Measuring The Health Of CRO-Sponsor Relationships

By Laurie Halloran, BSN, MS, president and CEO, Halloran Consulting Group

As the majority of clinical trials involve external collaborations, healthy relationships between a sponsor and its partners (e.g., CROs) cannot be overemphasized. In this article, much of what we will discuss pertains to the relationship between a CRO and its sponsor, the life science company. However, any company providing a contracted service to a sponsor will find there are valuable lessons to be learned regarding relationship management.

As the majority of clinical trials involve external collaborations, healthy relationships between a sponsor and its partners (e.g., CROs) cannot be overemphasized. In this article, much of what we will discuss pertains to the relationship between a CRO and its sponsor, the life science company. However, any company providing a contracted service to a sponsor will find there are valuable lessons to be learned regarding relationship management.

The market for CROs continues to consolidate, and many of these businesses are becoming as large as or even larger than the companies they serve. But no matter what size the sponsor (nor whether it’s public or private), shareholder return from profits of newly marketed products is always going to be a primary business goal. CROs, on the other hand, are service providers focused on selling their time. This difference between these entities sometimes creates a conundrum of imperfectly aligned business objectives that can be a major source of problems if not managed from the onset.

While small or early-clinical-stage companies are required to minimize their fixed costs through outsourcing, midsize and large companies seek more strategic relationships and single-source providers to tackle the challenges associated with both speedy program execution and cost containment. Thus, when collaborating with CROs, life science companies face complex challenges that obviously can impact clinical outcomes. However, there are a number of proactive approaches to take in working with CROs to manage relationships, align objectives, and reap benefits for both parties.

MITIGATING CRO-LIFE SCIENCE COMPANY RELATIONSHIP CHALLENGES

The health of these relationships is critical and is an often underlying cause of project failure if not attended to. If the arrangement is initiated and managed well, there is a better likelihood of identifying risks and preventing problems down the road. These relationships require continuous effort on both sides, and that effort is not to be underestimated.

A relationship catastrophe is often seeded in the early days of an outsourcing decision. For example, recently we were involved with a company that had an executive mandate to outsource with a midsize pharma company. They needed to become more efficient after two products were beaten to market by competitors. Since their end-of-year deadline was handed down from the C-level, there was a scramble to choose and begin a complex relationship that the majority of the development team had never encountered. Red flags were everywhere. Rushing the start of a new outsourcing model without the necessary support and insights can lead to missteps in the process. Instead, it is imperative a company allocate — up front — the appropriate time needed to learn how to work efficiently in a new outsourcing paradigm.

AVOID MISSTEPS WITH MASTER SERVICE AGREEMENTS

Contractual documents are almost impossible to draft without understanding future challenges. When sponsor companies elect to move to strategic outsourcing, many thorny issues arise when hastily negotiated Master Service Agreements (MSAs) are executed. This is a critical time to set expectations appropriately, yet it’s an opportunity that is frequently rushed with limited consideration for both a transparent exchange and appropriate checks and balances that favor both parties.

To avoid problems when setting strategic expectations:

- Create two or three deliverables for each program that are directly linked to the MSA. This helps clarify how to share risk, especially with change orders, quality issues, and staff transitions.

- Implement a fixed-price program approach. This will contain the scope creep that can threaten to derail early programs and sour the relationship.

- Determine the goals of the partnership and communicate them. Don’t assume that efficiencies in time, cost, and quality will all be achievable. There is always a tradeoff, and it is imperative to implement a shared-operational model.

- Agree upon customer-service metrics. Partner-health performance metrics must be decided upon for key stakeholders who may be affected by the partnership. The partnership must continue to improve over time in order for it to continue.

TAKING LESSONS FROM STRATEGIC PARTNERSHIPS

In a single-source scenario — or any outsourcing relationship — strong and involved governance, a shared operational model, and regular reconciliation on scope are must-haves for a healthy relationship. And all of this should be handled at the beginning of the relationship.

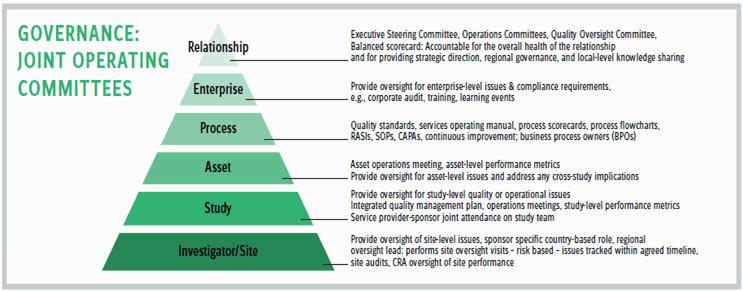

Early on you should also provide notification of key staff transitions and shared costs for transition time above a certain level of program size. Regardless of project size, clearly describe who all the participants are and the roles of joint-operating committees (see graphic on next page), which should meet quarterly. Include the ability for the sponsor to escalate issues to an executive level within the CRO and specify who the counterparts are at each of the partners.

At the onset of the relationship, determine a timeline and define a set of metrics with options to refine the metrics at predefined milestones. KPIs should be tailored to the critical aspects of your programs and shaped by:

- Determining how metrics will be available — ideally in a program that is continuously updated to maintain visibility.

- Appointing stable relationship managers to actively recognize when KPIs need refinement and manage the adoption of new metrics.

However, two issues can arise with data identification:

- Study teams frequently want a deluge of data that is not valuable for identifying areas of improvement or best practices.

- Inconsistency in what data teams want ensures that systemic relationship issues cannot be identified across multiple programs. In midsize or large sponsor companies this can require several FTEs when most of the portfolio is outsourced.

The value of metrics relies on the underlying data used to generate them. If you have 100 studies in your portfolio, what percentage of them should be performing on track? One colleague who has managed this successfully says it should be a minimum of 95 percent. Gaining this insight is difficult, and the governance at a middle level needs to determine an appropriate trigger point above which remediation is needed.

Another major requirement for healthy collaboration is retaining the interest level. From our conversations with sponsors who outsource as a business strategy, the bigger the spend, the higher the interest on the part of the CRO. This presents a major challenge to small sponsors who don’t have a lot of money to spend each year with a large CRO.

Our clients say that if large CROs think a long-term engagement will form, they will invest the time to build the relationship. Smaller companies acknowledge that they require more assistance than larger companies, and that is often a lot for the CRO to handle, but it illustrates the need for early, attentive, and transparent communication at an executive level. This level of communication should be mandated in every relationship, considering it is the biggest source of frustration for sponsors.

In earlier stages of development, it may be beneficial to go with a smaller CRO and then shift to a larger CRO for later stages where the global reach is a better fit to conduct large programs. This isn’t ideal for most companies to have to change relationships in a program, but it underscores the need for the sponsor to conduct development planning practices regularly.

From the sponsor’s viewpoint, one of the biggest disappointments in outsourcing is how the day to day work gets done, documented, overseen, and communicated. Every CRO project manager has likely encountered a sponsor manager who micromanages and criticizes every activity and deliverable. There need to be efficient communication channels between subject matter experts to build shared operational models that don’t bottleneck through the project managers. For example, at one client, we recently encountered four different groups that all thought they were responsible for managing the CRO, creating a lot of miscommunication.

At the outset, it is important to realign your business processes to cover the changes that outsourcing brings. Many companies that embark on a significant outsourcing change have SOPS that are irrelevant to the business model.

The most effective way to measure the health of the relationship is to look to the individuals and teams to do it. Surveys are a tried-and-true method but should be performed by both the sponsor and vendor as well as with any type of contracted service provider and investigators.

In summary, professional relationships are the most loyal and yield the greatest results when they are treated as personal relationships. Managing and checking-in on the relationship are the keys to fostering a strong partnership, regardless of shareholder return.