Strong Regulatory Compliance And Reliability Indicative Of Solid Partnership Choices Price Not The Driver Of Outsourcing Decisions

By Kate Hammeke, research manager, Nice Insight

There are dozens of articles on the Internet and in industry publications that suggest what to look for when selecting a CRO or CMO partner. One must consider factors such as the stability of the organization, possible barriers to producing necessary end results, the relationship between the monitor and site, and the qualifications of the team members who will be working on the job. However, reviewing these measures for every potential service provider can prove exhausting, expensive, and time-consuming.At present, there is debate surrounding the potential value in using online search tools to identify and short-list prospective partners. Contrarians assert the need to meet with companies directly, in person, to assess their capabilities and suggest visiting trade shows as the most effective means of finding the right fit. They speculate on the legitimacy of the listings on directory sites, as well as the reviews, since many service providers lack transparency in their ratings. Supporters of online CRO/CMO selection tools agree that the final decision in selecting a CRO/CMO should only be made after in-person meetings, yet they iterate the necessity of a device that narrows the prospective choices down to a reasonable number to reduce the time and cost of direct skill assessment.

be working on the job. However, reviewing these measures for every potential service provider can prove exhausting, expensive, and time-consuming.At present, there is debate surrounding the potential value in using online search tools to identify and short-list prospective partners. Contrarians assert the need to meet with companies directly, in person, to assess their capabilities and suggest visiting trade shows as the most effective means of finding the right fit. They speculate on the legitimacy of the listings on directory sites, as well as the reviews, since many service providers lack transparency in their ratings. Supporters of online CRO/CMO selection tools agree that the final decision in selecting a CRO/CMO should only be made after in-person meetings, yet they iterate the necessity of a device that narrows the prospective choices down to a reasonable number to reduce the time and cost of direct skill assessment.

No matter where one’s experience and opinions have led them with respect to this debate, when faced with the need to reduce the cost and expense of researching and selecting the right outsourcing partner, Nice Insight suggests developing a short list by focusing on each company’s regulatory compliance and reliability. In reviewing the data from our quarterly survey of CRO/CMO-facing members of the pharmaceutical and biotechnology industries, we found a pattern among the industry leaders and the attributes closely associated with winning projects.

The Same Five Companies Appear

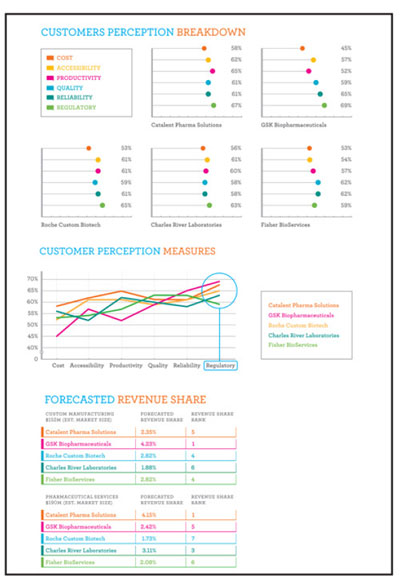

We selected the top 20 companies by potential revenue (budget already allocated according to our respondents) to see what, if anything, these businesses have in common and what separates them from their competitors. Not surprisingly, the same 5 companies appeared in the Top 20 by potential revenue share for both pharmaceutical analysis and custom manufacturing. As such, we focused on the results of these five companies: Catalent Pharma Solutions, Roche Custom Biotech, Charles River Laboratories, Fisher BioServices, and GlaxoSmithKline.

Through in-depth conversations with pharmaceutical and biotechnology industry thought leaders, we established six key attributes that decision makers consider when selecting potential partners. Respondents rank these attributes in order of importance, and the ranking determines the weight we apply to each of the measures to generate an overall Customer Perception score. Our first quarter results provided the following ranking: Quality, Reliability, Regulatory, Cost, Productivity, and Accessibility.

We sought to establish which industry drivers correlate to partner selection by viewing the breakdown of each company’s Customer Perception score. Sure enough, there was a pattern: The companies that allocated the largest potential spend in pharmaceutical analytical services and custom manufacturing achieved the highest ratings in regulatory compliance and reliability.

By focusing on reliability and regulatory compliance when conducting a search for a partner, one is able to gain a strong understanding of the business’ stability, dependability, and ability to fulfill projects. Success on these measures encompasses the key criteria suggested for review when selecting a CRO/CMO in industry publications. Additionally, excelling in these drivers is predictive of quality — something difficult to assess when looking to form a new relationship.

Interestingly, pricing perceptions didn’t factor as heavily as the survey respondents implied, with each of the five companies lowest ratings turning up in the cost/affordability category among the companies selected for projects. It appears the common notion that pricing is the ultimate influencer does not apply to outsourcing partner selection. After all, average ratings regarding a company’s affordability, coupled with the largest forecasted market share, indicates that higher prices won’t necessarily prevent them from winning business. Rather, the organizations that rank highest on communicating regulatory compliance and reliability will continue to capture market share.

Used with permission from Life Science Leader magazine.