Innovation In Stainless-Steel Bioprocessing

By Eric Langer (left), president and managing partner, and Ronald Rader, senior director, technical research, BioPlan Associates, Inc.

Anyone in the biopharmaceutical industry knows that one of the most active areas of innovation in biopharmaceutical manufacturing involves advances in single-use (disposable) technology. This involves bioprocessing equipment composed of plastics rather than traditional stainless steel. Single-use devices come presterilized, ready for use and disposal after single use. In contrast, bioprocessing classically has been done using fixed, stainless-steel equipment that requires in-house cleaning and sterilization prior to each reuse. Stainless-steel systems cost more than singleuse and take longer to build. Although improvements in stainless-steel-based bioprocessing equipment have been less frequent, there will continue to be significant advances in stainless-steel-based bioprocessing.

Anyone in the biopharmaceutical industry knows that one of the most active areas of innovation in biopharmaceutical manufacturing involves advances in single-use (disposable) technology. This involves bioprocessing equipment composed of plastics rather than traditional stainless steel. Single-use devices come presterilized, ready for use and disposal after single use. In contrast, bioprocessing classically has been done using fixed, stainless-steel equipment that requires in-house cleaning and sterilization prior to each reuse. Stainless-steel systems cost more than singleuse and take longer to build. Although improvements in stainless-steel-based bioprocessing equipment have been less frequent, there will continue to be significant advances in stainless-steel-based bioprocessing.

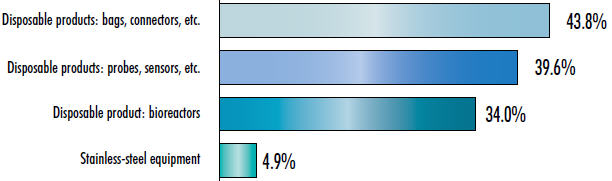

During the past 10 years, the BioPlan annual survey of biopharmaceutical manufacturers has shown that biomanufacturers have been focused on single-use devices, and demand for new stainless-steel product innovations has lagged. Figure 1 below shows the differences in demand for innovation by end users for selected singleuse devices compared with stainless steel. When asked in what areas (21 were listed) suppliers should concentrate their product development efforts, stainless-steel equipment ranked dead last at 4.9 percent.

Stainless Is Here To Stay

Despite this lack of industry interest in new and better stainless-steel systems, they are not likely to be replaced by single-use plastic systems. For example, single-use systems will probably never be as cost-effective at the largest manufacturing scales, such as for blockbuster antibody manufacture.

Based on economics, most companies, including those using exclusively single-use devices for development, convert in later stages of development to stainless steel for cGMP commercial manufacturing. The BioPlan annual survey also shows that stainless-steel facilities currently dominate larger-scale and commercialproduct manufacture, while adoption of single-use systems remains negligible at larger scales. Currently, about 85 percent of those surveyed report manufacturing in stainless steel, and over 75 percent expressed a preference for stainless steel for new commercial manufacturing facilities. In contrast, single-use bioprocessing systems now dominate manufacturing at smaller scales, for R&D and early trials, with about two-thirds or more of new bioprocessing systems at these scales being single-use. The benefits (e.g. flexibility) that single-use provides have yet to surpass the overall economies of scale and lower manufacturing costs of stainless-steel systems used in larger commercial manufacturing. However, in comparison with upstream bioprocessing (e.g. bioreactors), downstream bioprocessing innovations (e.g. chromatography) have been fewer and less significant, with much less adoption of single-use equipment.

Figure 1: Selected New Product Development Areas Of Interest

Top Areas Suppliers Must Focus Development Efforts On

Stainless Steel Is Tried And True

Stainless is a fully mature technology platform and remains more cost-effective versus single-use for commercial product manufacture (where productivity is most important, and flexibility and related changes are less significant). Despite rapid adoption of single-use systems at smaller scales, use of stainless steel is and will continue to grow, just not as rapidly. Even 10 years from now, and perhaps longer, stainless steel will remain the dominant commercial bioprocessing platform, with single-use adoption for commercial manufacture continuing to ramp up.

In fact, most of the largest facilities — built in the 1980s and 1990s and commonly described with terms such as “legacy” or “dinosaurs” — are still in use and overwhelmingly provide most of the world’s biopharmaceutical manufacturing capacity.

Stainless-steel bioprocessing equipment, especially for commercial-scale manufacture, has changed little in recent decades. And until recently, most of the innovation has come from the processing performed in the stainless equipment. But stainless equipment manufacturers continue to innovate, and indications are that there will be increasing incremental improvements. For example, according to Andrew Powell, VP and GM at CRANE CPE, innovation in stainless steel bioprocessing is a primary focus. “At Saunders, we recently released our Stainless Steel S360 actuator range, and we’re investing heavily in new product innovation. In the near future, I would expect to see even more substantial improvements in processes using stainless equipment.”

These improvements are needed, as most of the largest stainless-steel facilities are operating below capacity. Some are being converted to more adaptable multiuse facilities. In many cases, this involves radical innovation in business practices, with many of the largest and most established manufacturers now offering CMO services (e.g. GlaxoSmithKline) or concluding manufacturing agreements with other companies (e.g. MedImmune/ AstraZeneca manufacturing for Merck & Co). Thus, innovations continue to drive expanded use of stainless steel.

Survey Methodology: The BioPlan annual survey of biopharmaceutical manufacturers yields a composite view and trend analysis from over 300 responsible individuals at biopharmaceutical manufacturers and CMOs in 29 countries. The methodology included over 150 direct suppliers of materials, services, and equipment to this industry. This year’s study covers such issues as: new product needs, facility budget changes, current capacity, future capacity constraints, expansions, use of disposables, budgets in disposables, trends in downstream purification, quality management and control, hiring issues, and employment. The quantitative trend analysis provides details and comparisons of production by biotherapeutic developers and CMOs. It also evaluates trends over time and assesses differences in the world’s major markets in the U.S. and Europe.

If you want to learn more about the report, please go to bioplanassociates.com.

Major Technological Trends Driving Innovations In Stainless-Steel Bioprocessing:

Higher titers: Better cell lines and expression systems continue to increase yield, making it possible to specify stainless-steel equipment at smaller scale.

Sensors: There are not only few but sometimes inadequate sensors for most relevant analytes for single-use applications. Those available are primarily for use with stainless-steel systems. So, stainless-steel systems have clear advantages in terms of providing process data.

Automation/process control: Most stainless-steel facilities now have state-of-the-art, real-time process monitoring and control systems. These systems, combined with more and better sensors, PAT (process analytical technology), and other efforts to make optimal use of process data, enable better control and documentation of bioprocessing.

Perfusion: Perfusion (i.e. involving retaining higher levels of cells and expressed products in bioreactors using filter pumps) or other methods such as centrifugation enable the use of even smaller bioreactors. Perfusion devices are increasingly being adopted and added to many stainless-steel facilities.

Hybrid systems: Many stainless-steel facilities are slowly adapting single-use equipment into their existing facilities. This involves singleuse equipment where it provides significant or needed advantages over stainless steel, for example, single-use membrane filters. This will require specialized compatibility innovations.

Business models: As yields go up, many companies with large, in-place stainless-steel facilities and unused capacity are offering manufacturing services to other companies. This is a radical change for some companies. Relatively few stainless-steel facilities have yet to be mothballed or dismantled, with most still in use.