The Impact Of The Russia–Ukraine War On Clinical Trials

By Vladimir Misik, Ph.D., VIARES Academy

The war in Ukraine initiated by Russia has far-reaching global consequences. The majority of the leading global economies have imposed tough economic sanctions against Russia. Many global brands, including, but not limited to, McDonald’s, PepsiCo, Shell, Marriott, British American Tobacco, H&M, IKEA, Nestlé, and Nike, are closing or have closed their offices/stores in Russia and/or are suspending planned investments.1

While the export of life-saving pharmaceuticals does not fall under sanctions for ethical reasons, all major pharmaceutical companies have vowed to stop new investments in Russia, including clinical trials (CTs).2–4 Discontinuing the recruitment of new patients into ongoing CTs in which sites in Russia are participating and not placing new CTs in Russia are going to have a dramatic impact on innovative biopharma CTs (iBPCTs) in Russia and the associated socioeconomic benefits they bring. The war is naturally also impacting CTs in Ukraine: Among the millions of refugees are active or potential CT patients, investigators, and site staff; hospital infrastructures have been impacted directly and indirectly; importation of IP and CT supplies via air freight has become impossible with only land routes remaining and distribution of supplies to many CT sites is challenging or impossible; and, similarly, export routes of biospecimens for analysis in central study labs is a logistical challenge.

Previous articles have surveyed the iBPCTs landscape in Russia utilizing data by GlobalData and outlined the possible pipeline consequences both in Russia and globally.5–7 The conclusions were based on the number of impacted CTs by sponsors and therapeutic indications.

In this article, we go a step further, using our bespoke active sites methodology to provide a snapshot of iBPCTs at the time when Russia invaded Ukraine and also to project the likely impact not only on the two countries but also on global CTs. We also outline the broader socioeconomic consequences to both countries. Of interest to the reader, and contrary to assertion that sanctions do not work, may be a recently released authors’ preview published by a team from Yale School of Management and Yale Executive Leadership Institute demonstrating that the sanctions are already crippling the Russian economy.8

The methodology for analyzing global trends is based on an analysis of active studies and sites reported through various CT registries, including but not limited to clinicaltrials.gov and EudraCTs. This methodology has been utilized to analyze global geographic CT trends previously.9–12 You can find additional information about this methodology, model assumptions, and definitions in the appendix to this article: Methodology, Data Sources, And Model Assumptions.

Snapshots Of Pre-War CT Landscapes In Russia And Ukraine

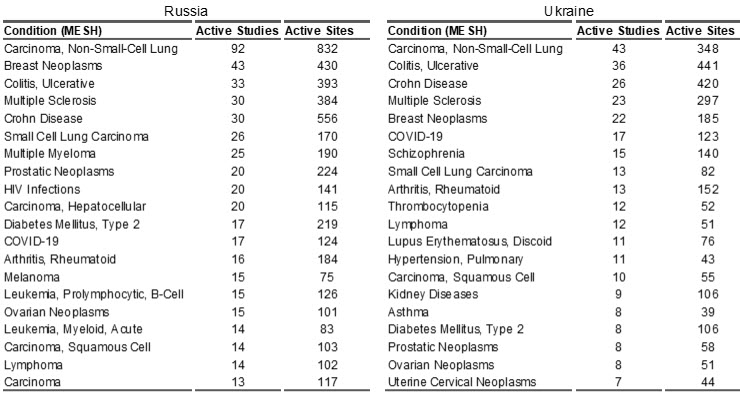

Russia: On February 24, 2022, when Russia invaded Ukraine, there were 1,243 active CTs in Russia involving 10,158 sites. In 2021, Russia ranked 11th in terms of global biopharma CT market share, with 2.44% of global share. The top 10 therapeutic areas for CTs in Russia are shown in Table 1, with the majority in oncology.

Ukraine: Ukraine’s iBPCT market was approximately ½ of Russia’s. When the war started, there were 612 active studies in Ukraine, conducted at 5,015 sites. In 2021, Ukraine ranked 18th in terms of global biopharma CT market share, with 1.18% of global share. The top 10 therapeutic areas for CTs in Ukraine are shown in Table 1, also the majority in oncology.

Table 1. Top 20 (based on the number of active studies) therapeutic conditions (MESH terms) in Russia and Ukraine as reported by trial sponsors. Source of data: LongTaal CT Informatics, data refreshed on August 16, 2022.

Expected Socioeconomic Impact Of The War And Sanctions In Russia And Ukraine

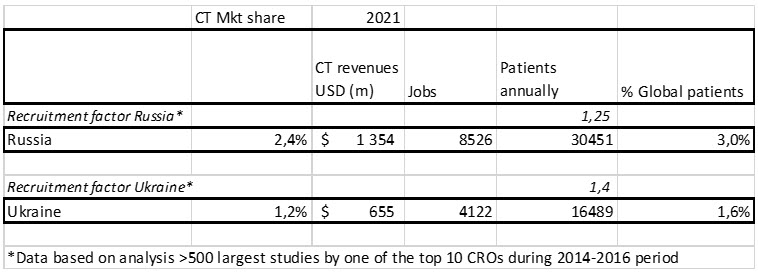

Using the methodology outlined in the methodology, Data Sources, And Model Assumptions section of this article, Table 2 summarizes the socioeconomic value of innovative biopharma CTs (iBPCTs) in Russia and Ukraine.

Table 2. Socioeconomic value in 2021 of iBPCTs in Russia and in Ukraine: estimated iBPCTs revenues, number of jobs in the country related to, or supporting iBPCTs, and estimated number of patients (iBPCT participants) in each country. Source: LongTaal CT Informatics, data from December 2, 2021.

As seen in Table 2, in 2021 the combined innovative biopharma CT market share of Russia and Ukraine was 3.6%, with Russia’s market share (measured in terms of active iBPCTs) being double that of Ukraine. More importantly, Russia and Ukraine contributed an estimated almost 5% of global iBPCT patients.

Estimated Global iBPCT Pipeline Impact

Given the sanctions imposed by the vast majority of the developed countries as well as the disruptions (or anticipated disruptions) caused by war, we analyzed the current iBPCT footprint in Russia and in Ukraine and came to the following conclusions:

Russia

Of the 1,233 iBPCTs active in Russia at the start of war, 1,135 (or 91.6%) were conducted by top 100 international companies and of the more than 10,000 active iBPCT sites, 9,193 (or 90.2%) were conducted by those companies. Out of these, only 27 studies (2.4%) and 123 sites (1.3%) were conducted by Russian pharma companies (Biocad, Valencia Pharm, and R-Pharm). More than 50% of all iBPCT studies and sites were conducted by the top 10 international iBPCT sponsors. These data contradict the recently published data by Synergy Research Group, suggesting that the top 10 Russian sponsors command 16% of CT market share in Russia, while the top 10 international iBPCT sponsors command 40% market share.13 The difference is likely a result of counting (with the same weight) bioequivalence studies, which are just an insignificant fraction of the total global iBPCT R&D spend and thus can be excluded when assessing the impact of sanctions.

Since all western international iBPCT sponsors have pledged and are likely to adhere to sanctions imposed on Russia, have halted recruitment of new patients into ongoing CTs, and will not initiate new trials in Russia, over the next three years iBPCT activity is expected to result in an almost 90% reduction from the pre-war levels. This will lead to a loss of 2.2% of global iBPCT market share, resulting in a greater than $1.2 billion loss of annual economic value, a loss of almost 8,000 high-end jobs created by the iBPCT industry, and more than 30,000 patients annually will lose access to cutting-edge experimental therapies. This impact is likely to last well beyond the end of the conflict – at least for the duration of sanctions (which are likely to last several years) – and possibly well beyond that, as perceptions of countries among sponsors of clinical trials and those making decisions regarding allocation of resources among countries play an important role in the country selection process.

Given the overwhelming share of western iBPCT sponsors in the Russian CT market (see analysis above), it is unlikely that such market share loss can be compensated for to an appreciable degree by Russian, Chinese, and Indian companies, the majority of which produce mostly generic compounds and represent only a small fraction of total global biopharma R&D spend.

Ukraine

The short- to midterm impact of the war in Ukraine will be similar to that of Russia: Due to war-related (or anticipated war-related) disruptions, most sponsors have halted recruitment of new patients in ongoing CTs and have paused initiation of new CTs.

Many patients from the active studies discontinued their trials due to their war-initiated displacements, either inside Ukraine or abroad. An example of good practice is the guidance document to the industry to enable continuation of exiled CT patients from Ukraine which has been released recently.14

This situation is likely to continue as long as there are risks (real or perceived) of the impact of the war on CTs. However, unlike in Russia, there is expected to be a revival of iBPCTs with the cessation of hostilities or upon reaching some kind of negotiated peace deal. Lessons learned from the 2014 occupation of Crimea, as well as parts of the Luhansk and Donetsk regions, show that pharma is prepared to adapt quickly to the changed situation: In 2014, a majority of large pharmas and CROs, rather than stopping activities in Ukraine on ongoing CTs, moved patients from impacted regions to other sites in Ukraine. For planned studies, they identified additional sites in western Ukraine to compensate for sites in the occupied territories, resulting in a growth of iBPCT market share between 2014 and 2017 (data by LongTaal, not shown).

For this report, we were able to obtain only informal information from a top tier CRO, a top tier biopharma, and a top tier CT logistics provider (they did not want to be named and formally quoted for this report). While both the biopharma contact and CT logistics provider reported that the volume of certain key business indicators were down between 50–70% in August 2022 vs. the pre-war situation in both Russia and Ukraine, the CRO noted a substantially lower decline in monitoring activities in these countries, possibly a result of high patient recruitment in studies, which were active before the start of the war. (Note: the proportion of new sites to all active sites in both Russia and Ukraine in 2021 was only around 16% (LongTaal data), thus the active studies and active sites carry a lot of momentum in both countries. The estimated reduction of total number of active sites due to the absence of new studies during the first six months of the war and sanctions is only about 8%.) Granted, this is just anecdotal evidence, but given that it comes from large players on both markets, it carries some weight. We therefore take with a grain of skepticism the recently released assertions that while iCT sector in Russia is in a free-fall, Ukraine’s CTs are on a path to recovery.7 While we believe that this will be ultimate outcome, it is likely to manifest itself only in a few months or even more than a year in Russia: please, refer to the note above, regarding impact on sites active before the war started.

Thus, regardless of the circumstances and with no signs of the end of the conflict in sight, the global iBPCT industry needs to plan to reallocate almost 3.5% of global iBPCT sites and almost 5% of iBPCT patients annually outside of Russia and Ukraine. What are the options?

Pipeline Reallocation Options For The Industry

There are several factors to consider when evaluating reallocation options:

- IP logistics (location of central depots)

- Procurement and distribution of other study supplies

- Biospecimen logistics (location of central lab)

- Availability of experienced sites and investigators: Do sites have existing CT infrastructure and personnel, including study coordinators? This is a crucial success factor with the increasing complexity of trials and ever-growing number of vendor portals as well as other electronic systems to be managed in each study.

- Productivity of sites (keeping in mind the known high productivity of sites in Russia and Ukraine)

- Cost: Replacing sites in Russia and Ukraine, which have known lower costs per patient, with sites with significantly higher cost per patient would result in study budget overruns. The same applies to cost of the monitoring (see below).

- Not to be overlooked is the availability of trained monitors (CRAs) in the country to oversee the sites (in-house pharma CRAs or CRO CRAs). The largest pharmaceutical markets continue to suffer from chronic CRA shortages, high turnover rates, and the resulting rapidly growing labor costs.

Given the criteria outlined above, which countries/regions are best positioned to deliver this unrealized CT capacity? As outlined below, it appears that countries in Central and Eastern Europe (Poland, Czech Republic, Hungary, Slovakia, Croatia, Serbia, Bulgaria, Romania, Latvia, Lithuania, and Estonia) appear to be best positioned to replace this at-risk pipeline for the following reasons:

- There is no impact of the war, so no hindrance of hospital activities or interruption of logistics of clinical trial supplies and monitoring activities.

- All of these countries are NATO members and thus protected by the full strength of the alliance (Article 5 of the treaty).

- The proximity of logistics routes for IP and CT supplies and biospecimens to Russia and Ukraine

- The majority of the studies by multinational iBPCTs active or planned in Russia and Ukraine include countries in Central and Eastern Europe (CEE), which provides an opportunity to increase patient recruitment at these sites or add new sites in these countries

- Cost

- Site productivity

One key component of the reallocation – residual CT capacity in the region – requires closer examination.

CEE has been the darling of the iBPCT industry after the fall of the iron curtain.9,15 Since 1997 (the adoption of ICH GCP), the region has grown from well-below 1% of global share into an iBPCT powerhouse, commanding over 13% of global iBPCT market share by 2015.

This initial growth can be attributed to saturation of the sites in Western European markets, with Central and Eastern Europe offering plenty of research-hungry European sites as well as cost advantages. Over the years, the region has offered a unique combination of capacity, site productivity, quality, and value for money.12 As a result, the region has enjoyed the highest industry CT reputation globally and has been home to 12 out of the top 20 countries with highest CT reputation index globally.16

More recently, following almost two decades of uninterrupted growth, the region’s share started to erode (with the notable exception of Poland) between 2015 and 2021, yielding almost 2% of its global share to other emerging market rivals, particularly those in Southeast Asia (mostly China and South Korea).12,16 Importantly, this market share loss was not related to worsening performance of the region but was directly attributable to a rebalancing of the global industry CT pipeline to support future ROI across the biopharmaceutical industry.12 Thus, we argue this recent reduction of global iBPCT share stands available to assume delivery of a significant portion of the Russian and Ukrainian pipelines.

Let’s examine other country/regional options:

Western Europe

This is the only other region meeting the geographic proximity criteria of the logistical routes. Capacity-wise, only a handful of Western European markets have been growing (most notably Spain), and thus most of them are not overheated and should be capable of taking on additional work. For example, Germany has been steadily losing its share of global market since 2014, and would appear to be poised to take on additional work. However, the cost differential vs. Russia and Ukraine is higher than in the CEE region,12 and sites’ productivity is also below that of the CEE levels,12 so a switch would result in study budget overruns. One additional factor working against Western Europe is a chronic shortage of CRAs, particularly in the larger countries.

North America

Much of what has been said about Western Europe applies to North America as well (cost, site productivity, CRA shortages). In addition, there are no synergies of logistics routes.12 Thus, North America does not appear to be a good reallocation fit, either.

Latin America

While Latin America compares more favorably on cost and site productivity, incremental capacity may be a problem: Global iBPCTs share is just 4.1%, which has been growing steadily from the low point of 3.8% in 2016.16 Thus, taking on an incremental > 3% of global pipeline would represent a > 70% market growth over a short time, which is not realistic, plus there are no logistics route synergies.

Southeast Asia

China and South Korea (but not India) have been the darlings of the global iBPCT industry, with China commanding a 4.8% global market share (having grown from just over 2% in 2015) and South Korea with a 2.2% share (having grown from 1.8% in 2015).16 China in particular benchmarks favorably on the cost side (Korea, less so), and on the site productivity side.12 However, China’s and Korea’s growth capacity appear to be stretched, as both countries have been among the top iBPCT growth countries globally. Therefore, increasing that growth by an incremental > 3% of iBPCTs’ pipeline may be a stretch too far. Also on the minus side, there are no logistics route synergies to lean on.

Middle East and Africa

While there may be some logistic route synergies, and several (but not all) countries in the region compare favorably with CEE, the biggest problem is capacity: In 2021 the region’s share of iBPCT was only 2.8% (to which Israel and Turkey contributed 2%).16 Thus, reallocation of the combined Russia and Ukraine pipeline would far exceed the (growth) capacity of the region.

So, CEE appears to be best positioned to assume responsibility for the iBPCT pipeline reallocated from Russia and Ukraine, as it possesses the required capacity, offers comparable cost and site productivity, and has geographic proximity.

Patient Diversity Considerations

What about patient diversity, to which much attention is being paid by biopharma sponsors of CTs in the wake of recent FDA guidance?17 Reallocation of the sites and patients from Russia and Ukraine to CEE would be neutral from a patient diversity standpoint, as populations in CEE share a similar ethnic footprint with those in Russia and Ukraine.

Summary

The war launched by Russia in Ukraine has immediate and long-term impacts on biopharma clinical trials in those countries and also globally, as those countries together contribute 3.6% of global sites in clinical trials performed by the innovative biopharma industry and an estimated 5% of global patients in those trials.

The global iBPCT industry needs to plan to reallocate almost 3.5% of global iBPCT sites and almost 5% of iBPCT patients annually to locations outside of Russia and Ukraine. We present arguments that countries in Central and Eastern Europe are best positioned to deliver (all or significant part of) this industry pipeline due to a unique combination of proximity of logistical routes, comparable cost, site productivity, and underutilized clinical trial capacity.

Appendix: Methodology, Data Sources, And Model Assumptions

For this report, we used the LongTaal Global Clinical Trials Landscape portal, enabling analysis of global trends based on the analysis of active studies and sites reported through various global CT registries, including but not limited to clinicaltrials.gov and EudraCTs. This methodology has been a reliable source for analysis of global geographic CT trends published previously.10,12 Our methodology for the assessment of CT market share is based on the number of active iBPCT sites, rather than number of iBPCT trials, as is used routinely by other authors.

For additional methodological details, please refer to our recently published report.12

References

- The New York Times. Companies Are Getting Out of Russia, Sometimes at a Cost. [Online] March 09, 2022. [Cited: July 01, 2022.] https://www.nytimes.com/article/russia-invasion-companies.html?action=click&pgtype=LegacyCollection&state=default&module=styln-russia-ukraine&variant=show®ion=BELOW_MAIN_CONTENT&block=storyline_flex_guide_recirc.

- Dyer O. BMJ 2022;326:o745. Essential medicines keep flowing to Russia, but sanctions could severely effect health. https://www.bmj.com/content/376/bmj.o745.full.

- GlobalData Healthcare. Sanctions hit Russian investors with limited impact on foreign innovator drugs. Pharmaceutical Technology 28 Mar 2022. https://www.pharmaceutical-technology.com/comment/sanctions-russia-foreign-innovator-drugs/.

- Mulero A. Ukraine-Russia war pushes big pharma into mixed response. HealthLeaders 23Mar2022 https://www.healthleadersmedia.com/pharma/ukraine-russia-war-pushes-big-pharma-mixed-response.

- Castaneda R. Clinical trials in Russia: drug development pipeline at risk. Clinical Trials Arena, March 7, 2022, downloaded on May 26, 2022. [Online] https://www.clinicaltrialsarena.com/special-focus/ukraine-crisis/clinical-trials-in-russia-at-risk/.

- Castaneda R. Clinical trials in Russia: big pharma makesmoves but what’s the pipeline impact?; Clinical Trials Arena, March 24, 2022, dowloaded on May 26, 2022. [Online] https://www.clinicaltrialsarena.com/analysis/clinical-trials-in-russia-big-pharma-makes-moves/.

- Castaneda R; As Russia’s clinical trials sector falls, Ukraine rebuilds. Clinical Trials Arena; August 23, 2022. [Online] https://www.clinicaltrialsarena.com/special-focus/ukraine-crisis/russia-clinical-trials-fall-ukraine-rebuilds/.

- Sonnenfeld J, Tian S, Sokolowski F, Wyrebkowski M, Kasprowicz M. Business Retreats and Sanctions Are Crippling the Russian Economy (July 19, 2022). Available at SSRN. [Online] July 20, 2022. [Cited: August 01, 2022.] https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4167193.

- V Misik,, RV Brady, M Bolecek and H Klech, Current Trends in Globalization of Industry-Sponsored Clinical Trials, Applied Clinical Research, Clinical Trials & Regulatory Affairs, 2014, 1, 56-66. pp. 56-66.

- Misik V, Brady RV, Boleček M, Klech H, Recent trends in globalization of industry R&D clinical trials: are emerging markets losing their allure?, Applied Clinical Research Clinical Trials and Regulatory Affairs, June 2017. Vol 4,. pp. 175-182.

- Mišík, V, Boleček, M and Brady, RV. Ethical Considerations of Industry-Sponsored Clinical Trials in the Arab Region. [book auth.] H Silverman. Research Ethics in the Arab Region. Research Ethics Forum. s.l. : Springer, 2017, pp. 161-170.

- Misik V, Jarosz B, Beckowski L, Czarnecka M, Dabrowski T, Drake D, Milowska K, Ziecik P, Magielski P, Szczepannik W: REPORT: Industry Clinical Trials in Poland. Possibilities to increase number and scope of trials in Poland. Publishers: INFARMA and POLCRO. December 2021; pp 1-115. [Online] https://www.infarma.pl/raporty/raporty-infarmy/raport-%E2%80%9Ekomercyjne-badania-kliniczne-w-polsce.-mozliwo%C5%9Bc-zwiekszania-liczby-i-zakresu-badan-klinicznych-w-polsce/.

- Synergy Research Group: Clinical trials in Russia, Research Report. Synergy orange paper: Summer 2019, quarter 2. [Online] www.srgcro.com.

- Participation of patients from Ukraine in the clinical trials conducted in Poland. Good practice of the clinical trials industry. Published by: GCPPl, POLCRO, INFARMA. 28April2022. [Online] https://polcro.pl/images/polcro/Protection%20of%20participants%20of%20clinic.

- Karlberg JPE, The Establishment of Emerging Trial Regions, Clin. Trial Magnifier 4: pp 7-23, 2011.

- LongTaal. Clinical Trials Landscape Dashboard - Global. Data refreshed on July 16, 2022. [Online] 2022. longtaal.com.

- Diversity Plans to Improve Enrollment of Participants from Underrepresented Racial and Ethnic Populations in Clinical Trials Guidance for Industry. Draft Guidance. US FDA, Rockwille, MD, USA. April 2022. [Online