The Impact Of CETA On The Pharmaceutical Industry

By Yazan Saleh, associate analyst, Decision Resources Group (DRG)

The Comprehensive Economic and Trade Agreement (CETA) is a free-trade agreement signed between Canada and the EU at the end of 2016. Described by the Canadian government as “one of the most ambitious trade initiatives,” the scope of the agreement extends across all sectors of the economy from agriculture to healthcare to pharmaceuticals.

The Comprehensive Economic and Trade Agreement (CETA) is a free-trade agreement signed between Canada and the EU at the end of 2016. Described by the Canadian government as “one of the most ambitious trade initiatives,” the scope of the agreement extends across all sectors of the economy from agriculture to healthcare to pharmaceuticals.

For Canadian businesses, the agreement will reduce trade barriers for access to Canada’s second-largest trading partner and the world’s second-largest economy. Similarly, European companies will enjoy opportunities for growth in Canada because of improved regulations and access to new market sectors. Overall, CETA will eliminate 99 percent of all tariffs between the trading partners upon signing, with the remaining 1 percent of tariffs to be eliminated over the next three to seven years. The impact of CETA on the life sciences industry is rooted in regulatory changes surrounding IP protection and government procurement as described below.

PATENT TERM RESTORATION

The level of IP protection in Canada has traditionally been a concern for multinational corporations (MNCs) as evidenced by consistent inclusion as a “Watch List Country” on the USTR (Office of the United States Trade Representative) Special 301 Report and its corresponding PhRMA submission. Prior to the signing of CETA, Canada was the only G7 country that did not incorporate any patent-term-restoration provisions in its legislation. As a result, some of the market exclusivity period for pharmaceutical products was lost while patentees were awaiting regulatory approval. Once ratified, CETA will help address this issue by allowing patentees to extend their patent terms for a certain duration depending on how long Health Canada’s approval takes. The exact length of the restoration period will be calculated by subtracting five from the period between the patent filing date and the marketing approval date (i.e., Notice of Compliance [NOC] date). Patent-term restoration, which is officially referred to in Canada as a certificate of supplementary protection (CSP), will not be retroactively available to already-approved products and will be capped at a maximum of two years. When compared to other countries, this cap falls short as EU countries allow patent-term restoration of up to five years. Nevertheless, the policy is a step in the right direction for the industry, as it will help recover some of the time lost from the 20-year term of a pharmaceutical patent.

RIGHT TO APPEAL

Patent linkage regulations in Canada require that generic (and biosimilar) manufacturers issue a notice of allegation (NOA) document to patent holders when seeking marketing approval for their generic products. The NOA should describe noninfringement of all the relevant patents or demonstrate how the patents are invalid if the generic company is making such a claim. The patentee would then have a 45-day period to decide whether to take action against the marketing of the generic product through the Federal Court of Canada. Overall, a 24-month stay period will begin when the patent holder initiates such an action. During this stay period, the Minister of Health may not issue an NOC to the generic company unless the federal court finds that the parties involved in the challenge were not acting with due diligence. The federal court decisions regarding the challenge could previously be appealed by the generic company but not by the patentee. CETA will give both the challenger and the patentee equal appeal rights, thus allowing court decisions to be potentially reversed regardless of the initial outcomes.

GOVERNMENT PROCUREMENT

Under CETA, Canadian and EU governments will allow businesses from any of the signatory countries to place bids on public tenders. Policies that favor local companies and products are to be eliminated, thus putting foreign companies on a level playing field with their domestic counterparts. A significant growth opportunity exists as European and Canadian government procurement markets amount to more than $2.6 trillion and $100 billion respectively. Most importantly, CETA will open up tenders to foreign businesses at the subnational level, thus allowing EU companies to place bids on provincial and municipal tenders in Canada (and vice versa). This change is particularly relevant to the healthcare and pharmaceutical sectors, as procurement of medications in Canada is largely conducted at the subprovincial level. Pharmaceutical manufacturers and suppliers will face some challenges in navigating the fragmented procurement system of each province. Nevertheless, direct access to hospital-level and regional public procurement agencies is undoubtedly an untapped market for foreign pharmaceutical manufacturers.

IMPLEMENTATION TIME FRAME

In Canada, Bill C30 (Canada-European Union Comprehensive Economic and Trade Agreement Implementation Act) received royal assent to become law in May 2017. The Canadian government has since begun publishing the impending regulatory changes for a public review process. In the EU, implementation of trade agreements generally depends on whether the union has exclusive competence or shared competence. Exclusive competence means that the executive arm of the EU, also known as the European Commission, can finalize the agreement solely. On the other hand, shared competence requires that both the European Commission and the individual European governments must approve and finalize the agreement prior to implementation. CETA has been introduced as a mixed- type agreement whereby the EU has exclusive competence for some provisions and shared competence for others. Since the EU approved CETA in May, exclusive-competence provisions, which account for over 90 percent of the provisions in CETA, will come into effect without requiring specific EU-member-state approval. According to a statement released by the Canadian Prime Minister and the President of EU Commission, and by the time this article goes to print, CETA provisional approval will have begun on Sept. 21, 2017. Provisions that require individual member states’ approval include those covering investment protection and the formation of the investment court system. As of September 2017, five EU countries — Croatia, Czech Republic, Denmark, Latvia, and Spain — have approved the agreement at their respective parliaments.

RECOMMENDATIONS FOR THE INDUSTRY

Innovator companies choosing to challenge generic manufacturers for infringement must act with due diligence as they could be held liable for delaying generic entry. For example, if the patent detailed in the NOA is deemed invalid by the Court of Canada, the generic manufacturer can seek compensation from the patentee for lost revenue for the period that begins on the date of the challenge. Particularly important is that the end date of the period for which damages can be claimed is no longer specified in the regulations. In other words, generic companies can try to argue for “future damages” that extend beyond the date that the final court decision is made. In light of the potential for increased damages, innovator companies should consider the option to avoid any liability by renouncing the 24-month stay period. In such a case, a generic product would be eligible to receive market authorization in the interim while the patentee could continue to pursue action for infringement.

In addition, companies seeking to acquire patentterm restoration in Canada should take extra note of the eligibility criteria for filing for CSP. According to the amended Patent Act, a manufacturer must file a CSP application within 18 months of filing marketing approval in any of the following international jurisdictions: Australia, EU (and any member country), Japan, Switzerland, or USA. Therefore, MNCs must ensure coordination in their international drug submissions to maintain eligibility for patent-term restoration in Canada. This deadline is set to become more restrictive one year after the implementation of CETA, as the 18-month time period is to be reduced to 12 months. Strengthening communication and work-sharing between the different market-access teams of a multinational manufacturer will be imperative to successfully meeting the deadlines for CSP applications.

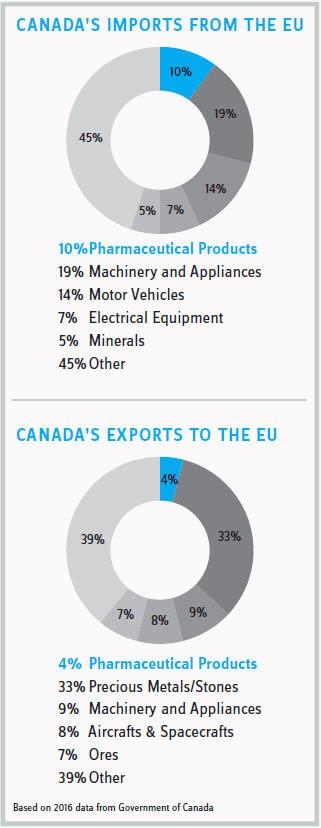

MNCs should consider taking advantage of the enhanced IP protection in Canada by boosting investment in manufacturing and research & development activities. Canada’s attractiveness for pharmaceutical manufacturers is further highlighted by having the lowest business costs across the G7 countries for biomedical research and development. A significant opportunity for growth exists, considering that Europe is currently Canada’s second-largest export market for pharmaceutical products ($1.04 billion in 2016). Since many of the changes brought about by CETA are regulatory changes made to federal laws, life sciences companies outside of Europe also will benefit indirectly from CETA. For example, patent-term restoration provisions will be applicable to all pharmaceutical manufacturers regardless of their geographic locale.

MNCs should consider taking advantage of the enhanced IP protection in Canada by boosting investment in manufacturing and research & development activities. Canada’s attractiveness for pharmaceutical manufacturers is further highlighted by having the lowest business costs across the G7 countries for biomedical research and development. A significant opportunity for growth exists, considering that Europe is currently Canada’s second-largest export market for pharmaceutical products ($1.04 billion in 2016). Since many of the changes brought about by CETA are regulatory changes made to federal laws, life sciences companies outside of Europe also will benefit indirectly from CETA. For example, patent-term restoration provisions will be applicable to all pharmaceutical manufacturers regardless of their geographic locale.

OVERALL IMPACT AND CONCLUSION

CETA is estimated to boost total trade between Canada and the EU from $71.4 billion to $85.68 billion. For life sciences companies, the new appeal rights and patent-term-restoration provisions will offer innovator companies increased protection against generic competition, which could potentially improve market share and boost revenue. On the other hand, provincial governments in Canada, which are largely responsible for funding reimbursed drugs, could face increased financial pressures because of the higher prices of patented drugs. For the industry, this can lead to negative consequences as provincial governments may be forced to omit coverage for new innovative therapies because of cost constraints. To help allay such fears, soon after signing CETA, the federal government of Canada noted that shifting expenses inappropriately onto the subnational government is not the intent, indicating that they would discuss the “cost of CETA” with the provinces at the appropriate time. It has been proposed that the federal government might consider providing some financial assistance to the provinces to help offset any unintended costs of CETA. Interestingly, the provisional implementation of CETA comes around the same time when the U.K. might begin proceedings to leave the single EU market. With the U.K. being Canada’s third-largest trading partner, governments of both countries have expressed a desire to preserve the deal in the post-Brexit era. Therefore, it is not unlikely that the U.K. and Canada will use CETA as a basis for negotiations to sign another very similar deal to maintain the trading benefits once the U.K. exits from the EU.

Yazan Saleh is an associate analyst on the Global Market Access (GMAS) Insights team at Decision Resources Group (DRG). He is responsible for monitoring the evolving healthcare and pharmaceutical landscapes with a focus on Canada, China, Japan, Saudi Arabia, and South Africa.