Rethinking Global-To-Local Pricing And Market Access For Pharmaceuticals

By Christian Schuler, Joerg Tritschler, and Miguel Ferreira

A substantial share of biopharmaceutical drug launches (>50%) fail to meet their projected analyst forecasts (see also Simon-Kucher Biotech industry study 2019). With considerable investment going into strategy development and launch planning, this raises the question of why so many launches ultimately lag behind.

In order to maximize value extraction, companies need to optimize both launch sequence and pricing and market access (P&MA) outcomes — which means launching on time and on target in every single market. Although critical, in practice this may not always be the case.

P&MA excellence is one key ingredient to realize the full value of a therapeutic innovation — including not only P&MA strategy development (and launch sequence optimization), but also local P&MA strategy implementation upon launch. When preparing for launch, indeed we see biopharmaceutical companies spending a significant amount of time and resources to get their P&MA strategy right, but it is critical to also ensure that local markets are individually and optimally prepared to roll it out on a global level consistently.

Simon-Kucher Industry Study Details

Against this background, Simon-Kucher has conducted a comprehensive industry study with a representative sample of 19 experienced senior executives working in P&MA and commercial functions. The study seeks to understand the status quo of P&MA launch preparations for new pharmaceuticals, as well as the main barriers and key success factors in practice for a best-in-class drug launch from a P&MA perspective.

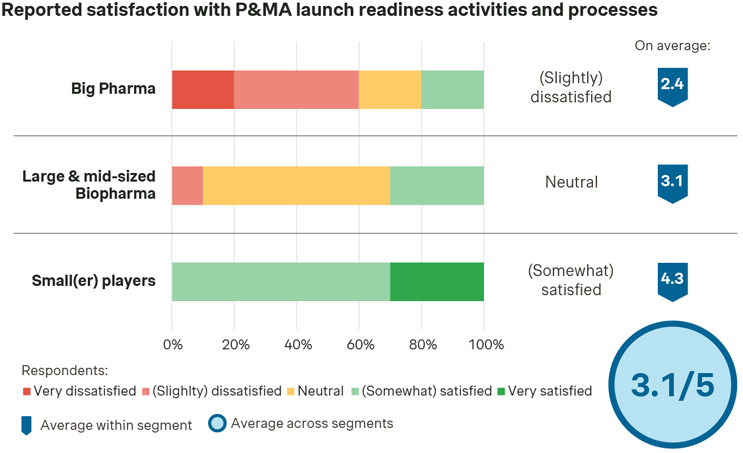

Larger Companies Dissatisfied With Current P&MA Launch Readiness Processes

Our industry study shows that a significant share of senior executives is not fully satisfied with their P&MA launch readiness activities. There is a strongly perceived room for improvement — confirming that local strategy roll-out is a key shortcoming.

Source: Simon-Kucher Industry Study (n=19).

Big Pharma manufacturers are most dissatisfied in comparison to their peers, although responses vary significantly within the segment (also applicable to large and midsized biopharma companies). On the contrary, small(er) players reveal the highest level of satisfaction of all.

Indeed, in Big Pharma, the asset portfolio and coverage of different disease areas is typically quite large. In addition to the need for coordination across many stakeholders within well-established structures and processes, this makes P&MA launch readiness considerably more complex and challenging. In contrast, small(er) players may be focused on one product only, with a smaller number of key stakeholders in the team. Therefore, they have more targeted and in-depth knowledge of that one asset, and their increased flexibility provides a further explanation for these results as well.

However, drawing definitive conclusions on the root causes for the strikingly suboptimal level of satisfaction with internal P&MA launch readiness processes still requires a closer look into the actual approach undertaken by the various companies.

P&MA Launch Readiness At The Global HQ Level

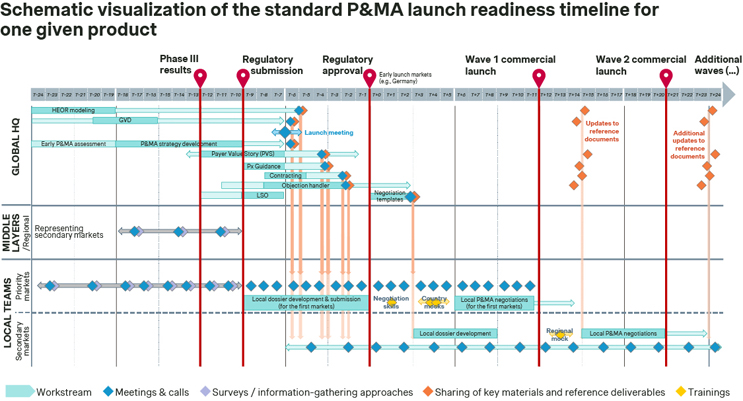

Mapping out the key activities and processes in the lead-up to a product launch is essential

both to create transparency and to be able to identify critical areas with room for improvement in the overall P&MA preparation process.

However, during Simon-Kucher’s industry study, most senior executives reported difficulty in keeping a clear overview of all the various workstreams taking place (incl. “who does what by when”) — and most importantly, how everything fits together into a ‘bigger picture.’ This sentiment indicates limited transparency and the lack of a truly integrated perspective on P&MA launch readiness.

Building on the insights from senior executives gathered during our industry study, Simon-Kucher mapped out what the standard P&MA ‘launch curriculum’ for one given product may typically look like. Despite differences that may of course apply to each company, there is a common skeleton of consistent interactions across different layers of organizations including global, regional, and local.

Source: Simon-Kucher Industry Study (n=19).

Prior to the launch meeting, global HQ focuses mainly on P&MA strategy development (which is then crystalized in a series of reference documents). Until the Phase 3 read-out, the key workstreams usually include HEOR modelling as well as developing the Global Value Dossier and the P&MA strategy. After that, all the additional key P&MA strategy building blocks are gradually developed, following a logical sequence and building on each other. During the launch meeting that follows, which serves as the main introductory touchpoint, the P&MA strategy is then presented to the whole organization, including all affiliates. The various materials and reference deliverables are gradually made available (with some flexibility), and a walkthrough is typically also provided. Finally, shortly before launch, mock workshops are often used to help ensure that (some of) the local teams are trained first-hand in how to communicate the asset’s value and negotiate.

The overall theme, though, is that P&MA strategy development typically focusses on only a few high priority markets (typically the U.S., Germany, France, as well as Japan and China). The majority of non-core countries worldwide (e.g. Italy, Spain, the Nordics, Canada, Australia, Brazil, Saudi Arabia, and many more), on the other hand, are only involved in P&MA strategy development and execution at a later stage. At best, they might be represented in high-level terms by regions acting as middle layers.

The result is that these non-core markets don’t usually receive tailored support for their P&MA strategy execution. Non-customized strategic P&MA guidance and P&MA reference materials (such as the product value story, payer objection handlers, innovative contracting guidance, etc.) are passed on to all affiliates at the same time — usually very early on, around the central launch meeting.

This standardized timeline typically fits the launch in priority markets. However, this does not necessarily fit the launch timing of most non-priority markets — both for advanced countries (such as Italy, Spain, the Nordics, Netherlands, Switzerland, Canada, Australia, etc.) and developing ones as well (such as Brazil, Argentina, Saudi Arabia, etc.). In fact, many of these many secondary markets might not launch for another 2-plus years.

The consequence is that many affiliates (of non-core markets) only have a limited bandwidth and perceived urgency when receiving this non-tailored P&MA information material and feel “left alone” when needing to execute and implement the P&MA strategy for a specific product. Overall, there are also significantly less frequent interactions of HQ stakeholders with non-core market stakeholders during P&MA launch preparations, even though those local teams are most in need for ongoing support.

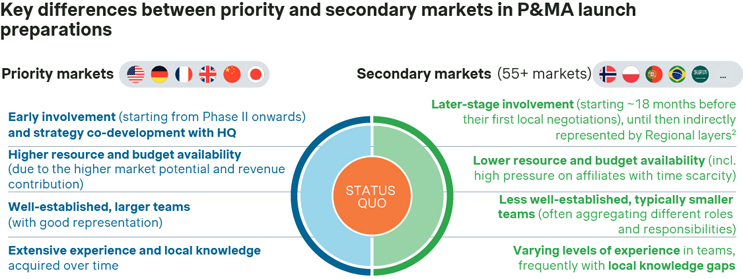

Source: Simon-Kucher Industry Study (n=19).

It should therefore not come as a surprise that secondary markets are not well prepared for their P&MA execution and negotiations, and often show sub-optimal or strongly varying P&MA outcomes. The result is a striking imbalance between core and non-core markets, with available P&MA investment and resources not matching the individual countries’ need for support:

Note that although the typical core or primary markets constitute a stronger strategic priority, the ‘secondary’ healthcare markets combined still represent a significant total share of (potential) global revenue up to approximately 25% to 30%. Additionally, such non-core markets with sub-optimal P&MA outcomes may have costly repercussions on global core markets given impacts via international reference pricing (IRP). As a result, there is a strong imperative for a holistic P&MA launch optimization and consistent local preparation and implementation across all markets so that companies successfully reach their global target P&MA aspiration for a given asset.

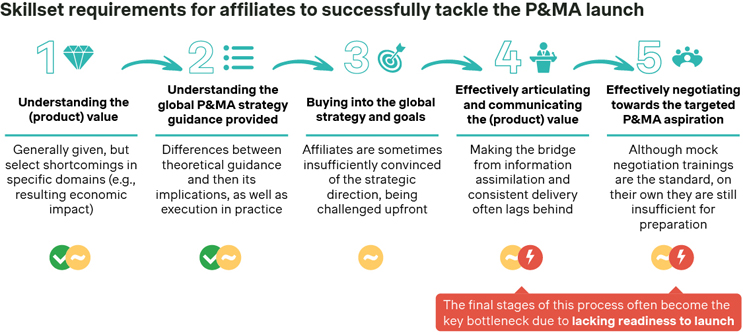

P&MA Imbalance Between Core And Non-Core Markets Creates Local Challenges

To optimize their P&MA launch readiness processes and successfully tackle local P&MA negotiations with their healthcare authorities, local affiliates must have acquired a set of key skills by the time of launch. However, the Simon-Kucher industry study indicates that affiliates frequently struggle along this preparation process, especially with regards to effectively articulating the product value of a new innovative therapeutic asset and negotiating toward the targeted P&MA aspirations for the asset:

Source: Simon-Kucher Industry Study (n=19).

Key Success Factors For Overcoming P&MA Challenges At Affiliates

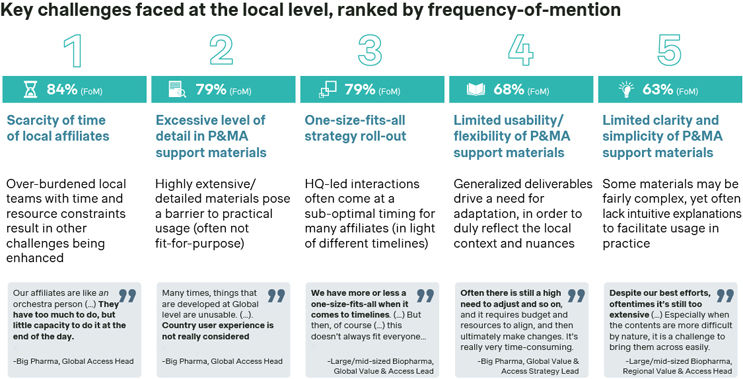

Simon-Kucher’s industry study shows that scarcity of preparation time is the most pressing challenge faced by local affiliates (mentioned by 84% of respondents). It lies at the genesis of all other local-level shortcomings, exacerbating and making them all the more pressing in light of an already high workload. The other main barriers then relate to P&MA support to affiliates often being neither fit-for-purpose materials nor provided at the right time — i.e., when most needed, considering their local launch timelines (both aspects mentioned by 79% of respondents, respectively).

Source: Simon-Kucher Industry Study (n=19).

In this context, biopharmaceutical companies are further faced with an evolving P&MA landscape which becomes increasingly more strict — with greater net price transparency, growing regional HTA cooperations and the requirements of a EU Joint Clinical Assessment, intensified payer budget management, and more complex national P&MA environments. The unanimous expectation of our interviewees is that these developments will only add to the existing P&MA launch readiness challenges at a company, and even enhance them.

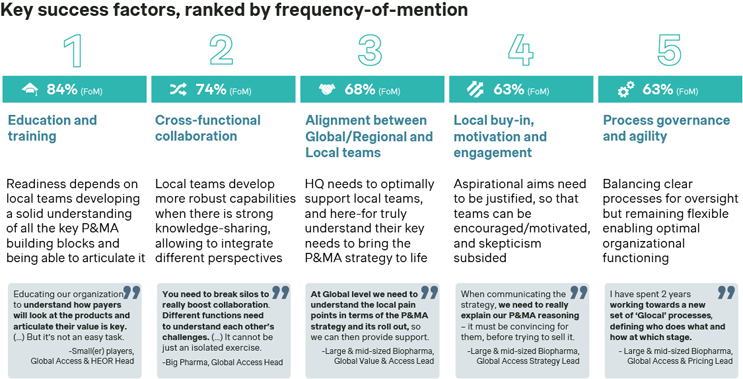

So, what are the most relevant success factors to counter these challenges? The key success factors for a successful global-to-local activation and P&MA strategy execution in non-core markets relate to ensuring that local affiliates get well-prepared within the least possible time to articulate and defend the value of a product and its underlying P&MA strategy. This is unanimously perceived to be achieved primarily through optimal education and trainings tailored to the local team’s needs (mentioned by 84% of respondents). Other key considerations include cross-functional collaboration (mentioned by 74% of respondents) and thorough alignment across all levels (mentioned by 74% of respondents). This is followed by local team engagement, and a delicate balance between process governance and agility (both aspects mentioned by 63% of respondents, respectively).

Source: Simon-Kucher Industry Study (n=19).

Key Takeaways And Recommendations For Optimizing P&MA Launch Readiness

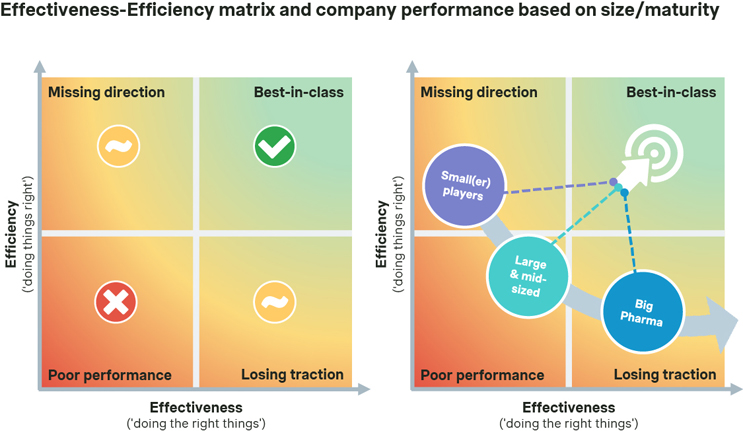

Based on our study results, many pharmaceutical companies appear to be ‘doing the right things’ (effectiveness), but the majority are oftentimes not ‘doing things right’ (efficiency). However, both are necessary to succeed. Excelling in both dimensions becomes all the more critical given the main challenge of constantly overburdened affiliates. The key goal is supporting affiliates in the most effective and time-efficient way in order to make them succeed on the P&MA front.

Source: Simon-Kucher Industry Study (n=19).

It is important to note that — based on our study results — there are differences between biopharmaceutical companies and the key challenges they face, especially depending on their maturity stage. While younger and less mature organizations may be 'missing direction' in their P&MA launch readiness approach, larger and more mature pharma companies are often 'losing traction’:

However, certain key challenges remain regardless of organizational size and maturity level. Especially local teams’ typical scarcity of time and resources, especially across secondary non-core markets is a common theme based on our industry study. Against this background, and considering the experience reported by the senior executives taking part in Simon-Kucher’s industry study, three key recommendations emerge for pharmaceutical companies:

- Map out the organization’s internal P&MA activities and processes (in detail).

Transparency in your company’s P&MA process is the first step toward optimization by illustrating the status quo and allowing it to uncover potential shortcomings in the current launch readiness processes (both in terms of effectiveness and efficiency).

- Develop a fit-for-purpose product-specific ‘P&MA launch curriculum.’

Affiliates' scarcity of time is perceived as the most pressing challenge across organizations — so optimization efforts should focus on making the educational journey for affiliates more time-efficient (e.g., by developing more easily absorbable and digestible (e-)learning materials).

- Consult with local affiliate teams and integrate their user experience perspective.

Local-level affiliate perspectives on key operational challenges, tactical P&MA support needs as well as training suggestions should be considered and duly integrated (first prior to launch, and then also retrospectively).

Defining A Best-In-Class, Product-Specific P&MA Launch Program

In sum, a best-in-class P&MA Launch Excellence program needs to collectively address all the previously identified challenges and key success factors.

The most important value driver for such a program would be undoubtedly time-efficiency for local affiliate teams. Achieving this will require gearing the key P&MA launch readiness resources to be developed in practical formats, with enhanced usability and flexibility accounting for local nuances, and ensuring that all contents can be easily understood by favouring clarity and simplicity. Enabling a country-specific, flexible strategy roll-out and supporting it at the right point in time is equally critical.

This also goes in line with the key success factors outlined in this industry research, with a lean educational journey ranking number one. A further key element is alignment at all levels — both cross-functionally, as well as between HQ and local teams. Local buy-in, motivation and engagement are not to be neglected, and finally a delicate balance should be sought between process governance and agility.

About The Authors:

About The Authors:

Christian Schuler is a Senior Partner and Head of the Health Sector at Simon-Kucher, based in the Munich office. With over two decades of experience, he specializes in pharmaceutical marketing, pricing strategies, market entry, and commercialization strategies. Christian has supported top global pharma, biotech, and medtech companies in successfully bringing innovations to market.

Joerg Tritschler is a Partner in Simon-Kucher’s Life Sciences division, based in the Zurich office. With over a decade of experience across multiple offices, he specializes in international pricing, market access strategies, and commercial excellence for pharmaceuticals. His expertise includes payer-rationalized trial design, value communication, and portfolio development strategies.

Joerg Tritschler is a Partner in Simon-Kucher’s Life Sciences division, based in the Zurich office. With over a decade of experience across multiple offices, he specializes in international pricing, market access strategies, and commercial excellence for pharmaceuticals. His expertise includes payer-rationalized trial design, value communication, and portfolio development strategies.

Miguel Ferreira is a Senior Manager in Simon-Kucher's Life Sciences division, based in the Munich office. With a background in international management and over 5 years of experience in life science consulting, he is dedicated to supporting clients with diverse strategic topics such as international pricing and market access strategy development, launch sequence optimization, negotiation excellence, and operational excellence.

Miguel Ferreira is a Senior Manager in Simon-Kucher's Life Sciences division, based in the Munich office. With a background in international management and over 5 years of experience in life science consulting, he is dedicated to supporting clients with diverse strategic topics such as international pricing and market access strategy development, launch sequence optimization, negotiation excellence, and operational excellence.