New Report Outlines Biopharma IPO Trends

Proskauer, an International law firm, recently released its newest IPO Study that includes analysis of market practices and trends for U.S.-listed IPOs. The study, conducted by the Global Capital Markets Group, examines data from 90 U.S.-listed 2015 IPOs with a minimum initial deal size of $50 million in the following sectors: healthcare; technology, media & telecommunications; energy & power; financial services; industrials, and consumer/retail.

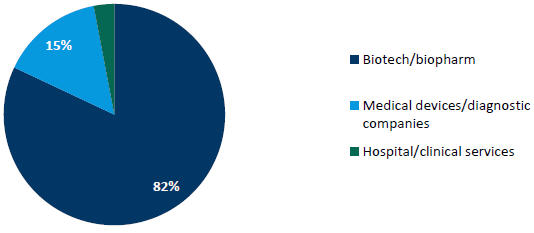

Healthcare was the largest sector (33 IPOs) by deal count for the third year in a row. Of healthcare IPOs priced in 2015, 27 (82%) were by biotech or biopharm companies, 5 (15%) were by medical devices or diagnostics companies and 1 (3%) was by a hospital/clinical services company.

Fewer SEC Comments and Shortest Time To Pricing

In 2015, healthcare IPOs received fewer first-round comments compared to the average IPO in our overall study (24 vs. 31). This continues a trend of a decreasing number of comments, down from 30 in 2014 and 36 in 2013.

- Healthcare issuers were more likely to receive a cheap stock comment than issuers in any other sector (73%, compared to 51% across all sectors), likely because biotech and biopharm companies more often use equity as pre-IPO compensation.

- Healthcare issuers are also comparatively less likely to receive revenue recognition (33%, compared to 52% across all issuers) or segment reporting (3%, compared to 25% across all issuers) comments, both of which can lead to delays in the SEC process.

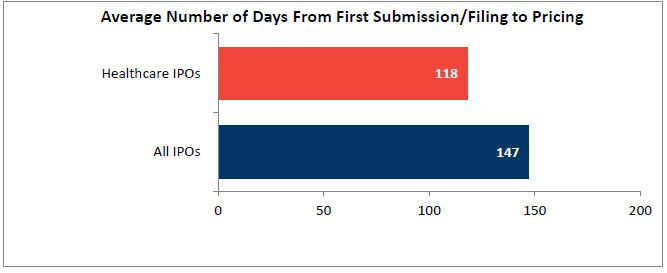

- Comments in these areas would not be applicable to pre-revenue issuers. These patterns of SEC comments may partially explain the shorter time to pricing in this sector – in 2015, healthcare IPOs took an average of 118 days from the first confidential submission to IPO pricing, compared to an average of 147 days overall for all IPOs.

*Excludes prior SEC-reviewed issuers (two in healthcare, five overall) and an additional IPO with confidential submission to pricing greater than 18 months in overall.

Corporate Governance: Key Items

*Excludes FPIs (subject to home jurisdiction governance rules).

Controlled Company Exemption*

» 6 of 29 (21%) healthcare issuers were eligible for the controlled company exemption, compared to 42% in our overall study.

- 5 of 6 (83%) elected to take advantage of the exemption.

Director Independence*

» 23 of 29 (79%) healthcare issuers had a majority of independent directors on their boards, compared to 68% in our overall study.

- On average, these 23 had 76% independent boards.

- On average, the remaining 6 issuers had 44% independent boards.4 of these 6 were controlled companies, and the other two took advantage of phase-in rules.

Separation of Chairman & CEO Roles*

» 22 of 29 (76%) healthcare issuers separated their Chairman and CEO roles, compared to 66% in our overall study.

Classes of Common Stock*

» 1 of 29 (3%) healthcare issuers had multiple classes of common stock, compared to 24% in our overall study.

IPO Fees and Expenses

Underwriting fees and total other IPO expenses (excluding underwriting fees) for healthcare IPOs are summarized below:

Legal fees, accounting fees and printing costs for healthcare IPOs are summarized below:

*Underwriting fees are the portion of IPO base deal that is paid as compensation to the underwriters in the form of a discount or commission.

**Total IPO expenses excludes underwriting fees.