Life Sciences Business Strategies For Trump 2.0 Policy Changes

By K. Randolph Peak and Joseph R. Decker

In this series, we will monitor emerging policies and priorities from the new Trump administration and its agencies that are expected to have particular effects on healthcare and life science-related sectors such as pharmaceuticals, biotechnology, medical devices, healthcare information technology (HIT), and hospital/health systems. The series also will offer some practical strategies for business planning and contractual risk mitigation.

Policy Changes Impacting Life Sciences And Healthcare Sectors

With all new administrations there should be an expectation of policy changes at governmental agencies. Such policy changes will likely have positive or negative implications to the operations and economic strategies of organizations that are subject to the regulatory authority of such governmental agencies.

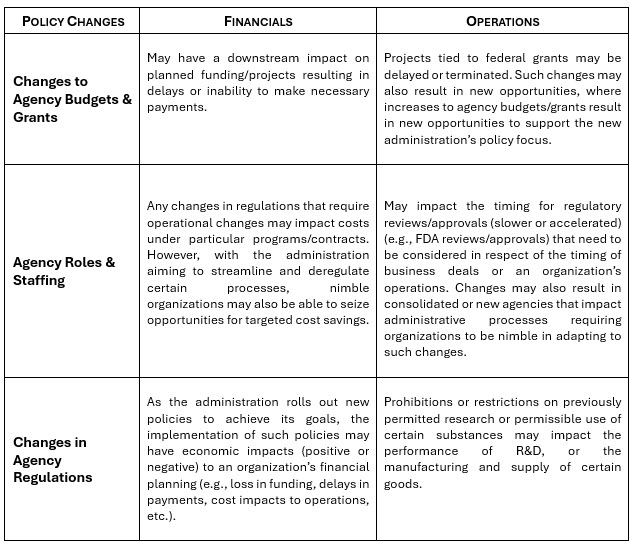

The table below briefly summarizes a few key recent policy changes that may be particularly impactful for organizations in the life sciences and healthcare sectors. Following the table is a deeper summary of certain policy changes that should be noted by business decision makers in these sectors.

- DOJ Bulk Sensitive Personal Data Rule: The Department of Justice (DOJ) released a new rule that requires compliance with certain cybersecurity requirements developed by the Department of Homeland Security’s Cybersecurity and Infrastructure Agency (CISA) for certain transactions, and also prohibits the sharing of material amounts of certain sensitive information (importantly including genomic information and personally identifiable information (PII)) with parties connected to certain restricted countries (such as China). This applies to both new and existing agreements, and both direct/indirect sharing. It will be important to consider who you share data with and what types of contractual restrictions are in place for any downstream sharing. This is also an example of policy changes that may affect the fundamental legality or feasibility of certain business transactions.

- Budget/Funding Changes: The administration has proposed significant budget adjustments to agencies such as HHS, aiming to streamline government spending while prioritizing certain initiatives. Some relevant proposals include (i) reductions to NIH funding (further discussed below), (ii) cuts to certain U.S. FDA R&D programs, potentially impacting certain food safety, tobacco regulation, and emerging health-tech initiatives, (iii) reforms to Medicare spending, such as lowering payments to providers, reforming payment models, and reducing fraud and abuse, and (iv) consolidating the Agency for Healthcare Research and Quality (AHRQ) into other agencies. These budget adjustments impact an organization’s ability to make payments under new or existing contracts or the ability of a party to perform its contractual obligations to manufacture or supply certain products. All contractual commitments should be viewed in light of potential future federal budgetary adjustments.

- Agency Staffing Reductions: The administration proposed, through the HHS, to make significant cuts in staffing levels across health agencies in an effort to reduce costs and realign the organization with its core mission and new priorities in reversing the chronic disease epidemic. Specific targets varied, but proposals included reductions of 10% to15% of the total HHS workforce. These cuts will occur at agencies including the FDA, the CDC, CMS, and the NIH. Staffing reductions are specifically targeted to avoid affecting timelines for key administrative processes, such as FDA approvals of new medical/pharmaceutical technologies; however, given the scope of these proposed staffing reductions, unanticipated changes to review and approval processes and timelines may still occur. Potential changes to timelines for regulatory reviews and approvals pertaining to such agencies should be considered in any contract for the development, supply, manufacture, or distribution of products that are subject to such regulatory reviews and approvals.

- NIH Indirect Cost Caps: The administration proposed capping the reimbursement rate for indirect costs associated with NIH grants at 15%, to ensure taxpayer dollars are used effectively and efficiently, and citing the average indirect cost rate reported by NIH as being between 27% and 28%, with some organizations reportedly charging indirect rates of over 50%. Opponents to the cap responded, saying it would reduce research institutions’ overall capacity to support overhead for large-scale/complex projects. While this policy change is currently paused by the courts, organizations that engage in projects that rely on such NIH grants should be mindful of the administration’s goals to establish a cap on such indirect costs that is below the reported average indirect cost reimbursement rate.

- Biological (Gain-of-Function) Research: The administration implemented new policies to ‘Improve the Safety and Security of Biological Research’ including a ban on federal funding for life-science research in countries of concern (e.g., China) or where there is not adequate oversight to ensure compliance with U.S. requirements on threats to public health, public safety, and economic or national security. A key initial move here is the administration’s ban on federal funding for gain-of-function research in such countries of concern. While this policy is relatively narrow, opponents assert that it is possible similar policies may affect funding for other ‘controversial’ research areas. Organizations that conduct biological research that may be subject to this policy should also make note of the policy requirement to include specified enforcement terms in every life-science research contract or grant award.

Strategies for Business Planning, Transactions, and Risk Mitigation

The following are business planning and risk mitigation strategies, particularly from a transactions and contracting standpoint, that may prove to be beneficial to consider in respect of anticipated or enacted administration policy changes.

- Organizational Readiness – One particular strategy involves taking proactive measures to be “ready” to act quickly rather than taking a reactive “wait and see” approach. While this strategy applies to general corporate operations, it is of particular importance with respect to a new administration’s policy changes.

- Contract and Document Administration – Before you can react to any regulatory, funding, or administrative policy changes, you will need to know and understand the terms, conditions and respective obligations in your organization’s contracts and related documents (such as policies and procedures in use across your organization). Having a contract administration function that utilizes software and technologies to inventory and track contract and organizational document content is a critical component of a proactive strategy. Consider, as part of your contract administration, tracking subject matter that has governmental agency and regulatory implications that could be impacted by the policy changes of an incoming administration. Doing so will support your efforts to quickly assess your organization’s transactions, contracts, and operations likely to be affected by any policy change.

- Timing Contract Negotiations – Determine when it would be most practical or advantageous to raise and negotiate modifications to contracts that may or are being impacted by policy changes. In many instances, the best opportunity to negotiate modifications is when existing contracts are set to renew or expire. As such, you should be carefully tracking the expiration dates and processes for providing renewal (or non-renewal) notices for each agreement.

- Change in Law provisions - Contracts often include provisions that permit ether party to terminate the contract due to a change in law provision if the parties are unable to negotiate an amendment to address regulatory compliance issues or the operational and economic impact stemming from such changes in law. Given the regulatory impact of a new administration’s policy changes, these “change in law” provisions should also be tracked as part of a contract administration function.

- Regulated Operations – Organizations that operate in a regulated industry will rely on the legal, compliance, and finance departments to guide, implement and monitor the organization’s compliance and interactions with applicable governmental authorities. In a proactive manner, consider implementing reporting and strategic planning sessions with such departments and the organization’s business stakeholders to understand the operational ripple effect and consequences of anticipated and enacted policy changes and to develop a plan of action to mitigate any negative repercussions as well leverage potential business opportunities.

- Contractual Options – We highlight below a few categories of contractual provisions that will provide options that may be beneficial in connection with administration policy changes:

- Links for ‘Operational’ Provisions: If you perform (under contract) functions or processes that are particularly vulnerable to changes in related regulations or administrative processing timelines, consider reflecting your processes in a referenced document within the agreement, and make such referenced documents subject to unilateral change and control by you. Often, this can be accomplished by incorporating these separate documents via hyperlink.

- Compliance with Applicable Law: Provisions requiring compliance with applicable laws are common. Given the potential for changes to regulations that may be difficult to comply with (e.g., changes in diversity, equity, and inclusion (DEI)-related rules or prohibitions on certain types of data sharing), approach these provisions with care and perform the diligence necessary to avoid compliance issues.

- Indemnification of Violations of Law: Similarly, you may need think deeply about the risk you take on under common indemnification provisions, such as an indemnification for third-party claims relating to violations of applicable law. As regulatory fines and penalties fall under these indemnification provisions, the risk associated with these provisions could increase significantly with changes in regulations or agency priorities.

- Confidentiality & Data Sharing: Consider what confidential information and data you may be obligated to share with partners, vendors and other third parties, and whether the disclosure of such data may be impacted in light of a new regulation or administration policy. In particular, consider carveouts from confidentiality obligations that permit sharing of confidential information or data as well as provisions that provide exceptions to data sharing obligations in response to policy changes that might otherwise curtail such information sharing obligations.

- Add Policy Change-Related Termination Rights: Consider termination rights specific to an administration’s policy changes that are flexible, and which may be useful in reacting to policy or budgetary changes, such as the following:

- Termination for Convenience: This is the most flexible termination right, but cuts both ways and may have unintended consequences if your contracting party elects to utilize it for different reasons.

- Termination for Change in Laws: Where changes in regulations are your primary concern, a termination right triggered by material changes to applicable laws can be effective; however, such provisions typically require the parties to attempt a contract amendment to address such change in laws prior to termination.

- Termination for Material Price/Cost Change: Where large changes in your cost structure or the prices charged by a vendor are your primary concern, a termination right triggered by changes in excess of some stated amount can be useful.

- Termination for Failure to Supply: Where policy changes are likely to impact regulatory approvals or product availability, including language that provides both the flexibility to procure such items from other sources as well as the right to exercise early termination rights may be advantageous.

- Funding Impact Provisions: To the extent the transaction is funded in whole or part by federal grants it should include provisions that address the possibility of payment delays and possibly even termination due to delays or loss in grant funding. From the buyer’s perspective, provisions that clearly establish such delays are possible and do not constitute a breach are important to consider. In such instances, the buyer may event want to require the seller to continue performing despite such delays for a certain period of time. From the seller’s perspective, there should be assurances that the seller will be paid for work performed and deliverables in progress notwithstanding such delays. The seller should also consider a clear process that provides the seller with the right to suspend performance and possibly terminate the agreement following an extended period of payment delays. Sellers should also keep in mind the downstream impact of such delays on its own obligations to its suppliers and subcontractors.

About The Authors:

About The Authors:

Joseph R. Decker, an associate at Faegre Drinker, is a registered patent attorney who helps clients structure, draft, and negotiate complex technology and intellectual property transactions.

K. Randolph Peak, is a partner at Faegre Drinker in the Healthcare, Intellectual Property and Corporate practice groups who represents clients on a wide range of complex healthcare and life sciences transactions and advises on related commercial, digital health, technology, and regulatory matters.

K. Randolph Peak, is a partner at Faegre Drinker in the Healthcare, Intellectual Property and Corporate practice groups who represents clients on a wide range of complex healthcare and life sciences transactions and advises on related commercial, digital health, technology, and regulatory matters.

This article is to inform interested persons generally and is not, and does not attempt to be, comprehensive. Due to its general nature, this article should not be regarded as legal advice. Specific contractual issues should always be addressed with legal counsel.