Know Your Customer: Strategic Considerations for AI-Powered Provider Segmentation

By Robert Broadnax, Eddie Li, and Brian Carpenter

Over the past decade, advances in drug discovery and clinical development have led to a rise in the number of approved therapies, resulting in an increasingly competitive marketplace. These evolving dynamics highlight the importance of understanding one’s healthcare provider (HCP) customer base for a given therapy and how to effectively engage with the customer to achieve maximum commercial success.

Segmentation is a strategic exercise in which the customer base is divided into distinct groups of HCPs with similar needs, characteristics, demographics, behaviors, attitudes, and underlying motivations, and serves as the cornerstone for promotional targeting and engagement to customers. In a healthcare system with highly diverse patients, multiple treatment options, and preferences compounded with ever-changing competitive environments, segmentation is essential to create a competitive advantage, tailor your promotional strategy, and allocate your resources efficiently.

To maximize the ability to identify high-value customer segments (i.e., those with the greatest market potential and expected brand performance), pharmaceutical and biotech companies should construct a strategic segmentation solution that characterizes how the behaviors and attitudes of the customers are linked to brand receptivity. The development of a segmentation solution ideally: (1) leverages a strategic framework to guide exploration of behavioral and attitudinal variables; (2) utilizes secondary data sources and primary market research to build a comprehensive HCP profile database; and (3) employs rigorous statistical and AI-powered analyses to support the definition of segmentation variables to construct the segmentation solution. In addition, the timing of the segmentation exercise is essential to ensure launch success or grow brand performance. This article focuses on best practices around these key considerations in developing a strategic customer segmentation solution in the pharmaceutical industry.

Leveraging a Strategic Framework to Guide the Segmentation Exercise and Achieve Commercial Goals

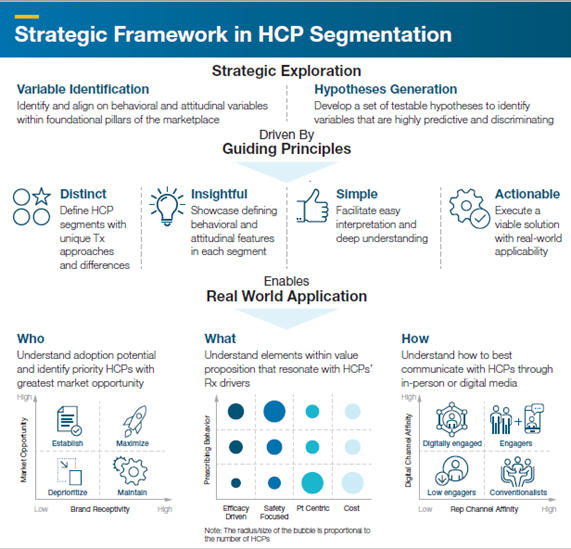

Initial steps in segmentation involve defining the potential variables that could drive meaningful differences among distinct HCP groups, and then systematically outlining a comprehensive set of research hypotheses to test and identify predictive, discriminating variables. We propose the following framework to serve as the blueprint for a segmentation exercise:

- Shaping the identification and exploration of key behavioral and attitudinal variables within foundational pillars of the market,

- Ensuring the segmentation is guided by strategic goals, and

- Enabling real-world applications to understand who the priority customers are, what factors motivate them to prescribe a given product, and how to best engage with them. (See Figure 1.)

Foundational market pillars encompass specific dimensions of HCPs’ background and management approach, including: HCP/practice demographics; current management and treatment goals; product choice drivers, new product adoption, and future management; and emerging factors and macrotrends in the disease area. Additional considerations such as digital and representative channel affinity, frequency of field force interactions, and KOL activities should be incorporated as supplementary background and preference characteristics. Once potential segmentation variables are defined, research hypotheses should be systematically outlined against behavioral and attitudinal variables, laying the foundation to collect and assess outputs in research and available secondary data, testing the relationships among variables, and identifying those that have significant predictive capacity to distinguish among distinct groups of HCPs with similar behaviors and attitudes.

The end goals are key to the strategic framework and need to be kept in mind throughout the exercise to ensure the segmentation solution is easy to interpret and implement in practice. Four attributes define the ideal segmentation solution:

- Distinct: Each HCP segment is unique and differentiated from the others according to one or more characteristic variables (e.g., segmenting or profiling).

- Insightful: The solution provides a deep understanding and thorough characterization of the underlying behaviors, attitudes, and motivations for each HCP segment.

- Simple: The solution is easy for the field force to understand and apply when interacting with the customer base.

- Actionable: The solution facilitates real-world applicability to undertake marketing endeavors that support the brand launch or growth strategy.

Such a segmentation solution enables companies to: (1) take a systematic and targeted approach for customer engagement based on market potential and brand receptivity (i.e., identify the ‘Who’); (2) tailor the narrative when engaging with customers based on prescribing behavior and how that relates to attitudinal drivers and demographics (i.e., understand the ‘What’); and (3) identify the appropriate channel(s) to engage with customers based on rep and digital channel affinity (i.e., determine the ‘How’).

Figure 1: CRA’s strategic framework to develop a robust HCP segmentation solution

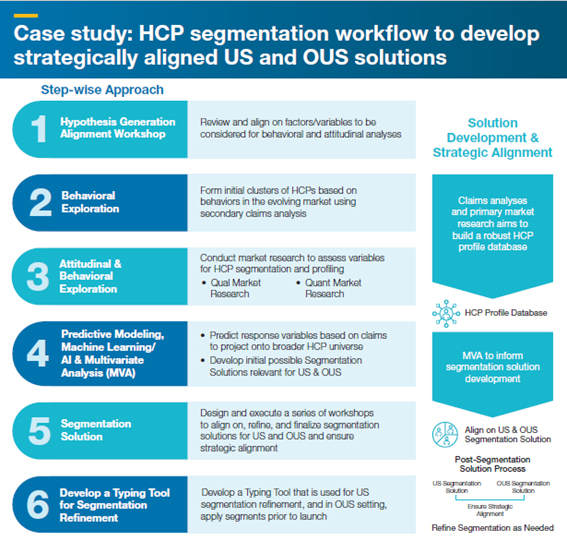

Case Study: The Power of Combining Real-world Data, AI, and Primary Market Research

CRA partnered with our client to develop a robust HCP segmentation solution for a first-in-class therapeutic using analytics and innovative qualitative and quantitative primary market research methodologies. We were able to develop a comprehensive dataset and identify key differences in metrics to determine the highly discriminating variables leading to a segmentation solution. Our approach is outlined in Figure 2 which delineates the step-by-step process taken to develop strategically-aligned U.S. and outside of the U.S. (OUS) segmentation solutions by combining analytics with behavioral and attitudinal components.

Figure 2: CRA’s process to develop strategic segmentation solutions

In this case study, CRA assisted our client to validate behaviors informed by claims analytics to uncover the underlying rationale in HCPs’ behavior and attitudes through primary market research. In executing primary research, approaches such as projective techniques and heuristic motivators (e.g., cognitive and affective biases in medicine) can elucidate HCPs’ rationales with greater freedom than direct questioning. These primary research outputs were aggregated with applicable data sources to develop a comprehensive HCP profile database, in which relevant data sources involved patient-level claims data, affiliation data, early adopter data, KOL/influence data, available omni-channel data, platform preference for nonpersonal and personal promotion, frequency and receptivity to promotional interactions, and call frequency data.

We then identified highly discriminating and predictive variables through rigorous multivariate analyses on the HCP profile database. This process informed the design of strategically-aligned U.S. and OUS segmentation solutions, while leveraging predictive modeling and artificial intelligence/machine learning-based models trained on claims analytics and market research outputs to predict the likelihood of adoption/brand receptivity. The benefit of using this AI-based approach enabled our pharmaceutical client to identify high-value customer segments. Given the high number of variables and HCPs at issue, multiple AI/ML models, including Neural Networks, XGBoost, Random Forest, etc., were explored and compared to determine the best model with optimal predictive power.

While this case study focuses on HCP segmentation to support a launch, we also deploy these AI/ML methodologies for in-line therapies to accelerate growth; for example, an HCP profile database leveraging multiple waves of awareness, trial, and usage (ATU) market research data can be used for predictive modeling when there is sufficient wave-over-wave sample overlap.

Segmentation Solutions Must Be Strategically Connected

In developing an HCP segmentation, durability and versatility of the solution is important to ensure that it not only captures the state of the market as it exists today, but is also reflective of a future state of the market on a relevant time horizon. A solution reflective of the current market state enables the identification of priority segments and an understanding of their relative size. In turn, this informs the level and corresponding effort in market shaping needed to maximize the opportunity for an asset. One such example is when the unmet need is not yet fully realized and/or appreciated but is increasingly acknowledged. By incorporating emerging factors and relevant macrotrends as key variables in the solution, the segmentation intrinsically reflects a future-facing state in addition to the current market; this deliberate construction ensures that segments are driven by key differences in prospective outputs that relate to ongoing market evolutions. Moreover, accounting for forward-looking behaviors and attitudes assures that the segmentation solution will remain actionable and reflective of the real world for an extended period of time, which is particularly important for pipeline assets approaching launch. Established solutions can be adaptive and remain relevant over time, with simple changes in membership through the development of a robust typing tool to accompany the field force upon detailing interactions.

Versatility is not only characterized by temporal durability, but also takes into consideration the geographic scope in which segmentation solution(s) are applicable, ensuring a unified approach in downstream market research, targeting, and messaging. Solutions are carefully developed and tailored to reflect the nuanced elements of each market, which is highly important to account for market-specific unmet needs, current and future landscapes, other market nuances, and market access ecosystems. While reflective of market-specific factors, localized solutions can be strategically connected to one another if developed against the same strategic framework at the onset of variable exploration. For example, U.S. and pan-EU solutions may be developed leveraging the same primary research approach and prioritizing a set of unified core variables, in which the outputs in the respective HCP profile databases are congruent, but multivariate analyses may demonstrate distinct predictive and discriminating variables and uncover unique HCP behaviors and/or attitudes that resonate within each market. As such, differing outcomes in the localized segmentation outcomes may inform geography-specific targeting and messaging.

In conclusion, a versatile segmentation solution allows a pharmaceutical company to continuously determine the best mix of channel and content for field force targeting and interaction: a true omni-channel approach. This capability maximizes the marketing potential for pipeline and inline products, including promotional strategy, message tailoring, digital affinity and channel preference, etc.

About The Authors:

Robert Broadnax is a vice president in the Life Sciences Practice at CRA with more than 25 years of marketing, sales, customer insights and advanced analytics experience and has spent his career in leadership roles in positions across the life cycle – from early pipeline, to launch to in-line brands. Mr. Broadnax spent 18 years on the client side before becoming a consultant and advisor to life sciences clients worldwide. He specializes in developing global brand and go to market strategies, cultivating deep customer insights and deploying advanced analytic capabilities to develop strategy that delivers innovation, value and access to patients in specialty diseases.

Robert Broadnax is a vice president in the Life Sciences Practice at CRA with more than 25 years of marketing, sales, customer insights and advanced analytics experience and has spent his career in leadership roles in positions across the life cycle – from early pipeline, to launch to in-line brands. Mr. Broadnax spent 18 years on the client side before becoming a consultant and advisor to life sciences clients worldwide. He specializes in developing global brand and go to market strategies, cultivating deep customer insights and deploying advanced analytic capabilities to develop strategy that delivers innovation, value and access to patients in specialty diseases.

Eddie Li is a vice president and head of the Analytics Center of Excellence in the Life Sciences Practice at CRA with more than 10 years of analytical consulting experience helping pharmaceutical clients across broad therapeutic areas. He regularly leverages various data sources including pharmacy and medical claims, affiliations, prescriptions and marketing data to inform commercial strategy.

Eddie Li is a vice president and head of the Analytics Center of Excellence in the Life Sciences Practice at CRA with more than 10 years of analytical consulting experience helping pharmaceutical clients across broad therapeutic areas. He regularly leverages various data sources including pharmacy and medical claims, affiliations, prescriptions and marketing data to inform commercial strategy.

Brian Carpenter is a principal in the Life Sciences Practice at CRA with more than 10 years of experience in commercial strategy and customer insights within the life sciences industry, including therapeutics and diagnostics. He advises his clients across the product life cycle, including a focus on brand and competitor strategies, leveraging customer insights and advanced analytics capabilities to develop meaningful and differentiating strategy across therapeutic areas.

Brian Carpenter is a principal in the Life Sciences Practice at CRA with more than 10 years of experience in commercial strategy and customer insights within the life sciences industry, including therapeutics and diagnostics. He advises his clients across the product life cycle, including a focus on brand and competitor strategies, leveraging customer insights and advanced analytics capabilities to develop meaningful and differentiating strategy across therapeutic areas.