed views in this area. As downstream operations improve, the industry is recognizing that, while it is open to considering Protein A alternatives, this isn’t a burning topic. In addition, few viable alternatives are currently available or at least proven and documented to be cost-effective at large scale. Thus, most of the industry has not yet formed strong opinions and are sticking with Protein A products for lack of better, cheaper alternatives. The prevailing opinion, then, seems to be that Protein A works well enough.

Many Have Interest; Few Make The Switch

The gap between interest and behavior when it comes to Protein A alternatives is evident in other results from this year’s study. In our in-depth exploration of downstream operations, we asked respondents to indicate the various activities their organizations have engaged in to improve downstream purification operations.

Tellingly, while about one-quarter (23.8 percent) of the respondents claimed to have investigated alternatives to Protein A, just 4.8 percent said they had actually switched to alternatives. That follows a pattern seen in past years: in 2012, 21 percent indicated they had investigated alternatives, while 10 percent had made the switch; in 2011, the figures were 31 percent and 11 percent, respectively.

Aside from demonstrating that far fewer respondents switch to Protein A alternatives than investigate them, the results also show that the percentage who have switched to alternatives is in the midst of a multiyear decline.

That may not change soon. That’s because CMOs appear to have less interest in switching to Protein A alternatives than innovators. This year, while a relatively equal percentage explored alternatives (23 percent for biomanufacturers, 25 percent for CMOs), no CMOs reported switching, compared to 5 percent of biomanufacturers who did so. Given that other results from our study suggest that CMOs tend to be leading indicators of future innovator trends, there’s reason to believe that developers won’t be flocking to alternatives anytime soon.

There are also some fascinating differences when sorting the responses into three geographic regions: the United States, Western Europe, and the rest of the world (ROW). Among U.S. respondents, one-quarter claimed to have investigated alternatives to Protein A in order to improve downstream operations, although none switched to alternatives. By contrast, while fewer European respondents explored alternatives (14 percent), a significant 7 percent switched. And finally, respondents from the rest of the world were both most likely to have investigated alternatives to Protein A (30 percent) and to have switched to alternatives to Protein A (15 percent).

This may be due to the construction of newer ROW facilities that have enabled them to consider alternatives to legacy purification processes. Or, perhaps, ROW respondents simply have less need or concern regarding meeting major market cGMP and major market regulatory standards, with Protein A long the standard for initial mAb capture, which has allowed them to more quickly consider and adopt alternatives. But contrary to this finding, overall, ROW facilities are doing much less investigation of bottlenecks and adopting of alternative downstream technologies.

What’s To Come?

This year, we continue to see a decrease in the percentage of biomanufacturers indicating that they expect to move away from Protein A. Thus, the current dominance of Protein A products for initial mAb capture can be expected to continue. We can expect the market for Protein A products to remain stable in the nearterm, other than shifts and increases associated with new major commercial products coming online.

Those products also may take some time to develop. Perhaps in response to lessening demand on the part of end users, fewer suppliers are working on Protein A alternatives, according to our study. Indeed, only 15 percent of supplier respondents cited “chromatography, alternatives to Protein A” as a top-new technology or new product development area their company is working on in biomanufacturing. That figure is down from 19 percent last year and 23 percent the year before. What’s more, the $12,000 to $15,000 per-liter cost for Protein A and its recyclability makes disposable options for current products unlikely.

It’s worth noting that the introduction and adoption of recombinant Protein A products in recent years in place of legacy nonrecombinant Protein A products may be contributing to a less perceived need to adopt Protein A alternatives. There’s reason to believe that the industry will continue to seek alternatives to Protein A: A recent survey we conducted among a panel of hundreds of biotechnology experts found alternatives to Protein A emerging as a key micro-trend to watch. In the end, though, it seems simply that while many firms would like to avoid the high cost of Protein A affinity resin, most are reluctant to make changes to existing processes, particularly as there continue to be few, if any, proven alternatives.

Figure 1: Issues Regarding Protein A In Downstream Purification

Survey Methodology: The 2013 Tenth Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production yields a composite view and trend analysis from over 300 responsible individuals at biopharmaceutical manufacturers and CMOs in 29 countries. The methodology included over 150 direct suppliers of materials, services, and equipment to this industry. This year’s study covers such issues as: new product needs, facility budget changes, current capacity, future capacity constraints, expansions, use of disposables, budgets in disposables, trends in downstream purification, quality management and control, hiring issues, and employment. The quantitative trend analysis provides details and comparisons of production by biotherapeutic developers and CMOs. It also evaluates trends over time and assesses differences in the world’s major markets in the U.S. and Europe.

If you want to learn more about the report, please go to bioplanassociates.com.