Innovation In Assays And Analytical Methods Urgently Needed

By Eric Langer, president and managing partner, BioPlan Associates, Inc.

Industry Continues To Seek Better Bioassays

Biomanufacturers are increasingly demanding better analytical methods development as the industry expands its need to provide better metrics regarding process monitoring, comparability of products, quality, and a number of other critical areas associated with process improvement. In fact, when we surveyed the 450 global subject matter experts and senior participants on our Biotechnology Industry Council to identify the critical factors and trends they expect to be addressed over the coming year, 24% pointed to demands for better analytical methods.

Biomanufacturers are increasingly demanding better analytical methods development as the industry expands its need to provide better metrics regarding process monitoring, comparability of products, quality, and a number of other critical areas associated with process improvement. In fact, when we surveyed the 450 global subject matter experts and senior participants on our Biotechnology Industry Council to identify the critical factors and trends they expect to be addressed over the coming year, 24% pointed to demands for better analytical methods.

To stay on top of the emerging trends in this important area, we also include this topic in our annual study of biomanufacturing, asking hundreds of global biomanufacturers from around the world to identify which assays are most critical and where improved testing methods are most urgently needed for biomanufacturing.

Improved Testing Methods For Bioassays

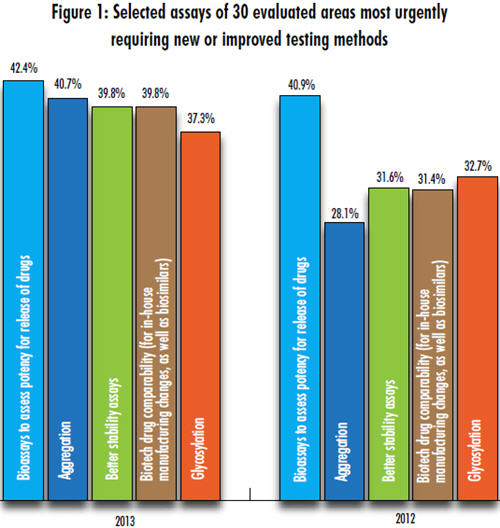

This year, preliminary results from our 10th Annual Report and Survey of Biopharmaceutical Manufacturers, due for release in April, show that the industry continues to look for improved testing methods for bioassays. We evaluated 30 different assay areas and found that assessment of potency for release of drugs topped the list again this year, with 42% of respondents to date indicating this to be an assay area urgently in need of innovation (see Fig. 1). This was also the leading area in need of innovation in last year’s study, cited by 41% of respondents.

Next on the list this year is aggregation, indicated to be in serious need of testing innovation by 40% of respondents, a big increase from last year’s 28%. Roughly 4 in 10 respondents also see the need for better testing in stability assays and biotech drug comparability (for inhouse manufacturing changes as well as biosimilars), each at around 39% of respondents and each up from around 32% in 2012.

Rounding out the top five this year is glycosylation, an area which 37% of our survey respondents indicated to be urgently in need of new or improved testing methods, up from 33% last year.

Other trends we see developing this year (noting that our data remains preliminary) include:

- host cell-protein assays, which 36% of respondents see as urgently needing new or improved testing methods, up from 25% last year

- bioassays of proteins with multiple functional domains, also up this year

- bioassays for ADC (antibody drug conjugates) molecules showing an increase in cell viability, down somewhat in 2013

- precalibrated disposable sensors, down in 2013.

Qualitative Analysis of Innovation from the Experts

When we asked our expert panel about this year’s critical trends, those citing analytical methods mentioned a variety of micro trends, including high-throughput assays for high-level expression, therapeutic efficacy, improved high throughput, high-resolution glycosylation analysis, and better characterization tools for upstream analysis. The following are some qualitative analyses from respondents, diving deeper into the critical trends that will shape innovation in this all-important area.

According to a manager of technology development at a large biopharma company, developing better characterization tools for upstream analysis is critical. “The importance of in-process analytics means pushing the analysis of key product qualities further upstream in the process as opposed to relying primarily on end-product testing,” the manager said. “This entails higherend characterization tools such as mass spectrometry that provide multiple levels of information. The standardization and qualification of these information-rich assays are key to implementation of these assays for supporting process decisions.”

Another senior scientist and group leader at a global biopharma noted that high-throughput assays that assess IgG (Immunoglobulin G) clones for expression levels and therapeutic efficacy are critical. “The overriding goal is to identify efficacious drug candidates. However, there are quite a few occasions where functionally selected candidate monoclonal IgG clones would not to be suitable for manufacturing,” the scientist said. Ideally, assays should be developed to show this earlier, rather than after large investments of time and money. What is needed is a simple assay run during the early stages to guide the suitability of individual IgG clones for large-scale manufacturing. A number of industry experts believe there is substantial need for convenient high throughput assays that allow assessment of physicochemical properties of individual IgG clones for high-level expression to evaluate therapeutic efficacy.

With at least ¼ of our survey respondents to date seeing an urgent need for new or improved testing methods across eight assay areas, it’s clear that significant attention from an innovation angle is needed. Yet innovation in assay services may still be a few years away.

In coming articles, we will discuss how suppliers and assay innovators are focusing (or not) on new technologies. For example, last year, only about 1 in 10 vendors said they were working on new technologies related to testing and assay services, whether for impurities detection, raw materials testing, glycosylation analysis/characterization, etc. We will be discussing whether assay innovators this year plan to take on a new commitment to improved testing and assay services. What we do know is that the industry is definitely seeking innovation, and as our preliminary study results show, that interest does not appear to be waning.

Survey Methodology: The 2013 Tenth Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production is an evaluation by BioPlan Associates, Inc. that yields a composite view of and trend analysis from 300 to 400 responsible individuals at biopharmaceutical manufacturers and CMOs in 29 countries. The respondents also include more than 185 direct suppliers of materials, services, and equipment to this industry. Each year the study covers issues including new product needs, facility budget changes, current capacity, future capacity constraints, expansions, use of disposables, trends and budgets in disposables, trends in downstream purification, quality management and control, hiring, and employment. The quantitative trend analysis provides details and comparisons of production by biotherapeutic developers and CMOs. It also evaluates trends over time and assesses differences in the world’s major markets in the U.S. and Europe.

If you want to learn more about the report, please go to bioplanassociates.com.