The MENA Pharma Market: An Untapped Opportunity

By Karim Smaira, founder and CEO, Genpharm

The total size of the MENA (Middle East and North Africa) pharmaceutical market is estimated at $36 billion, which is only 2 percent of global pharmaceutical sales, but it has one of the highest growth rates (9 to 11 percent until 2020, based on info from IMS Health) in emerging markets.

That growth rate is driven by the significant rise of chronic diseases — diabetes (affecting 25 percent of the nationals in the Gulf Cooperation Council [GCC]), cardiovascular, cancers, respiratory — and due to lifestyle changes and better education. For example, lifestyle changes are leading to an increase in chronic and “lifestyle diseases” (e.g., lack of exercise and bad diet leading to diabetes and hypertension, smoking leading to COPD and lung cancer). Better education and increased health and medical knowledge is making the general population more demanding when it comes to the quality and reach of medical services and access to drugs. Furthermore, as a result of cultural reasons such as consanguinity rates, the incidence of genetic diseases is significantly high, creating opportunities for companies focused on producing drugs for orphan and rare diseases. Governments, particularly those of Egypt, Algeria, Iran, Saudi Arabia, Jordan, and the UAE (United Arab Emirates), have recently supported the birth of local and regional drug manufacturers.

That growth rate is driven by the significant rise of chronic diseases — diabetes (affecting 25 percent of the nationals in the Gulf Cooperation Council [GCC]), cardiovascular, cancers, respiratory — and due to lifestyle changes and better education. For example, lifestyle changes are leading to an increase in chronic and “lifestyle diseases” (e.g., lack of exercise and bad diet leading to diabetes and hypertension, smoking leading to COPD and lung cancer). Better education and increased health and medical knowledge is making the general population more demanding when it comes to the quality and reach of medical services and access to drugs. Furthermore, as a result of cultural reasons such as consanguinity rates, the incidence of genetic diseases is significantly high, creating opportunities for companies focused on producing drugs for orphan and rare diseases. Governments, particularly those of Egypt, Algeria, Iran, Saudi Arabia, Jordan, and the UAE (United Arab Emirates), have recently supported the birth of local and regional drug manufacturers.

Due to the MENA region being the last frontier for many healthcare companies, regulators have implemented rapid reforms to improve the business environment and access to medicine. For example:

- Faster marketing authorizations for FDA- or EMA-approved drugs. The GCC has introduced an efficient centralized regulatory procedure.

- Harmonized pricing based on the international referencing system and a benchmark with the country of origin.

- Universal healthcare coverage for GCC nationals and higher reimbursement coverage across the region with newly introduced, mandatory basic insurance schemes

Contrary to common perception, the MENA region is very heterogeneous, spanning from Morocco in the south to Iran in the north. It is clustered into three main subareas:

- GCC: Saudi Arabia, Kuwait, UAE, Oman, Bahrain, Qatar, and Yemen, whose economies are mainly dependent on energy exports

- THE LEVANT: Lebanon, Jordan, and Syria — with main economic drivers in services, tourism, and agriculture — and oil-dependent Iran and Iraq

- NORTH AFRICA: Egypt, Algeria, Morocco, Tunisia, and Libya, combining services and energy sectors

Although mostly bound by a common language and religion, the MENA population is influenced by diverse cultures and past civilizations. This is observed in the genetic composition of the inhabitants. Some important characteristics to retain are:

- The population of almost 300 million continues to grow rapidly at >2 percent annually. (source: World Bank)

- It remains largely young, with 20 percent between the ages of 15 and 24. (source: Youth Policy)

- Life expectancy is an average 74 years. (source: World Bank)

- The female-to-male ratio is 49.65 percent respectively. (source: Trading Economics)

- The literacy rate has progressed from 59 percent in 1990 to 78 percent in 2010. (source: World Bank)

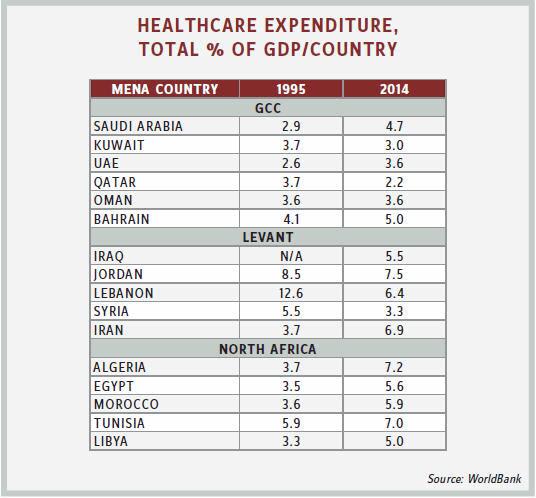

- The GDP per capita, with Qatar boasting $132,100 and $2,900 in the Palestinian Territories, and the percentage spent on healthcare, are very disparate. (source: the CIA factbook)

KEY SUCCESS FACTORS AND MARKET STRATEGIES

In addition to deciding which operational strategy to implement, it is critical for companies to consider some of these key success factors:

- Ensure that the product mix fits the region’s needs by addressing unmet medical needs and supplying innovative drugs that compete on added value and not on price only.

- Avoid “me-too” products and competition with local manufacturers.

- Ensure the right regulatory sequence to secure the best pricing across the region.

- Diligently choose the regional partner needed for regulatory and commercial support.

- Hire, train, and retain staff who have the best expertise and cultural knowledge to navigate the local nuances. The region suffers from a scarcity of talents.

- Collaborate with local organizations that have a strong network with key decision makers and have multinational experience in launching and managing the life cycle of products.

The business model depends mainly on the level of risk and investments companies are willing to allocate to the MENA region as part of their expansion strategy. Some of these penetration strategies to consider are:

- Setting up a legal entity with full-fledged operations

- Registering a licensed scientific office to promote pharmaceutical products

- Contracting the marketing and sales to a regional player, whether fully or through comarketing and copromotion arrangements

- Out-licensing rights to the product with a royalty deal

- Engaging in M&A and joint ventures with existing local or regional players

- Partaking in local manufacturing by contract manufacturing or owning facilities (Several companies have recently decided to sign agreements for second brands anticipating the patent expiration.)

- Setting up a central distribution hub to control the flow of product and the quality aspects.

The increasing competition and the fast maturation of the MENA markets are facts. With a large potential for growth, this region commands a long-term strategy instead of an opportunistic approach.