U.S. CEOs See Greater Willingness To Use Artificial Intelligence: KPMG Survey

More than two-thirds of U.S. life sciences CEOs say their organizations are ready to adopt advanced artificial intelligence technology, but they acknowledge there are barriers – such as skills, complexity and costs – to implementing it, the KPMG’s 2017 CEO Outlook found.

KPMG’s survey also found that more than 90 percent of CEOs were forecasting annual revenue growth of less than 5 percent for the next three years, reflecting less optimism than the 2016 survey.

The level of readiness among U.S. life sciences companies -- with 68 percent of CEOs saying they are prepared for artificial intelligence – exceeds the 22 percent from Asian-Pacific companies and 47 percent of European organizations whose leaders expressed that their organizations were ready.

Two-thirds of U.S. executives at the largest pharma and medical device makers were also concerned about integrating this emerging technology into business processes. The biggest barriers to implementing new technologies were the lack of internal skills/knowledge (35 percent) and the complexity of implementations (16 percent), followed by the lack of budget (14 percent), according to the 43 CEOS of the largest U.S. life sciences companies who were surveyed.

“Technology, especially artificial intelligence, will reshape the life sciences industry by shortening drug development times and increasing efficiency,” said Alison Little, KPMG U.S. Advisory Leader for life sciences.

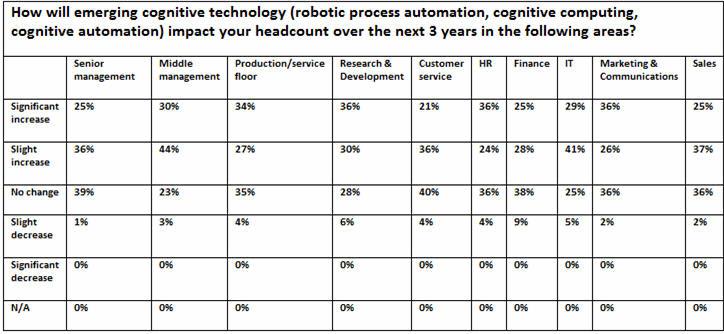

Life sciences CEOs are not anticipating reductions in staff related to how cognitive technologies, such as artificial intelligence, robotic process automation and cognitive automation. A small fraction saw slight reductions in employment in functional areas, such as finance (9 percent), R&D (6 percent) and IT (5 percent).

When it comes to spending on “cognitive technologies” for the next three years, however, a slight majority saw no new investment except for maintaining current business needs. A third (33 percent) saw significant investments and 14 percent saw gradual increases in investments.

Struggling with Revenue Growth

Regarding the growth outlook, KPMG’s survey found that 93 percent of life sciences CEOs expect annual revenue growth of less than 5 percent and only 7 percent project growth greater than that figure for the next three years. When life sciences CEOs were asked the same question in 2016, 85 percent saw growth below the 5 percent mark.

CEOs tend to be a fairly confident group, but life sciences CEOs based in the United States were less bullish than their peers abroad as 70 percent had a confident outlook about their company’s growth prospects and 30 percent had a neutral outlook. In the Asia-Pacific region, 89 percent of life sciences CEOs were confident about their company’s growth prospects, while 91 percent in Europe expressed the same sentiment. Only 9 percent had a neutral outlook in Europe and the Asia-Pacific regions.

“Revenue growth is difficult to achieve in the life sciences industry, as patent expirations across a broad range of therapeutic categories act as a major constraint,” Little said. “The emergence of biosimilars, coupled with public scrutiny of drug pricing, are creating additional headwinds for the industry. This comes as more payers are demanding that drug and medical device makers show evidence that their treatments provide value and decrease future hospitalizations.”

Some of the survey’s findings echo KPMG’s report from February, Pharma Outlook 2030: From evolution to revolution, which detailed how current business models in the pharmaceutical industry are not reflecting the turbulence in the marketplace and how revenue will fall “well short of forecasts.” The report also highlights how companies serving as massive storage houses of data could reshape business models in the pharma industry.