Mid-Year M&A Outlook: Challenges And Opportunities Update

By David Stuart

As we reach the mid-point of 2024, it's important to reflect on the year's economic backdrop and its impact on M&A activities within the life sciences sector. The year began amid a complex global economic climate, characterized by persistent, albeit gradually decreasing, inflation and ongoing geopolitical tensions.

Economists at the start of 2024 anticipated three to four rate cuts. However, expectations have shifted, with the first rate cut now projected for September. Inflation continues to hover above the Federal Reserve's 2% target. The Fed's stance has been clear since they began raising interest rates that achieving the 2% target is paramount, and until this is assured, higher rates will persist.

Valuations in the M&A sphere are heavily influenced by discount rates, which reflect future economic expectations. Predicting these future economic conditions remains challenging, with bond rates showing significant fluctuations over the past two years. Current market conditions suggest that valuations will remain subdued until there's more certainty about long-term inflation and interest rates. Despite this, some sellers remain optimistic about achieving premium sale prices.

M&A Activity Has Increased

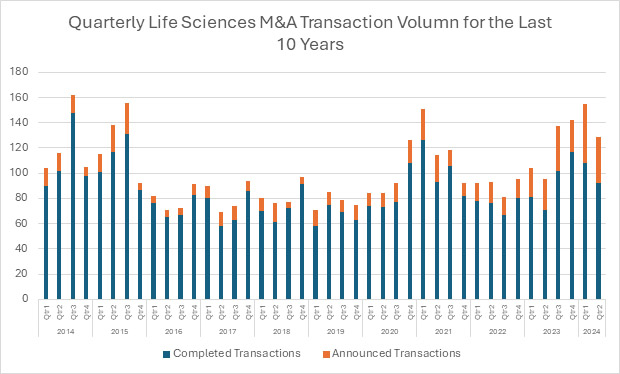

Year over year, transaction volume has increased significantly. The year started strong with major announcements made during the annual J.P. Morgan Healthcare Conference. If we look at activity levels by quarter, completed deals for the first half of the year are up over 30% from the previous year, with a significant backlog of announced transactions expected to close later this year. If this pace continues, we’ll see even higher volumes in the second half of the year.

Source: GlobalData

Capital Markets Remain Sluggish

Despite a buoyant M&A scene, IPO activity in the biotech sector remains sluggish. Many companies appear to be on the brink of an IPO, yet are hesitant due to volatile market conditions and less-than-favorable recent performance. Of the 14 biotech companies that have gone public in 2024, at the time of this writing, only four currently have share prices above their initial IPO price. Therefore, this hesitation seems to point to a strategic wait for a clearer, more stable pathway to successful public offerings, hinting at cautious optimism toward future market improvements. However, if the market improves, a rush of biotech companies wanting to go public could overwhelm the SEC, which might delay processing filings due to limited resources.

Co-Development And Partnership Agreements Remain A Viable Option

The current market conditions have fostered the emergence of innovative partnership models. These partnerships, often seen as win-win, are proving essential, particularly in areas demanding high investment and specialization. For instance, Scribe Therapeutics announced a significant CRISPR-related partnership in March 2024, which underscores the growing trend of collaboration in cutting-edge research areas.

Early-stage companies in the life sciences sector, while facing hurdles related to funding and market entry, continue to be a vibrant source of innovation and partnership opportunities. Highlighted below are three significant partnership, licensing and co-development agreements:

- VantAI and Bristol Myers Squibb forged a partnership valued at $674 million in February 2024 to harness AI in drug discovery and development. VantAI will receive payments based on discovery, development, clinical, regulatory, and sales milestones plus tiered royalties with an option to further expand to additional therapeutic programs.

- In June, Day One Biopharma and MabCare Therapeutics entered into a licensing agreement focused on pediatric cancer treatments. The deal gives MabCare $55 million upfront, and they are eligible to receive an additional $1.152 billion if certain development, regulatory, and commercial milestones are achieved.

- Also in June, Belharra Therapeutics and Sanofi signed a co-development deal to create new immunological treatments. Belharra is eligible to receive up to $40 million in upfront and near-term milestones, and an additional $700 million based on aggregate research, development and commercial milestone payments and royalties on net sales.

These significant transactions not only reflect robust activity but also highlight a strategic pivot toward collaborative and innovative approaches for early-stage biotech companies to overcome current capital market challenges.

Closing Thoughts

As we advance through 2024, the life sciences sector demonstrates remarkable resilience, navigating through economic uncertainties and an impending election that could significantly reshape regulatory landscapes. Despite challenges like fluctuating interest rates and persistent inflation, the sector's sustained M&A activity highlights its capacity for strategic ingenuity. Companies are not just reacting defensively but are actively seizing opportunities to drive innovation and competitive advantage through strategic partnerships and technological integrations. As the year progresses, these proactive moves are pivotal, setting new industry standards and preparing companies to adapt to potential shifts in policy and economic conditions. The second half of 2024 holds significant promise for those who continue to navigate these complex dynamics with precision and innovation, emphasizing the sector's agility and forward-thinking approach in turbulent times.

About The Author:

David Stuart, a Director at CREO, has over 15 years of experience guiding Life Sciences and Healthcare companies through growth, people development, and digital transformations. He specializes in new product launches, mergers, acquisitions, and carve-outs. He works extensively with private equity firms to drive strategic and operational transformations. His expertise includes designing operating models, business processes, and managing complex programs to align strategic planning with corporate goals.