Pricing For COVID-19 Vaccines And Therapies: What Do Payers, Physicians And Patients Believe Is Fair?

By Andrew Parece, Matthew Majewski, David Persampieri, Joseph Black

Introduction

The COVID-19 pandemic has had an immeasurable impact on society. It has revealed significant shortcomings in the structure, resource capacity and administrative efficiency of health systems globally. It has also changed the nature of social interaction. While vaccines and antiviral therapies hold promise to restore some degree of normalcy to post-pandemic society, novel health interventions come with significant questions about the funding for drug development, and the ethics and implications of health policy decisions. Moving forward, it will be critical to address the unprecedented public health need by ensuring access for the greatest number of patients, while providing incentives for pharmaceutical manufacturers to continue to invest in vaccines and therapeutics to combat COVID-19.

As the economic and societal impacts of COVID-19 continue to pervade our social discourse, an emerging question is how vaccines and antiviral therapies will be priced. More specifically, given the development costs and resource requirements, and the array of societal benefits and avoided costs, what is fair? In their pioneering paper on the topic of fairness of pricing practices “Fairness as a Constraint on Profit Seeking: Entitlements in the Market,” [1] Nobel Prize winning economists Daniel Kahneman and Richard Thaler, and co-author Jack Knetsch, provide a framework for identifying the determinants of fairness judgements when setting prices. We apply this framework to understand perceptions of fairness of prices for COVID-19 vaccines and therapies, and the drivers of these perceptions.

Research Approach

In May 2020, CRA initiated a study with a broad range of U.S. respondents – physicians, payers, and patients – to evaluate what these respondents believe is fair with respect to prices of COVID-19 vaccines and therapies. This article presents the findings from survey research conducted between mid-May and mid-June 2020 with the following U.S. respondents:

- 48 payer representatives from large commercial health plans and pharmacy benefit managers (27 pharmacy directors and 21 medical directors responsible for coverage decisions in organizations with over 270 million total beneficiaries);

- 243 physicians across a wide range of specialty areas (pulmonologists, anesthesiologists, emergency medicine specialists, internists, cardiologists, and general practitioners); and

- 239 patients, spanning a range of age levels, 109 of whom had direct experience – personally and/or family members – with COVID-19 diagnoses and/or hospitalization, 130 without such experience (this group is intended to reflect the views of the general public).

As of July 2020, there have been no COVID-19 vaccines approved in the U.S. and there has been one therapy granted emergency use authorization (EUA) to treat hospitalized COVID-19 patients in the U.S. [2] Moreover, the efficacy of COVID-19 vaccines and therapies is not well known, as the findings of limited, small-sample clinical trials have only just begun to be released. Similarly, key aspects of the future state of the COVID-19 pandemic are largely uncertain, such as the level of immunity in the population, the virus’ infection fatality rate (IFR) and the number of patients requiring hospitalization. To address this uncertainty, the study sought to determine views on fairness of prices for archetype vaccines and therapies, spanning a range of therapy and disease characteristics and other relevant factors. We designed the research to elicit perceptions of fairness of prices based on well-defined attributes (e.g. effectiveness in immunization, improvement in patient outcomes), as well as the state of the pandemic (e.g. population immunity, infection fatality rate) and the relative timing and availability of vaccines and treatments. The research was designed to provide insights into the perceptions of fairness of prices for two different types of COVID-19 interventions:

- COVID-19 vaccine with varying effectiveness, population immunity and infection fatality rates, and

- COVID-19 IV hospital treatment, with varying effectiveness and hospitalization rates.

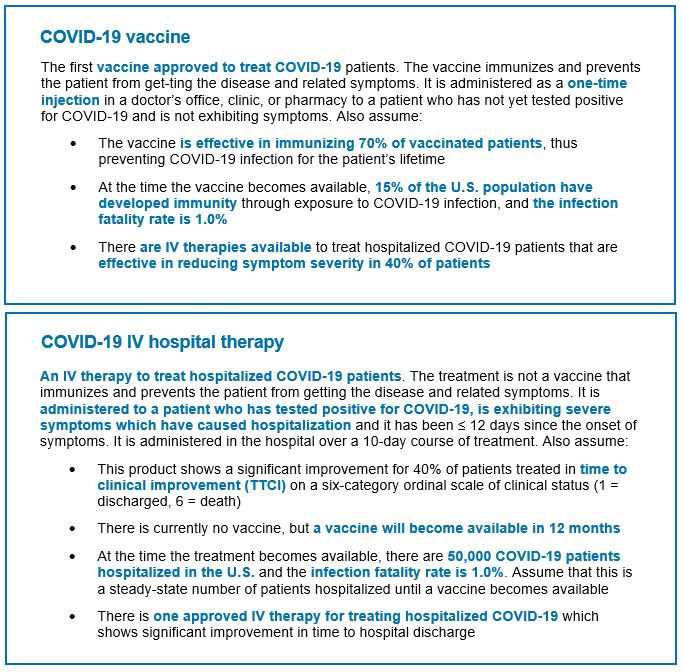

To define archetypes for review by respondents, we developed conceptual vaccine and IV therapy profiles together with specific assumptions about COVID-19 immunity and lethality, the population and the treatment context. Figure 1 specifies the archetype interventions which were developed to provide detail for respondents to give feedback about prices that would be considered fair. We also tested variations on these baseline archetypes and the impact on perceptions of fairness of prices.

Perceptions of fairness – baseline fair prices

Respondents were asked to identify the maximum list price that would be considered fair for each of the archetypes shown in Figure 1, without any additional context or information. They were asked whether specific price levels would be considered fair on a 4-point scale (very unfair, somewhat unfair, somewhat fair, very fair). Based on their answers, questions were asked to determine the maximum price that would be considered fair.[3]

Figure 1: Baseline COVID-19 archetype vaccine and therapy

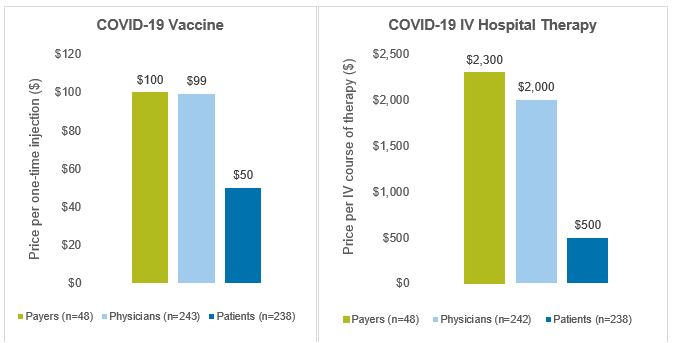

Findings on the prices considered by respondents to be fair are shown in Figure 2. The median prices considered to be fair for the first COVID-19 vaccine administered as a single, one-time injection were $100 for payer respondents, $99 for physician respondents and $50 for patient respondents. Similarly, for COVID-19 IV therapies administered in the hospital, the median price respondents considered to be fair was $2,300 for payers, $2,000 for physicians and $500 for patients. We refer to these prices as “baseline fair prices”.

Figure 2: Median Baseline Prices Considered to be Fair

Source: CRA research and analysis

Effect of context on perceptions of fairness

After identifying “baseline fair prices,” we provided alternative or additional information to understand how the respondents’ perceptions of fairness depend on varying characteristics of the therapy, the COVID-19 virus, the patient population and other factors. For example, we considered how the efficacy of COVID-19 vaccines and therapies (immunization effectiveness, symptom improvement, mortality benefits), and the level of population immunity and virus lethality impact respondent perceptions of what constitutes a fair price.

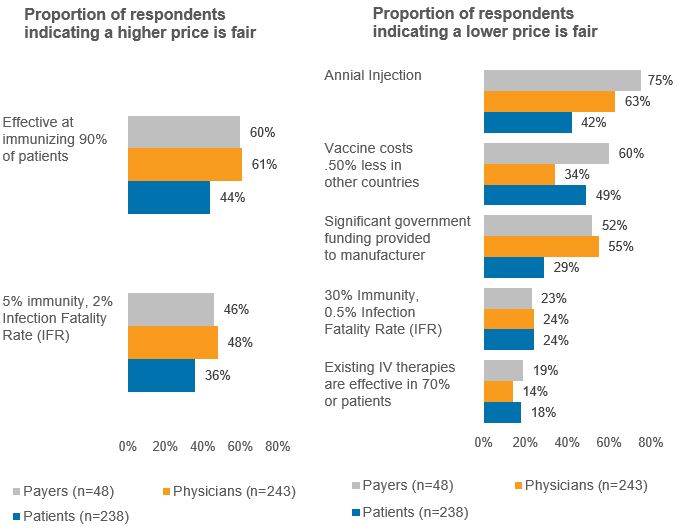

COVID-19 vaccine – For the archetype vaccine for COVID-19, several contextual elements were varied, and respondents were asked whether the prices that they previously identified as being fair – their baseline fair prices – still would be considered fair and whether higher prices would be considered fair. Figure 3 shows the percent of respondents who answered that a price higher than the baseline fair price would be considered fair, or that the baseline fair price would no longer be considered fair, when alternative or additional context is provided. For example, assuming the vaccine needs to be administered on an annual basis (vs. a one-time injection) results in the baseline price no longer being considered fair for a majority of payers (75%) and physicians (63%), but a much lower proportion of patients (42%). In contrast, most payers and physicians (60% and 61%, respectively) would consider a higher price to be fair if the vaccine is effective at immunizing 90% of patients (vs. 70% of patients), whereas only 44% of patients would consider a higher price to be fair in that context. Different assumptions about the proportion of the population with immunity at the time of vaccine availability (from 5% to 30% of the population) and the virus’ lethality (from 0.5% IFR to 2.0% IFR) had less of an impact on perceived price fairness, although 46% of payers and 48% of physicians do believe a higher price would be fair in the event of a more susceptible population and more lethal virus (5.0% immunity, 2.0% IFR).

Figure 3: Alternative contexts for archetype COVID-19 vaccine

Source: CRA research and analysis

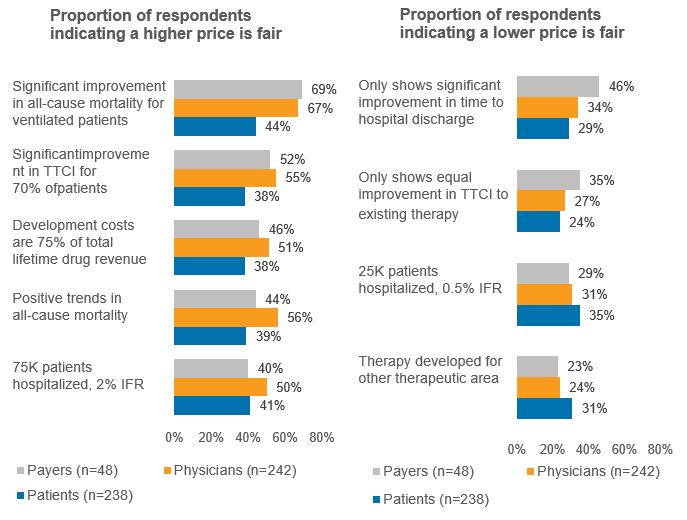

COVID-19 IV hospital therapy – Several contextual elements also were varied for the archetype IV hospital therapy, and respondents were asked whether the prices that they previously identified as being fair – their baseline fair prices – still would be considered fair, and whether higher prices would be considered fair. Figure 4 shows the percent of respondents who answered that a price higher than the baseline fair price would be considered fair, or that the baseline fair price would no longer be considered fair when provided with an alternative or additional context. Demonstrating a significant improvement in all-cause mortality among hospitalized patients who are ventilated results in a majority of payers (69%) and physicians (67%) considering a higher price as fair, while 44% of patients feel similarly. Varying assumptions around the virus lethality (from 0.5% IFR to 2.0% IFR) and number of patients hospitalized at the time the therapy becomes available (from 25,000 to 75,000 nationally) were not as impactful to respondent views on the level of price considered fair.

Figure 4 – Alternative contexts for archetype COVID-19 IV therapy

Source: CRA research and analysis

Conclusions

Research with U.S. payers, physicians, and patients was undertaken to understand perceptions of prices considered to be fair for COVID-19 vaccines and therapies under a wide range of contexts. The key findings are:

- COVID-19 vaccine – The study finds that for a one-time vaccine that would be effective in immunizing 70% of patients, the median price perceived to be fair is $100 for payers, $99 for physicians, and $50 for patients. Respondents were asked to assume that at the time the vaccine becomes available, 15% of the population would have immunity and the infection fatality rate would be 1.0%. The study varied these and other aspects of the vaccine description, such as its efficacy and whether it is a one-time vs. annual administration, to determine which characteristics drive the price level considered to be fair. The factor identified as most influential amongst variations considered with respect to perceptions of fairness for COVID-19 vaccine prices is whether the vaccine is a one-time or annual injection.

- COVID-19 hospital IV therapy – For an IV treatment for hospitalized patients, the study finds that for a 10-day course of therapy that would show a 40% improvement in time to clinical improvement (TTCI scale), the median price perceived to be fair is $2,300 for payers, $2,000 for physicians, and $500 for patients. Like the vaccine, respondents were provided with additional information to consider, e.g. 50,000 COVID-19 patients would be hospitalized, the infection fatality rate would be 1.0% and a vaccine would not become available for 12 months. The study varied these aspects of the IV hospital treatment description, such as different clinical outcomes and levels of efficacy, to determine which characteristics drive the price level considered to be fair. The factors identified as most influential amongst variations considered with respect to perceptions of fairness of

COVID-19 hospital IV therapies are measures of efficacy, including: significant reduction in all-cause mortality for ventilated patients, positive trend in all-cause mortality for hospitalized patients, and significant improvement in time to clinical improvement.

This study was designed to inform and contribute to the discussions about the issues and implications of pricing COVID-19 vaccines and therapies. It is an extension of ongoing CRA research on perceptions of fairness of pricing for other types of novel pharmaceuticals, including curative gene and cell therapies, and therapies used to treat rare chronic diseases (see http://www.crai.com/sites/default/files/publications/Fairness-of-Rare-Disease-Pricing-Payers-0620.pdf).

References

Kahneman, Daniel, et al. “Fairness as a Constraint on Profit Seeking: Entitlements in the Market.” American Economic Review, vol. 76, no. 4, 1986, pp. 728-741

McGraw, A. Peter, et al. “From the Commercial to the Communal: Reframing Taboo Trade-Offs in Religious and Pharmaceutical Marketing.” Journal of Consumer Research, vol. 39, no. 1, 2012, pp. 157–173

Piron, Robert, and Luis Fernandez. “Are Fairness Constraints on Profit-Seeking Important?” Journal of Eco-nomic Psychology, vol. 16, no. 1, 1995, pp. 73–96

Trujillo, Antonio J., et al. “Fairness in Drug Prices: Do Economists Think Differently from the Public?” Health Economics, Policy and Law, vol. 15, no. 1, 2018, pp. 18–29

Vogler, Sabine. “Fair Prices for Medicines? Exploring Competent Authorities’ and Public Payers’ Preferences on Pharmaceutical Policies.” Empirica, vol. 46, no. 3, 2019, pp. 443–469

Xia, Lan, et al. “The Price Is Unfair! A Conceptual Framework of Price Fairness Perceptions.” Journal of Marketing, vol. 68, no. 4, 2004, pp. 1–15

Author biographies

The views expressed in this paper are those of the authors and do not represent the views of Charles River Associates.

Andrew Parece, Vice President

Andrew Parece has more than 30 years of consulting experience, and specializes in competitive strategy, pricing, quantitative analysis and market research in the pharmaceutical, biotech, and life sciences industries. He has managed competitive assessments and product launch strategy engagements for several high-profile products and franchises. He earned an MBA from Cornell University.

Matthew Majewski, Vice President

Matthew Majewski has provided life science clients with analytically based solutions to their strategic issues for more than 15 years. He has led a range of engagements from product-related topics such as positioning, pricing, contracting, and navigating disruptive market events, to corporate challenges such as developing channel leadership, portfolio value creation, and organizational restructuring. He earned an MBA from Rutgers University.

David Persampieri, Vice President

David Persampieri brings more than 30 years of consulting experience in the life sciences industry. He focuses on assisting clients with the development of strategies to maximize the value of their products. His expertise includes the development of pricing and managed care strategies, opportunity assessments and helping clients remove barriers from their patients’ journeys to treatment. He earned a MS in Material Science and Engineering from Dartmouth College.

Joseph Black, Associate Principal

Joseph Black has successfully managed multiple projects to develop pricing and market access strategies for biopharmaceutical therapies across a broad range of therapeutic areas, focusing on oncology and rare disease. His experience includes pricing and contracting strategies, value story development, competitive simulation workshops, landscape assessments, stakeholder mapping and patient journey assessments. He received his MS in health economics and BA in biology and economics from Lehigh University.

---

[1] Kahneman, Knetsch, Thaler, “Fairness as a Constraint on Profit Seeking: Entitlements in the Market,” American Economic Review (September 1986, Vol. 76, No. 4).

[2] Gilead Sciences announced on June 29, 2020 that the price for remdesivir will be $390 per vial for governments of developed countries including the U.S., or $2,340 per 5-day course of therapy (6 vials of remdesivir). For U.S. private insurance companies, the price will be $520 per vial, or $3,120 for a 5-day course of therapy (see http://investors.gilead.com/news-releases/news-release-details/open-letter-daniel-oday-chairman-ceo-gilead-sciences). On July 22, 2020 Pfizer and BioNTech announced they will sell their mRNA-based COVID-19 vaccine to the U.S. government at an estimated cost of $19.50 per shot, with its $1.95B supply deal (see https://www.fiercepharma.com/pharma/pfizer-biontech-s-u-s-supply-deal-price-tag-leaves-room-for-decent-profit-covid-19-shot#:~:text=Pfizer%20and%20BioNTech%20will%20sell,a%20note%20to%20investors%20Wednesday). On Aug 5, 2020 Moderna agreed to early preorder deals for its experimental coronavirus vaccine that set a price of $32 to $37 per dose (see https://www.biopharmadive.com/news/moderna-coronavirus-vaccine-price-dose/582947/). On Aug 5, 2020 Johnson & Johnson pledged 100M coronavirus vaccine doses to U.S. for $10 each, with government committing an additional ~$1B in funding (see https://www.fiercepharma.com/pharma/j-j-scores-1b-contract-from-u-s-to-deliver-100-million-coronavirus-vaccine-doses).

[3] Throughout this paper, the term “fair” applies to responses that were either “somewhat fair” or “very fair”.

---

The conclusions set forth herein are based on research and publicly available material. The views expressed herein are the views and opinions of the authors and do not reflect or represent the views of Charles River Associates or any of the organizations with which the authors are affiliated. Any opinion expressed herein shall not amount to any form of guarantee that the authors or Charles River Associates have determined or predicted future events or circumstances, and no such reliance may be inferred or implied. The authors and Charles River Associates accept no duty of care or liability of any kind whatsoever to any party, and no responsibility for damages, if any, suffered by any party as a result of decisions made, or not made, or actions taken, or not taken, based on this paper. Detailed information about Charles River Associates, a trademark of CRA International, Inc., is available at www.crai.com.

Copyright 2020 Charles River Associates