Is Innovation In Chromatography Losing Steam?

By Eric Langer, president and managing partner, BioPlan Associates, Inc.

The biopharmaceutical industry continues to thrive on innovation, new technologies, and product developments that drive efficiencies in a globally competitive market. For several years, BioPlan Associates has measured the industry’s attitudes toward new product development, identifying trends in the areas most sought-after by end users and paid the most attention to by vendors.

The biopharmaceutical industry continues to thrive on innovation, new technologies, and product developments that drive efficiencies in a globally competitive market. For several years, BioPlan Associates has measured the industry’s attitudes toward new product development, identifying trends in the areas most sought-after by end users and paid the most attention to by vendors.

Preliminary data from our 10th Annual Report and Survey of Biopharmaceutical Manufacturers, to be released in April, shows that many new product development areas of interest (i.e. where end users want suppliers to focus development efforts for new technologies) have gone unchanged over the past few years. However, one area sticks out in the results: chromatography products for downstream processing. Last year, of the 21 new product development areas we identified, chromatography products ranked third in interest by end users (32.2%). The previous year, they ranked fifth on the list (29.7%), while in 2010 they were second (36.7%).

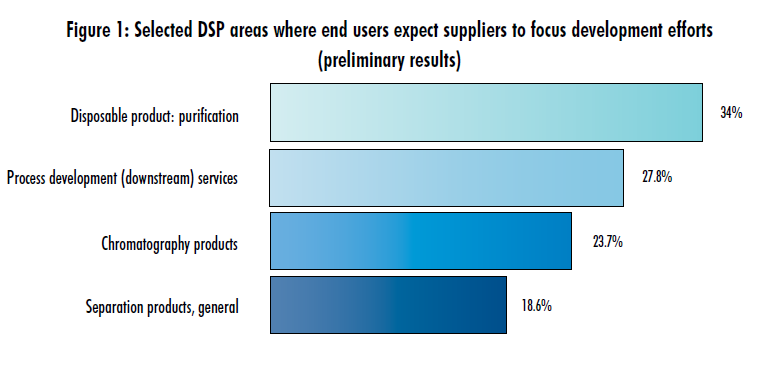

This year, though, among respondents who have currently completed the survey, chromatography products rank as the ninth most-critical area of interest for new product development, cited by 23.7% of respondents (Figure 1). This may be an indication that the pains and bottlenecks involved in current downstream bioprocessing (DSP) continue to moderate. Biopharmaceutical manufacturers are continuing to streamline their DSP operations. And while the need for better solutions continues, the pain appears to be less acute.

Suppliers Less Enthusiastic About Chromatography Innovation

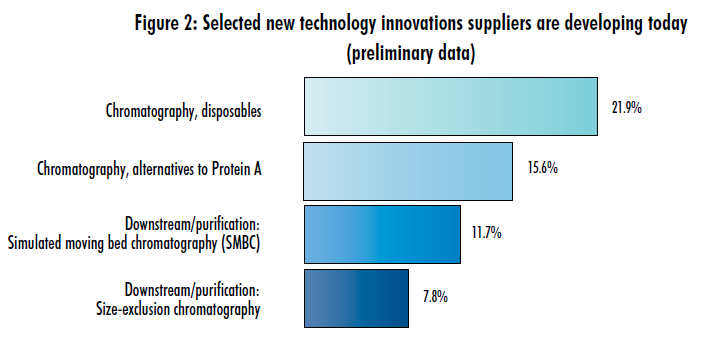

To some extent, the decreased level of interest paid to chromatography innovation among vendors in separate, preliminary results this year may be due to the decreased interest in broad DSP new technologies among end users. This year, we also asked industry suppliers to identify which of 40 different new technologies or new product development areas their companies are working on (Figure 2). Nearly 22% of supplier respondents to date said their companies are working on disposable chromatography (ranking 12th on the list), and 15.6% noted work on chromatography alternatives to protein A.

Our preliminary data appears to be following a downward trend. Looking first at vendor developments for disposable chromatography, the respondents indicating work in this area represent a step down from 2012’s results (ranking #5 on the list), but an ever bigger drop from 2011’s results (ranking #3). Likewise, alternatives to protein A have followed a similar pattern (Figure 2): The 15.6% of respondents from our preliminary data this year is down from 19.2% last year (#9) and 23.4% the year before (#9).

In comparison, the preliminary data we have received on suppliers’ new product development activities shows more variability from previous years. For example, this year, innovation appears to be greater in cell-line optimization and animal-free media components, and there appears to be less interest in disposable bioreactors. It is possible that the numbers will smooth out as further responses come in. Nevertheless, the data appears to indicate a multiyear trend where suppliers are responding to lower demand from end users.

Chromatography Innovation on Horizon

There may be various explanations for the apparent drop in interest in chromatography innovation by both manufacturers and suppliers. In recent years, advances in upstream expression improvements have not been met with capacity improvements in chromatography. That has not changed for several years now and appears to remain the status quo for the time being.

That’s particularly disconcerting for biomanufacturers struggling with capacity constraint issues. In last year’s 9th Annual Report and Survey of Biopharmaceutical Manufacturers, we found that chromatography steps are the chief contributor to capacity constraints — more so than depth filtration or ultrafiltration steps. Moreover, more than half of those experiencing capacity constraints as a result of chromatography steps said those constraints were “moderate” or higher. In all, roughly 1 in 6 respondents said that chromatography column issues were contributing to either significant or severe issues.

Still, it may be simply that while chromatography problems remain, these issues have leveled off, and the industry has learned to “live with it.” The percentage of the industry experiencing at least “significant” constraints last year on account of chromatography steps was, after all, down slightly from 21.6% in 2009 and 20.2% in 2008. And since innovation tends to be forward- rather than backward-looking, chromatography innovation may be falling off the industry’s radar because capacity issues tied to chromatography steps aren’t getting measurably worse.