Lack Of Real Estate Prompts Life Sciences To Get Creative

By Roger Humphrey, executive managing director and life sciences leader, JLL

Curing diseases and other groundbreaking innovations are all in a day’s work for life sciences companies. But that innovation mindset goes well beyond the lab; it helps industry executives find creative solutions to some of their biggest business issues. Attracting and retaining talent is one such challenge.

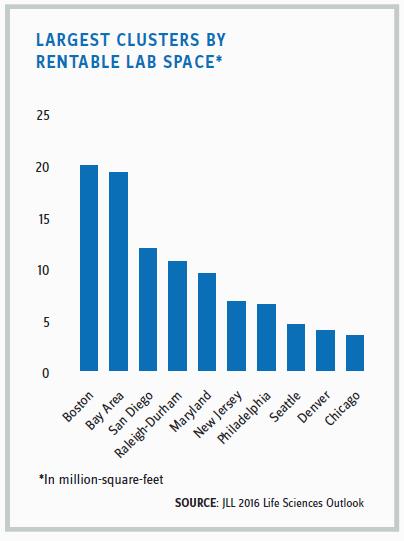

The search for highly specialized talent is why life sciences companies tend to cluster around top research universities and why finding facilities in the top clusters can be very difficult. It’s no surprise that seven of the top 10 U.S. biological science programs are at graduate universities located in the top life sciences clusters of Boston, the Bay Area, and San Diego.

The search for highly specialized talent is why life sciences companies tend to cluster around top research universities and why finding facilities in the top clusters can be very difficult. It’s no surprise that seven of the top 10 U.S. biological science programs are at graduate universities located in the top life sciences clusters of Boston, the Bay Area, and San Diego.

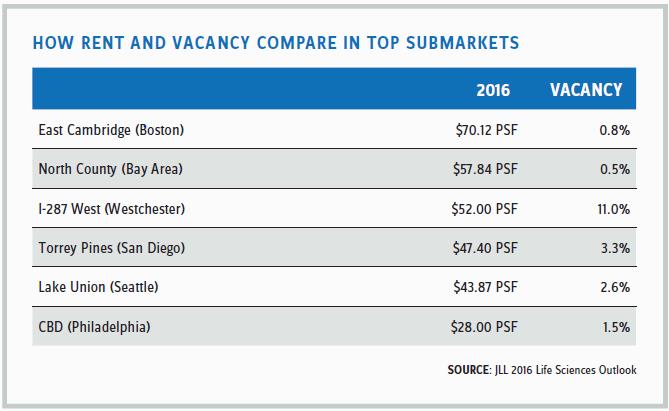

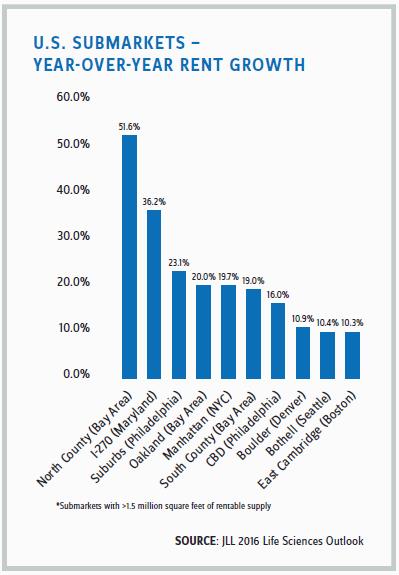

In these cities, office and laboratory space opportunities can be few and far between — so a little innovation is needed to find locations that connect talent with top companies. The space crunch is real; across the country, vacancy rates remain unfathomably low in top clusters while rents continue to climb. For example, in Boston’s East Cambridge submarket, the average rent for office and lab space of $70 per square foot isn’t scaring away life sciences companies — the area has a vacancy rate of just 0.8 percent. On the opposite coast, the Bay Area’s North County is experiencing a 0.5 percent vacancy rate with rent at $58 per square foot. Up-and-coming life sciences markets, such as Denver, Seattle, and Chicago, are seeing an uptick in leasing activities and a growing shortage of life sciences facilities.

As detailed in JLL’s 2016 Life Sciences Outlook Report, expensive and competitive real estate markets are forcing life sciences companies to explore nontraditional real estate options to ensure innovation and productivity in their workforce. The lack of available space, particularly in urban clusters, is driving real estate solutions from new development to creative renovations of existing space. Meanwhile, fierce competition for top talent is increasing the influence of employee needs in real estate decisions, including site selection, infrastructure, and amenities.

As detailed in JLL’s 2016 Life Sciences Outlook Report, expensive and competitive real estate markets are forcing life sciences companies to explore nontraditional real estate options to ensure innovation and productivity in their workforce. The lack of available space, particularly in urban clusters, is driving real estate solutions from new development to creative renovations of existing space. Meanwhile, fierce competition for top talent is increasing the influence of employee needs in real estate decisions, including site selection, infrastructure, and amenities.

MOVING TO THE SUBURBS

Thanks to high demand and low interest rates, development of laboratory space is at an all-time high. However, the rising cost of labor and materials has made it increasingly expensive to develop sizable facilities, particularly the build-to-suit projects most favored by companies in need of highly customized laboratory space. With no space to be found in crowded urban clusters, the neighboring suburbs are welcoming life sciences companies as well as offering a similar talent pool.

In Greater Boston, for example, life sciences tenants have recognized the added value the suburbs provide. In contrast to Cambridge — Boston’s life sciences epicenter — where what little space is available may well be in older buildings, the suburbs provide the opportunity for office-to-lab conversions as well as brand-new development projects at a lower cost than building in Cambridge. Indeed, Boston’s first suburban speculative laboratory facility is under development in the suburb of Lexington.

Similarly, San Francisco is seeing development rise outside the city center. High occupancy rates in the primary Bay Area markets of Emeryville and Berkeley are pushing life sciences companies into the suburban Tri-Valley area. Biotech and pharmaceutical companies in that area generated more than $100 million in venture capital funding in 2016, indicating that the Tri-Valley is emerging as a powerful life sciences hub in addition to neighboring cities in the East Bay.

TRANSFORMING OFFICE BUILDINGS INTO HIGH-TECH LABORATORIES

Life sciences innovation can only happen when the right scientists, doctors, and business minds come together. That’s why talent recruitment and retention appeal are key deciding factors in site selection. For example, having a life sciences facility that is relatively close to leading research centers will enhance employee engagement and retention.

One solution is to transform office space into labs. In the Bay Area’s mid-peninsula market, for example, 200,000 square feet of office space is being converted to laboratories.

The creative renovation of outdated facilities is playing out in several markets throughout the country, including Cambridge, where Blackstone is converting a 90,000-square-foot office facility into highly coveted lab space.

Biotech companies in Los Angeles County are converting low-rise office-flex buildings into affordable multiuse facilities with spacious floor plates (i.e., the amount of rentable area on one whole floor), loading capabilities, high ceilings, and high-volume ventilation.

In Denver, real estate executives at life sciences companies compare the search for appropriate lab space in the market to “finding a needle in a haystack.” To overcome this challenge, they’ve started repurposing second-generation restaurants or clean-tech spaces. In Denver’s Boulder/Northwest submarket, the majority of product is first-generation conversion lab space and flex/office-to-lab conversion space. Longmont and Gunbarrel represent low-cost alternatives with access to the Boulder workforce. Longmont has a supply of flex and light industrial buildings that have infrastructure in place and could be quickly converted to lab space.

ADDING AMENITIES TO ATTRACT TOP TALENT

Whether in a new development or adaptive reuse space, life sciences companies are adding amenities and investing in space that improves the well-being and productivity of employees — as well as offers downtime and socializing among peers. Gone are the claustrophobic laboratories of the past, as life sciences companies seek modern facility designs with more natural light, open spaces, and interactive types of workspaces.

Whether in a new development or adaptive reuse space, life sciences companies are adding amenities and investing in space that improves the well-being and productivity of employees — as well as offers downtime and socializing among peers. Gone are the claustrophobic laboratories of the past, as life sciences companies seek modern facility designs with more natural light, open spaces, and interactive types of workspaces.

A noteworthy example is The Cove in San Francisco, currently the largest life sciences development underway in the United States. A seven-building, 1 million-square-foot campus, The Cove will feature a full-service amenities center with fitness and exercise rooms, a bowling alley, bocce ball courts, a café, an amphitheater, and hotel space.

Similarly, in the Torrey Pines submarket of San Diego, low vacancy and high rents in life sciences properties have led to a number of projects being upgraded. Alexandria Companies is in the midst of major renovations and upgrades at its Nautilus and Spectrum campuses within Torrey Pines and is converting a 90,000-square-foot building into The Alexandria at Torrey Pines. The latter will serve as a community center, providing Alexandria tenants with a gym and other amenities, including a restaurant open to the public. The facility also houses the local Biocom trade group.

On the opposite coast, the Alexandria Center at Kendall Square (ACKS) is under development in Boston. Located in East Cambridge, ACKS offers a rich urban environment that includes more than 10 hotels, 50 restaurants, 150 shops, and four Cambridge Athletic Club fitness centers — all within a mile radius. The development is attracting attention from the life sciences industry. Bluebird Bio will occupy the laboratory portion of the campus’ 500,000 square feet of office and laboratory space at 50-60 Binney St., while Bristol- Myers Squibb will be the anchor of the 430,000-squarefoot 100 Binney St. facilities.

In these developments and others across the country, companies understand that what is best for the individual aspirations of the talent pool is also beneficial for the company.