Trials Or Tribulations: Does Patient Recruitment Offer Acceptable ROI?

By Richard Malcolm, Ph.D.

Centralized patient recruitment in the United States has a cost that is relatively modest when compared to overall clinical trial fees. In assessing whether this cost is justified, though, life science executives should look at two areas: actual costs associated with conducting the study and incremental revenue obtained through faster or earlier approval of the drug.

Few examples exist of the impact of centralized recruitment — the term used to describe how a supplier centrally manages recruitment activity for geographically dispersed research sites (versus localized recruitment where sponsors provide research sites with individual recruitment funds). In many cases, due to tracking and other data collection limitations, case studies reflect a statement of the recruitment challenge, a summary of the tactics employed, and subjective or anecdotal comments regarding results. There often are no specifics on how many patients from the recruitment campaign enrolled in the study, over what time frame, and what the impact was on study closing (perhaps because no one collected this data). There is even less information on the financial implications of spending money for patient recruitment. Are the costs offset by real savings in other study-related costs? Are costs justified in terms of time saved?

The following are a few case studies that begin to fill that data vacuum about the financial impact of centralized patient recruitment on the time needed to complete enrollment. Specifics include the size of the study, the number of patients sourced from a central campaign, and the timing of the recruitment activity. This information should enable executives to better evaluate the return on investment of centralized patient recruitment.

CASE STUDY 1: WOMEN’S HEALTH

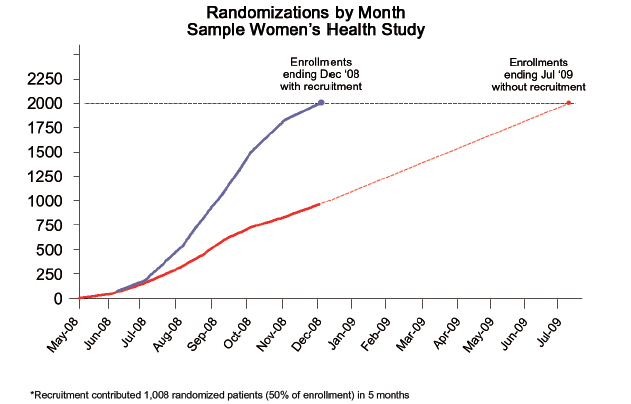

A major pharmaceutical company needed to quickly enroll a large study of postmenopausal women who experienced hot flashes. From prior experience in this area, the sponsor knew it needed recruitment assistance to meet its aggressive enrollment target, especially due to stringent BMI (body mass index) and hormone replacement exclusions in the protocol. This Phase III prospective study needed a total of 2,000 patients across 113 sites in the United States. The sponsor approved a centralized patient recruitment campaign using direct-to-patient outreach, a study website, and a comprehensive enrollment tracking system.

Figure 1 shows the results. The central recruitment campaign supplemented the site recruitment, providing 1,003 randomized patients in less than seven months. The enrollment rate doubled from approximately 1.25 patients per site per month to 2.5 patients per site per month. Importantly, the sponsor avoided a seven-month delay that would have been unavoidable with solely site-based recruitment and actually finished enrollment one month earlier than originally planned.

CASE STUDY 2: HYPERCHOLESTEROLEMIA

The sponsor of this Phase III study faced challenges enrolling patients despite the large number of people in the United States with elevated cholesterol. Requirements for LDL, HDL, and triglycerides within specific ranges greatly reduced the portion of the hypercholesterolemia population that would potentially qualify.

The screen fail rate was approximately 80%; consequently, six months after the study started enrolling patients, it fell behind schedule. This large study required randomization of 1,800 patients across 186 sites in the United States.

The sponsor chose to supplement site-derived enrollment with a centralized recruitment campaign. This rescue project used both direct-to-patient outreach around the 186 sites and a comprehensive enrollment tracking system.

As shown in Figure 2, the centralized campaign increased the rate of enrollment, ultimately contributing more than 400 randomized patients, nearly 25% of total enrollment. Projecting expected enrollment from the sites at a constant rate, one concludes that the centralized recruitment enabled enrollment to close six months earlier. Using this data from Figure 2, it appears that the sponsor would have saved an additional two months had it used centralized recruitment from the start of the study.

CASE STUDY 3: OVERACTIVE BLADDER

A major pharmaceutical company needed to accelerate enrollment for a group of four Phase III studies of a drug for overactive bladder. Two of the studies were under way, but not meeting the sponsor’s timelines for enrollment. The other two studies had yet to begin. This group of studies required 2,500 randomized patients across the four protocols.

To meet its enrollment timelines for these important studies, the sponsor supplemented site-derived enrollment with a centralized recruitment campaign that included direct-to-patient outreach and a sophisticated screening/tracking system that assigned potential patients to the appropriate protocol based on a prescreening

process.

The centralized recruitment campaign, employed from the start of this study, contributed approximately 400 of the 900 patients randomized into this study. Importantly, central recruitment nearly doubled the rate of enrollment and reduced the enrollment period by nearly four months.

Across the program of four studies, central recruitment generated over 700 randomized patients, over 25% of the total enrollment goal. Consequently, the sponsor closed enrollment on time for this group of studies and eight months early for one protocol.

COST JUSTIFICATION

Clearly, closing enrollment a month earlier will result in a savings for direct costs such as CRO fees, central lab fees, EKG fees, etc. A recent study (Cutting Edge Information, 2007) estimated that, on average, the operational costs of a Phase III study exceed $1 million per month. If this is accurate, for the case studies presented in this article, the operational cost savings ranged from $6 million to $9 million. This alone is enough to more than offset the cost of the central recruitment campaigns employed, without ever considering the impact of an earlier approval.

Often, recruitment is employed for late stage, critical path studies. It is reasonable to assume that the time savings in enrollment translates to a more rapid study completion, and this in turn will lead to an earlier NDA (new drug application) submission, and ultimately, an earlier approval. For drugs in many therapeutic areas, an extra month of market exclusivity can generate a substantial amount of additional revenue. For example, the asthma market is estimated to be more than $15 billion annually in the United States. By garnering a 2% market share, a month in that market is worth approximately $25 million, manyfold the expense of an effective centralized patient recruitment campaign. Together with the operational cost savings noted earlier, additional market opportunity provides strong justification for centralized patient recruitment.

Delays in meeting enrollment objectives for clinical trials are clearly a challenge that clinical teams will continue to face in the future. Teams wrestle with the value of centralized patient recruitment in the timely completion of clinical trials and find it difficult to articulate ROI in order to secure executive-level budget approvals. Initial analysis strongly indicates that recruitment costs can be more than offset by savings in actual study costs and a more rapid time to market. Further, it appears in many cases that they produce a very high ROI. Given both the increasing number of cases illustrating success and the strong financial justification with centralized patient recruitment, more attention needs to be given to this option when evaluating patient recruitment and enrollment challenges. Where possible, executives should look toward recruitment services that offer performance-based contracts or time-based guarantees.

About The Author

Richard “Rick” Malcolm, Ph.D. is the CEO of Acurian, a provider of patient recruitment solutions. He has more than 22 years experience in healthcare management. Prior to joining Acurian, he was VP of business development for ICON Clinical Research, one of the world’s largest CROs.