New Bio Technology Developments A Leading Trend For 2013

By Eric Langer, president and managing partner, BioPlan Associates, Inc.

In November 2012, we asked the 425 global subject matter experts and senior participants on our Biotechnology Industry Council (BIC) to evaluate the 2013 trends in bioprocessing and biopharmaceuticals. Trends the BIC expects in bioprocessing over the coming year are presented below. This is the first of BioPlan’s monthly columns on how innovation in biopharmaceuticals, related bottlenecks, and regulatory hurdles to new technology adoption are affecting the industry.

In November 2012, we asked the 425 global subject matter experts and senior participants on our Biotechnology Industry Council (BIC) to evaluate the 2013 trends in bioprocessing and biopharmaceuticals. Trends the BIC expects in bioprocessing over the coming year are presented below. This is the first of BioPlan’s monthly columns on how innovation in biopharmaceuticals, related bottlenecks, and regulatory hurdles to new technology adoption are affecting the industry.

A few of the 65 key microtrends identified by the Council include:

Analytical Methods; Assays

- Expect simpler assay processes that increase process knowledge and speed/simplify product release

- Expect more convenient, high-throughput assays that assess physicochemical properties, IgG clones for highlevel expression, and therapeutic efficacy

- Innovators are developing assays to demonstrate biosimilarity and analytics to demonstrate equivalent product quality

Biosimilars

- Expect more models for demonstrating biosimilarity: lack of established definition and standards on “biosimilarity” regarding biochemical or biophysical characterization

- Process development for biosimilars that allows comparisons to innovator biologic

- Expect more quality by design for all products including generics/biosimilars

Biomanufacturing Process Improvements

- Expect higher workload, fewer staff, at higher quality, and shorter time frames

- Improved processing (especially downstream) to handle 10g/l and greater cell cultures

- Improved upstream process efficiency to reduce costs, increase productivity while ensuring compliance and quality

Biomanufacturing Downstream Process Improvements

- Alternatives to protein A will continue to be sought and developed

- Need for better performing chromatography resins

- Development of nonchromatographic recovery unit operations

Single-use Biomanufacturing

- Building more quality into single-use operations to further reduce regulatory activities/oversight

- Addressing problems of disposable bioreactors and devices that are creating inconsistent growth due to changes in resins, films, gamma irradiation, and cell line specificity

- SUS (single-use systems) downstream operations using membrane adsorbers

- Emergence of flexible and modular biomanufacturing facilities

- Establishing leachables and extractables guidance for testing and for cell growth

- Single-use devices facilitating large-scale bioproduction in China

Regulatory Compliance

- Creating processes and technologies that support lower costs of clinical and commercial supplies

- Continuous validation programs that link PD (process development) and manufacturing data

- Implementing process controls such as PAT (process analytical technology)

Supply Chain, Raw Materials: Control and Sourcing

- Development of international regulations for quality and raw materials sourcing

- Development of process controls that reduce impact of process or raw materials changes on quality

- Expect decreased product defects when manufacturing facilities relocate to lower production costs

The Industry is Demanding Innovation

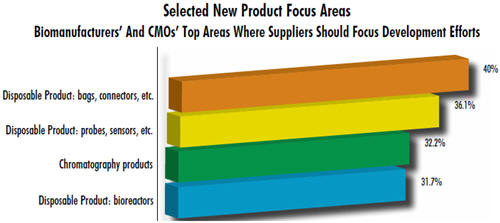

These trends are supported by our 9th Annual Report and Survey of Biopharmaceutical Manufacturing, 2012. For example, fully 40% of the 302 biomanufacturers surveyed expressed a desire for improved bags and connectors, the most basic components of single-use systems. More than a third (36.1%) need better disposable probes and sensors, and nearly a third showed a desire for improved single-use chromatography products (32.2%). In contrast with disposable equipment, only 10% indicated a desire for improvements in fixed stainless steel bioprocessing equipment.

Particularly needed in the industry is the development of new materials, improved plastics, and variations of current materials that enable major design innovations. Possible innovations might include unitary (single-piece) molded solid, structurally self-supporting, plastic bioreactors.

Improving the New Technology Evaluation Process

Evaluating new technologies in the regulated pharma environment can be slow and costly to both innovators and the end users doing the beta or evaluation testing. To reduce these challenges, the new technology and product evaluation program (NTAP) spearheaded by BioPlan Associates is designed to help kick-start innovation in bio/pharma manufacturing segments. The program helps ensure that the best technologies are evaluated, even when innovators are small or resource constrained.

The program streamlines the evaluation process and cuts down on internal staff time, both at new technology innovators and at the bioprocessing facilities evaluating suppliers’ new products. The program compresses external beta testing and postlaunch evaluations and takes the time-consuming responsibility for recruiting facilities and the costly process for managing the evaluation process out of the hands of technology innovators. By leveraging our network of evaluators and field testing staff and providing access to global commercial process development facilities, we free up innovators’ staff from project and site management. This helps assure independent, cross-lab analysis and provides facility data comparability. It also cuts time to market and reduces site recruiting costs significantly.

The program benefits suppliers by providing high-value evaluations, getting new products into the right hands, and coordinating multisite testing with integrated, compiled data. The program benefits evaluators by giving them access to the most promising and cutting-edge technologies while eliminating the need to deal with multiple contacts from multiple suppliers. Rather than testing all technologies, BioPlan can provide available data from other commercial evaluations.

Innovation is the lifeblood of the biopharma industry, fueling new efficiencies, greater quality, and cost reductions in manufacturing processes. New ways of introducing new technologies are needed to allow facilities to focus on core aspects of R&D and to provide better evaluation methods that significantly cut down on time to market and streamline the testing process. There is a strong desire in the industry, as our study observes, for innovation and an accompanying sense that cost reductions and improved quality will come about for production of current biologics, biosimilars, and for production in emerging markets using flexible processes. Suppliers and technology innovators have repeatedly demonstrated their commitment to investment in innovation and new technologies, and industry demand will continue to support and fund suppliers’ process improvements.

Survey Methodology: The 2012 Ninth Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, in the series of annual evaluations by BioPlan Associates, Inc., yields a composite view and trend analysis from 302 responsible individuals at biopharmaceutical manufacturers and CMOs in 29 countries. The methodology also included 185 direct suppliers of materials, services, and equipment to this industry. This year’s survey covers such issues as new product needs, facility budget changes, current capacity, future capacity constraints, expansions, use of disposables, trends and budgets in disposables, trends in downstream purification, quality management and control, hiring issues, and employment. The quantitative trend analysis provides details and comparisons of production by biotherapeutic developers and CMOs. It also evaluates trends over time and assesses differences in the world’s major markets in the U.S. and Europe.

If you want to learn more about the report, please go to bioplanassociates.com.